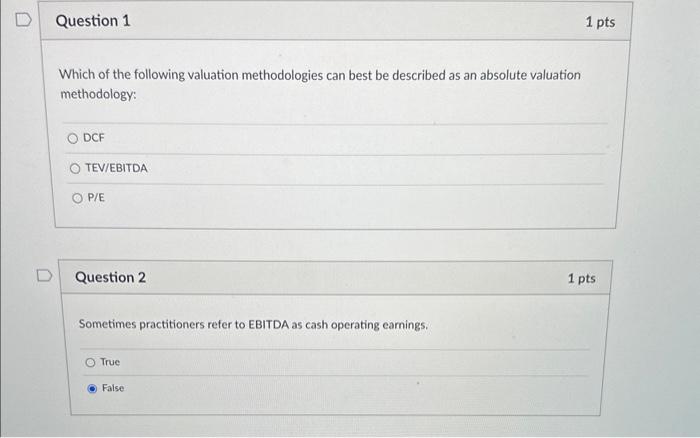

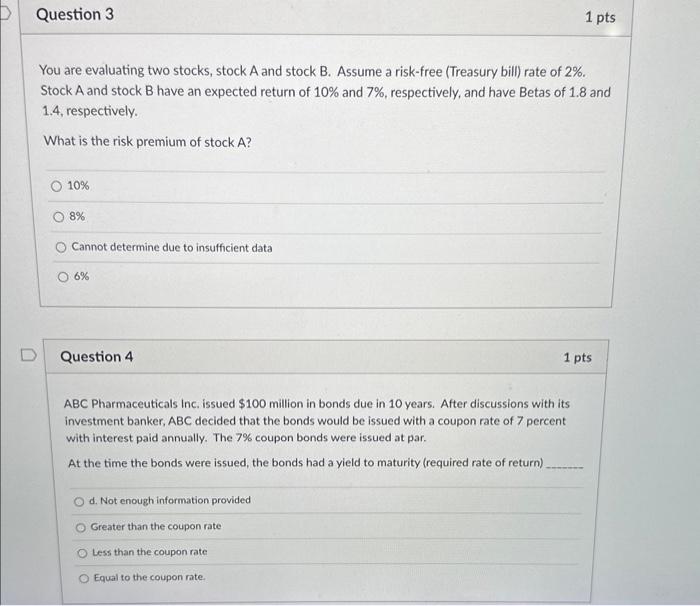

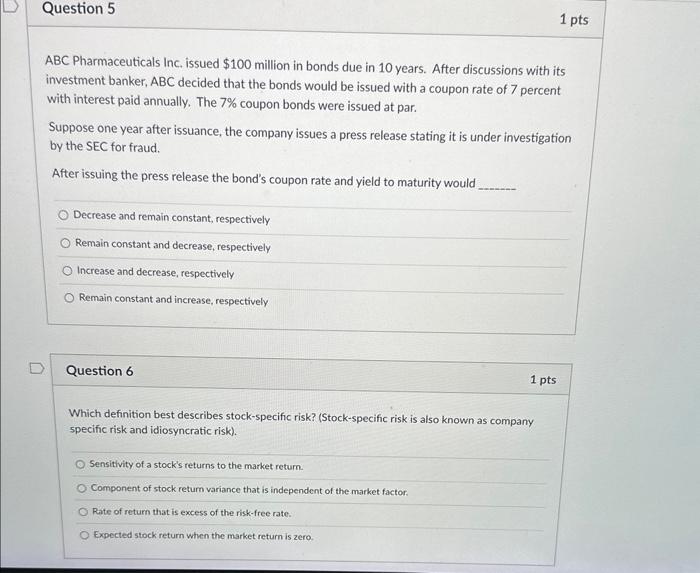

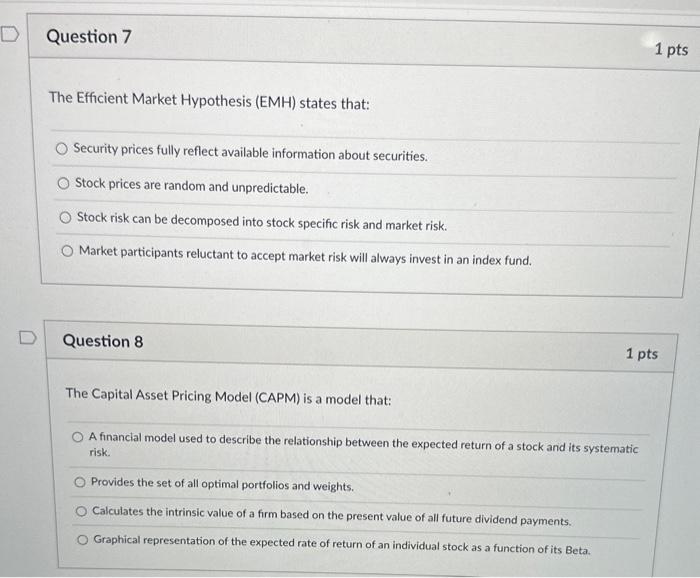

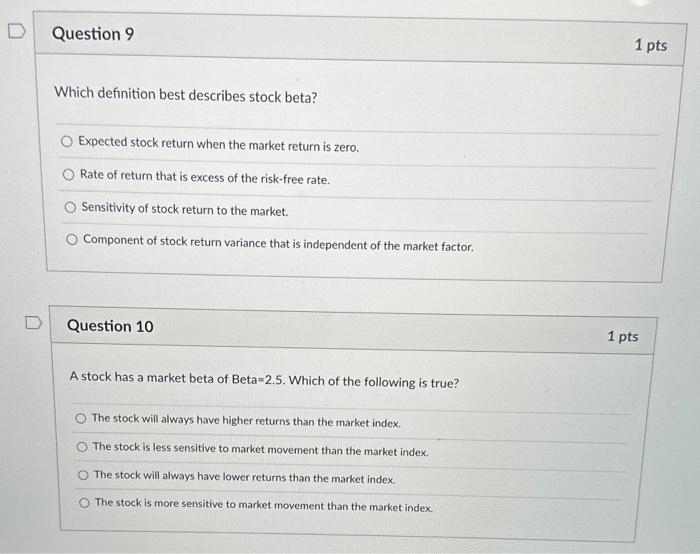

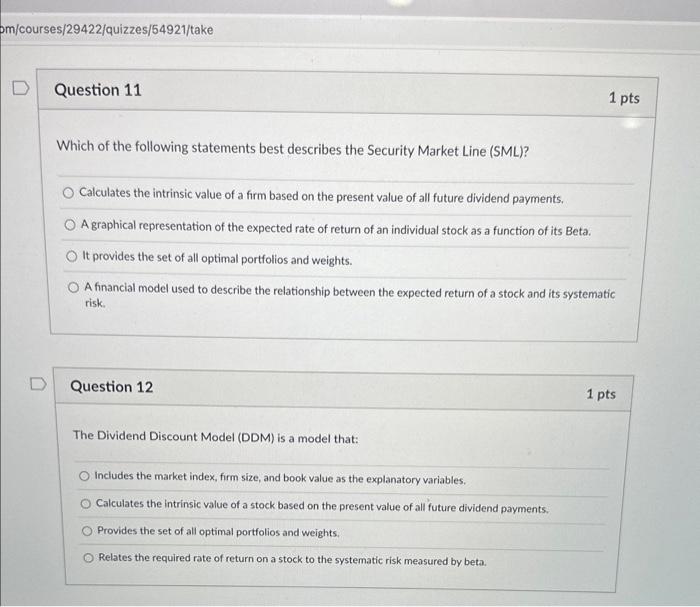

Which of the following valuation methodologies can best be described as an absolute valuation methodology: DCF TEV/EBITDA P/E Question 2 1 pts Sometimes practitioners refer to EBITDA as cash operating earnings. True False You are evaluating two stocks, stock A and stock B. Assume a risk-free (Treasury bill) rate of 2%. Stock A and stock B have an expected return of 10% and 7%, respectively, and have Betas of 1.8 and 1.4 , respectively. What is the risk premium of stock A ? 10% 8% Cannot determine due to insufficient data 6% Question 4 1 pts ABC Pharmaceuticals Inc. issued $100 million in bonds due in 10 years. After discussions with its investment banker, ABC decided that the bonds would be issued with a coupon rate of 7 percent with interest paid annually. The 7% coupon bonds were issued at par. At the time the bonds were issued, the bonds had a yield to maturity (required rate of return) d. Not enough information provided Greater than the coupon rate Less than the coupon rate Equal to the coupon rate. ABC Pharmaceuticals Inc. issued $100 million in bonds due in 10 years. After discussions with its investment banker, ABC decided that the bonds would be issued with a coupon rate of 7 percent with interest paid annually. The 7% coupon bonds were issued at par. Suppose one year after issuance, the company issues a press release stating it is under investigation by the SEC for fraud. After issuing the press release the bond's coupon rate and yield to maturity would Decrease and remain constant, respectively Remain constant and decrease, respectively Increase and decrease, respectively Remain constant and increase, respectively Question 6 Which definition best describes stock-specific risk? (Stock-specific risk is also known as company specific risk and idiosyncratic risk). Sensitivity of a stock's returns to the market return. Component of stock return variance that is independent of the market factor. Rate of return that is excess of the risk-free rate. Expected stock return whien the