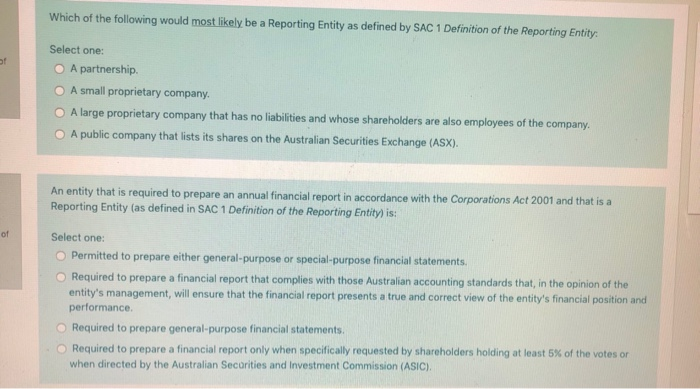

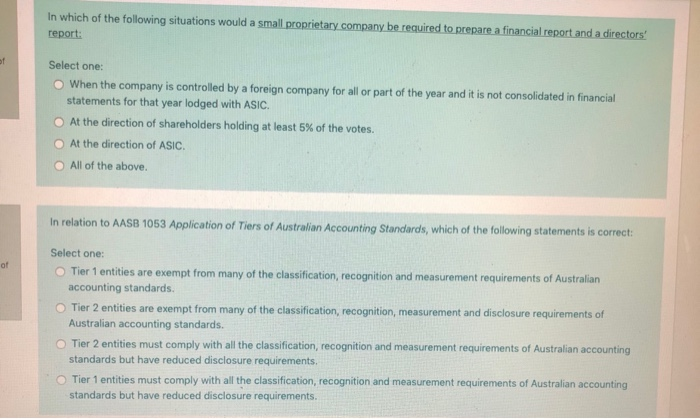

Which of the following would most likely be a Reporting Entity as defined by SAC 1 Definition of the Reporting Entity: Select one: A partnership A small proprietary company. O A large proprietary company that has no liabilities and whose shareholders are also employees of the company, A public company that lists its shares on the Australian Securities Exchange (ASX). An entity that is required to prepare an annual financial report in accordance with the Corporations Act 2001 and that is a Reporting Entity (as defined in SAC 1 Definition of the Reporting Entity) is: Select one: Permitted to prepare either general-purpose or special-purpose financial statements. Required to prepare a financial report that complies with those Australian accounting standards that in the opinion of the entity's management, will ensure that the financial report presents a true and correct view of the entity's financial position and performance Required to prepare general-purpose financial statements. Required to prepare a financial report only when specifically requested by shareholders holding at least 5% of the votes or when directed by the Australian Securities and Investment Commission (ASIC). In which of the following situations would a small proprietary company be required to prepare a financial report and a directors' report: Select one: When the company is controlled by a foreign company for all or part of the year and it is not consolidated in financial statements for that year lodged with ASIC. At the direction of shareholders holding at least 5% of the votes. At the direction of ASIC. All of the above In relation to AASB 1053 Application of Tiers of Australian Accounting Standards, which of the following statements is correct: Select one: Tier 1 entities are exempt from many of the classification, recognition and measurement requirements of Australian accounting standards. Tier 2 entities are exempt from many of the classification, recognition, measurement and disclosure requirements of Australian accounting standards. Tier 2 entities must comply with all the classification, recognition and measurement requirements of Australian accounting standards but have reduced disclosure requirements. Tier 1 entities must comply with all the classification, recognition and measurement requirements of Australian accounting standards but have reduced disclosure requirements