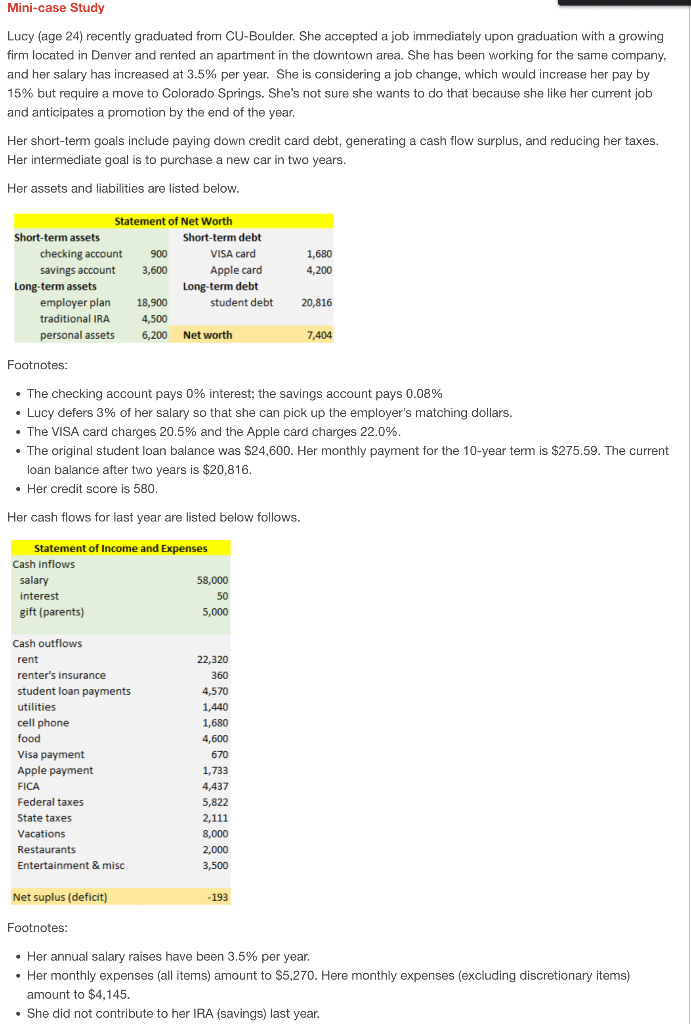

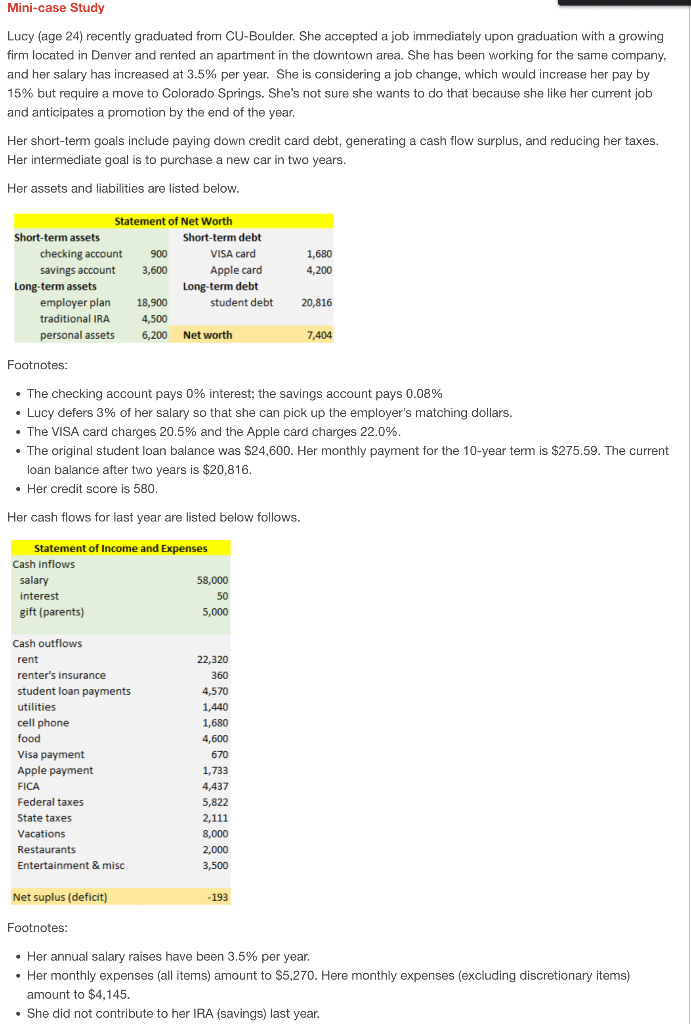

Which of the following would be the best strategy for improving her FICO credit score of 580? Get organized and avoid missing minimum debt payment due dates. Apply for a third credit card since it would improve her overall access to debt. Take out a car loan since it would add another type of credit to the mix. File for bankruptcy, which would eliminate all of her debt. Mini-case Study Lucy (age 24) recently graduated from CU-Boulder. She accepted a job immediately upon graduation with a growing firm located in Denver and rented an apartment in the downtown area. She has been working for the same company, and her salary has increased at 3.5% per year. She is considering a job change, which would increase her pay by 15% but require a move to Colorado Springs. She's not sure she wants to do that because she like her current job and anticipates a promotion by the end of the year. Her short-term goals include paying down credit card debt, generating a cash flow surplus, and reducing her taxes. Her intermediate goal is to purchase a new car in two years. Her assets and liabilities are listed below. 1.680 4,200 Statement of Net Worth Short-term assets - Short-term debt checking account 900 VISA card savings account 3,600 Apple card Long-term assets Long-term debt - employer plan 18,900 student debt traditional IRA 4,500 personal assets 6,200 Net worth 20,816 7,404 Footnotes: The checking account pays 0% interest; the savings account pays 0.08% Lucy defers 3% of her salary so that she can pick up the employer's matching dollars. The VISA card charges 20.5% and the Apple card charges 22.0%. The original student loan balance was $24,600. Her monthly payment for the 10-year term is $275.59. The current loan balance after two years is $20,816. . Her credit score is 580. Her cash flows for last year are listed below follows. Statement of Income and Expenses Cash inflows salary 58,000 interest 50 gift (parents) 5,000 Cash outflows rent renter's insurance student loan payments utilities cell phone food Visa payment Apple payment FICA Federal taxes State taxes Vacations Restaurants Entertainment & misc 22,320 360 4,570 1,440 1,680 4,600 670 1,733 4,437 5,822 2,111 8,000 2,000 3,500 Net suplus (deficit) -193 Footnotes: Her annual salary raises have been 3.5% per year. Her monthly expenses (all items) amount to $5,270. Here monthly expenses (excluding discretionary items) amount to $4,145. She did not