market return is zero. The Efficient Market Hypothesis (EMH) states that: Security prices fully reflect available information about securities. Stock prices are random and unpredictable. Stock risk can be decomposed into stock specific risk and market risk. Market participants reluctant to accept market risk will always invest in an index fund. Question 8 The Capital Asset Pricing Model (CAPM) is a model that: A financial model used to describe the relationship between the expected return of a stock and its systematic risk. Provides the set of all optimal portfolios and weights. Calculates the intrinsic value of a firm based on the present value of all future dividend payments. Graphical representation of the expected rate of return of an individual stock as a function of its Beta. Which definition best describes stock beta? Expected stock return when the market return is zero. Rate of return that is excess of the risk-free rate. Sensitivity of stock return to the market. Component of stock return variance that is independent of the market factor. Question 10 A stock has a market beta of Beta =2.5. Which of the following is true? The stock will always have higher returns than the market index. The stock is less sensitive to market movement than the market index. The stock will always have lower returns than the market index. The stock is more sensitive to market movement than the market index. Which of the following statements best describes the Security Market Line (SML)? Calculates the intrinsic value of a firm based on the present value of all future dividend payments. A graphical representation of the expected rate of return of an individual stock as a function of its Beta. It provides the set of all optimal portfolios and weights. A financial model used to describe the relationship between the expected return of a stock and its systematic risk. Question 12 The Dividend Discount Model (DDM) is a model that: Includes the market index, firm size, and book value as the explanatory variables. Calculates the intrinsic value of a stock based on the present value of all future dividend payments. Provides the set of all optimal portfolios and weights. Relates the required rate of return on a stock to the systematic risk measured by beta