Which of the three pricing strategies below would you recommend to Tanner Pharmaceuticals?

A. Maintain the high price everywhere and take advantage of the patent period

B. Maintain the high price in developed economies and lower the price for emerging markets

C. Lower prices everywhere

Justify your choice. Evaluate the pros and cons of the one you selected.

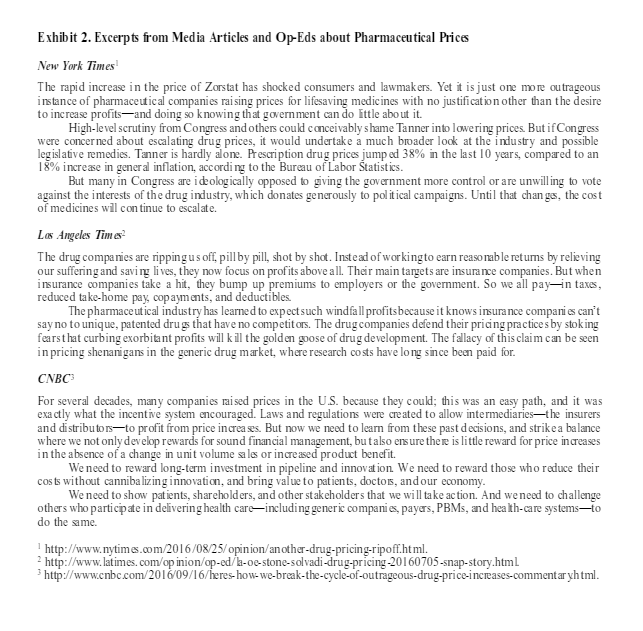

Tanner Pharmaceuticals and the Price of a New Drug Jack Stevens savored his morning newspaper ritual before starting work as CEO of Dominion Health. In September 2024, this ritual had become less enjoyable. Stevens was the lead independent board member for Tanner Pharmaceuticals Inc. (Tanner), a major U.S. pharmaceutical company. Tanner's most profitable product was a vaccine for the nulux virus with the brand name Zorstat. Tanner was the first company to launch a successful nulux vaccine. Unfortunately, accolades for Tanner were turning into brickbats. Tuesday's NYT had the headline, 'Painted as Zorstat Villain, Tanner's Chief Says She's No Such Thing." The Wall Street Journal wrote, "Tanner Faces Scrutiny over Zorstat Price Increases: Criticisms Mount After Drugmaker Raises Cost of Nulux Vaccine by 550% since 2020." On Wednesday, the NYT had an op-ed feature titled "Stop Immoral Price Gouging for Life-Saving Zorstat." Ata press conference that included questions about Zorstat, the White House press secretary said, "Pharmaceutical companies often do real damage to their reputation by being greedy and jacking up prices in a way that victimizes vulnerable people." On Thursday 2024, Democratic presidential nominee Kanye West called the price increase "outrageous"; Tanner's stock ended the day down by 6.2%. In two days, Stevens would attend theannual meeting of Tanner independent directors. The Zorstat pricing controversy was on the agenda. Stevens would have to take and defend a position on Tanner's drug-pricing strategy. Inevitably, there would be a heated discussion on Zorstat and whether management was effectively driving shareholder value with drug-pricing decisions. The Pharmaceutical Industry The main goal of the pharmaceutical industry is to provide drugs that prevent infections, mainta in health, and cure diseases. This industry directly affects the global population, so a number of international regulatory bodies monitor things like drug safety, patents, quality, and pricing. The industry includes several distinct sec tors: patented drugs, generic (off patent) drugs, over-the-counter (OTC) products, and active pharmaceutical ingredients (APIs ), which are the chemicals used to manufacture drugs. Pharmaceutical companies focused on R&D and patented drugs, such as Pfizer and Novartis, were consistently among the most profitable companies in the world. The cost of bringing a new drug to market was estimated at $2.6 billion.' New drug inventions were protected by patents. The length of the patent and its enforceability depended on the country's legal environment. In the U.S., the patent period was 20 years and included the clinical testing and approval period. Once the patent expired, if the drug was still on the market, generic drugs were usually introduced, rapidly eroding profit margins. The upstream activities in the pharmaceutical industry value chain were similar to those of other industries in the manufacturing sector. In the United States, the pharmaceutical industry had only two drug distribution channels: prescriptions from doctors, and OTC. The U.S. Food and Drug Administration regulated both channels. Because pharmaceutical drugs directly affect millions of people's health, strict regulations and oversight existed to ensure safety and quality at each step in the value chain. Total global pharmaceutical sales were expected to grow in line with overall health care spending and global economic growth. The main factors driving health care demand included aging populations, the rise of chronic diseases, and the increase in innovative and expensive treatments for diseases such as cancer and Hepatitis C.Stewart indicated that Tanner would expand the number of un insured patients getting free Zorstat shots. Stewart also said Tanner would consider a generic version of Zorstat with a lower list price, an unusual move since Tanner was the only company that could sell the product. The Directors Meeting Although it was management's responsibility to make pricing decisions, Stevens decided the independent board members needed to provide guidance for top management. It looked likely that Congress would be holding hearings on drug prices. CEO Stewart could get called up to Capitol Hill next month to explain Zo istat's price. Lowering