Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following yield calculations accounts for holding the bond for its entire predetermined lifetime? Yield to maturity Yield to call Suppose you were

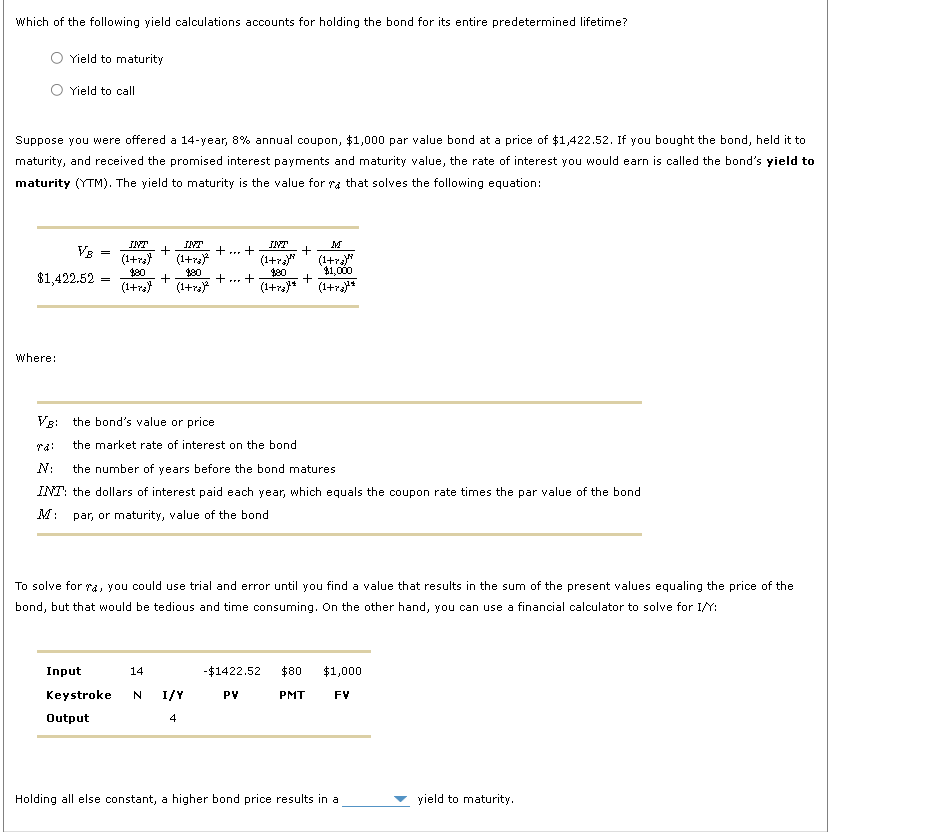

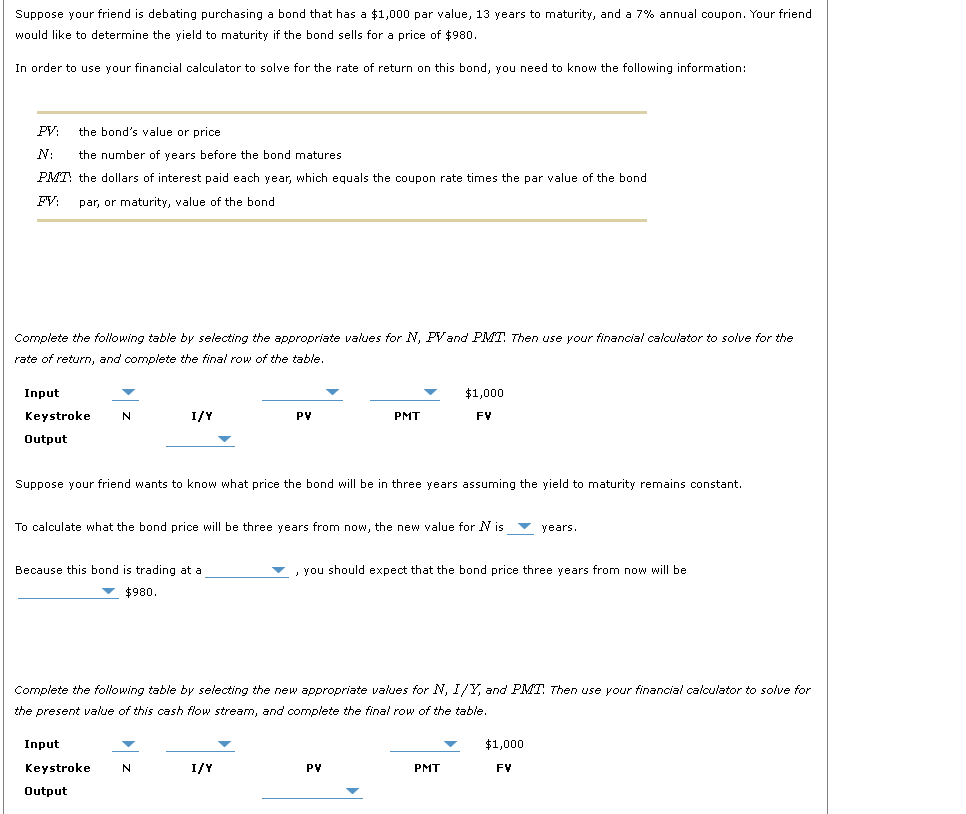

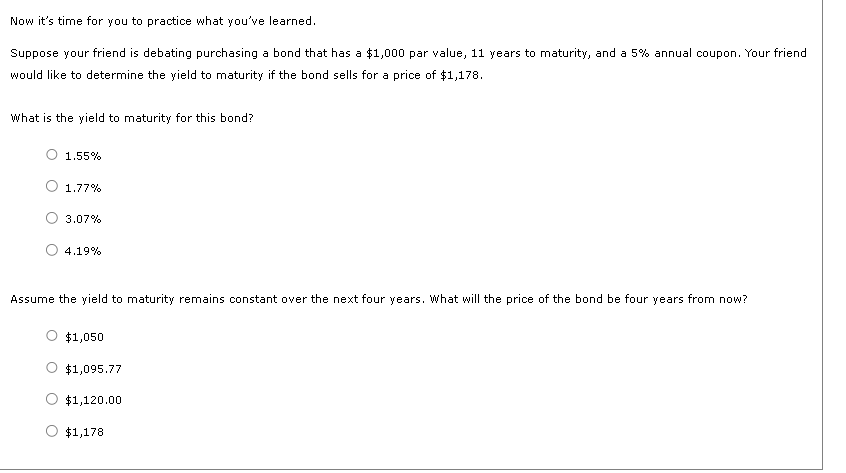

Which of the following yield calculations accounts for holding the bond for its entire predetermined lifetime? Yield to maturity Yield to call Suppose you were offered a 14 -year, 8% annual coupon, $1,000 par value bond at a price of $1,422.52. If you bought the bond, held it to maturity, and received the promised interest payments and maturity value, the rate of interest you would earn is called the bond's yield to maturity (YTM). The yield to maturity is the value for ra that solves the following equation: VB=(1+rj)2JWT+(1+rs)2JWT++(1+rj)HJMT+(1+rj)HM$1,422.52=(1+rs)2$90+(1+rs)2$90++(1+rs)4$90+(1+rs)14$1,000 Where: VB : the bond's value or price ra : the market rate of interest on the bond N : the number of years before the bond matures INT: the dollars of interest paid each year, which equals the coupon rate times the par value of the bond M : par, or maturity, value of the bond To solve for ra, you could use trial and error until you find a value that results in the sum of the present values equaling the price of the bond, but that would be tedious and time consuming. On the other hand, you can use a financial calculator to solve for I/Y: Holding all else constant, a higher bond price results in a yield to maturity. Suppose your friend is debating purchasing a bond that has a $1,000 par value, 13 years to maturity, and a 7% annual coupon. Your friend would like to determine the yield to maturity if the bond sells for a price of $980. In order to use your financial calculator to solve for the rate of return on this bond, you need to know the following information: Complete the following table by selecting the appropriate values for N, PVand PMT. Then use your financial calculator to solve for the rate of return, and complete the final row of the table. Suppose your friend wants to know what price the bond will be in three years assuming the yield to maturity remains constant. To calculate what the bond price will be three years from now, the new value for N is years. Because this bond is trading at a , you should expect that the bond price three years from now will be $980. Complete the following table by selecting the new appropriate values for N,I/Y, and PMT. Then use your financial calculator to solve for the present value of this cash flow stream, and complete the final row of the table. Now it's time for you to practice what you've learned. Suppose your friend is debating purchasing a bond that has a $1,000 par value, 11 years to maturity, and a 5% annual coupon. Your frien would like to determine the yield to maturity if the bond sells for a price of $1,178. What is the yield to maturity for this bond? 1.55% 1.77% 3.07% 4.19% Assume the yield to maturity remains constant over the next four years. What will the price of the bond be four years from now? $1,050 $1,095.77 $1,120,00 $1,178