contribute to her IRA (savings) last year. Which of the following would be the best strategy for improving her FICO credit score of 580? Get organized and avoid missing minimum debt payment due dates. Apply for a third credit card since it would improve her overall access to debt. Take out a car loan since it would add another type of credit to the mix. File for bankruptcy, which would eliminate all of her debt. Mini-case Study Lucy (age 24) recently graduated from CU-Boulder. She accepted a job immediately upon graduation with a growing firm located in Denver and rented an apartment in the downtown area. She has been working for the same company, and her salary has increased at 3.5% per year. She is considering a job change, which would increase her pay by 15% but require a move to Colorado Springs. She's not sure she wants to do that because she like her current job and anticipates a promotion by the end of the year. Her short-term goals include paying down credit card debt, generating a cash flow surplus, and reducing her taxes. Her intermediate goal is to purchase a new car in two years. Her assets and liabilities are listed below. 1.680 4,200 Statement of Net Worth Short-term assets - Short-term debt checking account 900 VISA card savings account 3,600 Apple card Long-term assets Long-term debt - employer plan 18,900 student debt traditional IRA 4,500 personal assets 6,200 Net worth 20,816 7,404 Footnotes: The checking account pays 0% interest; the savings account pays 0.08% Lucy defers 3% of her salary so that she can pick up the employer's matching dollars. The VISA card charges 20.5% and the Apple card charges 22.0%. The original student loan balance was $24,600. Her monthly payment for the 10-year term is $275.59. The current loan balance after two years is $20,816. . Her credit score is 580. Her cash flows for last year are listed below follows. Statement of Income and Expenses Cash inflows salary 58,000 interest 50 gift (parents) 5,000 Cash outflows rent renter's insurance student loan payments utilities cell phone food Visa payment Apple payment FICA Federal taxes State taxes Vacations Restaurants Entertainment & misc 22,320 360 4,570 1,440 1,680 4,600 670 1,733 4,437 5,822 2,111 8,000 2,000 3,500 Net suplus (deficit) -193 Footnotes: Her annual salary raises have been 3.5% per year. Her monthly expenses (all items) amount to $5,270. Here monthly expenses (excluding discretionary items) amount to $4,145. She did not contribute to her IRA (savings) last year