Which of the following yield calculations accounts for holding the bond for its entire predetermined lifetime? Yield to maturity Yield to call Suppose you were offered a 14 -year, 8% annual coupon, $1,000 par value bond at a price of $1,422.52. If you bought the bond, held it to maturity, and received the promised interest payments and maturity value, the rate of interest you would earn is called the bond's yield to maturity (YTM). The yield to maturity is the value for ra that solves the following equation: VB=(1+rj)2JWT+(1+rs)2JWT++(1+rj)HJMT+(1+rj)HM$1,422.52=(1+rs)2$90+(1+rs)2$90++(1+rs)4$90+(1+rs)14$1,000 Where: VB : the bond's value or price ra : the market rate of interest on the bond N : the number of years before the bond matures INT: the dollars of interest paid each year, which equals the coupon rate times the par value of the bond M : par, or maturity, value of the bond To solve for ra, you could use trial and error until you find a value that results in the sum of the present values equaling the price of the bond, but that would be tedious and time consuming. On the other hand, you can use a financial calculator to solve for I/Y: Holding all else constant, a higher bond price results in a yield to maturity. Suppose your friend is debating purchasing a bond that has a $1,000 par value, 13 years to maturity, and a 7% annual coupon. Your friend would like to determine the yield to maturity if the bond sells for a price of $980. In order to use your financial calculator to solve for the rate of return on this bond, you need to know the following information: Complete the following table by selecting the appropriate values for N, PVand PMT. Then use your financial calculator to solve for the rate of return, and complete the final row of the table. Suppose your friend wants to know what price the bond will be in three years assuming the yield to maturity remains constant. To calculate what the bond price will be three years from now, the new value for N is years. Because this bond is trading at a , you should expect that the bond price three years from now will be $980. Complete the following table by selecting the new appropriate values for N,I/Y, and PMT. Then use your financial calculator to solve for the present value of this cash flow stream, and complete the final row of the table. Now it's time for you to practice what you've learned. Suppose your friend is debating purchasing a bond that has a $1,000 par value, 11 years to maturity, and a 5% annual coupon. Your frien would like to determine the yield to maturity if the bond sells for a price of $1,178. What is the yield to maturity for this bond? 1.55% 1.77% 3.07% 4.19% Assume the yield to maturity remains constant over the next four years. What will the price of the bond be four years from now? $1,050 $1,095.77 $1,120,00 $1,178 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started