Zorstat's U.S. price could help the company's corporate reputation but would lower Tanner's profitability and lead to cutbacks in several promising research areas. Another factor for Stevens and the independent board members to consider was the executive compensation plan. Tanner had put a special incentive plan in place more than two years ago that rewarded executives if they hit profit targets. The compensation award was potentially worth as much as $82 million overall to the company's top five executives. Several large shareholders had criticized the plan when it was made public. Reducing the price of Zorstat could mean sharply lower compensation for executives. As a member of the Tanner Compensation Committee, Stevens had approved the incentive plan but was now concerned that perhaps it was driving decisions on drug prices that were jeopardizing Tanner's corporate reputation and long-term performance. Stevens knew that Tanner was not thefirst U.S. pharmaceutical company subject to criticism over its pricing practices and would not be the last. Health care costs were a regular source of debate in the U.S., especially during presidential campaigns. Outside the U.S., Tanner was being hailed as a savior for its success with the nulux vaccine, and its pricing practices generated little controversy. Endnotes Tufts Center for the Study of Drug Development, "Costto Develop and Win Marketing Approval for a New Drug Is $2.6 Billion," Press Release, November 18, 2014. J. Whalen, "Why the US. Pays More than Other Countries for Drugs," Wall Street Joumal, December 1, 2015.Exhibit 2. Excerpts from Media Articles and Op-Eds about Pharmaceutical Prices New York Times" The rapid increase in the price of Zorstat has shocked consumers and lawmakers. Yet it is just one more outrageous instance of pharmaceutical companies raising prices for lifesaving medicines with no justification other than the desire to increase profits-and doing so knowing that government can do little about it. High-level scrutiny from Congress and others could conceivably shame Tanner into lowering prices. But if Congress were concerned about escalating drug prices, it would undertake a much broader look at the industry and possible legislative remedies. Tanner is hardly alone. Prescription drug prices jumped 38% in the last 10 years, compared to an 18% increase in general inflation, according to the Bureau of Labor Statistics. But many in Congress are i deologically opposed to giving the government more control or are unwilling to vote against the interests of the drug industry, which donates generously to political campaigns. Until that changes, the cost of medicines will continue to escalate. Los Angeles Times The drug companies are ripping us off, pill by pill, shot by shot. Instead of working to earn reasonable returns by relieving our suffering and saving lives, they now focus on profits above all. Their main targets are insurance companies. But when insurance companies take a hit, they bump up premiums to employers or the government. So we all pay-in taxes, reduced take-home pay, copayments, and deductibles. The pharmaceutical industry has learned to expectsuch windfall profitsbecause it knows insurance companies can't say no to unique, patented drugs that have no competitors. The drug companies defend their pricing practices by stoking fearsthat curbing exorbitant profits will kill the golden goose of drug development. The fallacy of this claim can be seen in pricing shenanigans in the generic drug market, where research costs have long since been paid for. CNBC3 For several decades, many companies raised prices in the US. because they could; this was an easy path, and it was exactly what the incentive system encouraged. Laws and regulations were created to allow intermediaries-the insurers and distributors-to profit from price increases. But now we need to learn from these past decisions, and strikea balance where we not only develop rewards for sound financial management, butalso ensure there is little reward for price increases in the absence of a change in unit volume sales or increased product benefit. We need to reward long-term investment in pipeline and innovation. We need to reward those who reduce their costs without cannibalizing innovation, and bring value to patients, doctors, and our economy. We need to show patients, shareholders, and other stakeholders that we will take action. And we need to challenge others who participate in delivering health care-including generic companies, payers, PBMs, and health-care systems-to do the same. http://www.nytimes.com/2016/08/25/opinion/another-drug-pricing-ripoff.html. http://www.latimes. com/opinion/op-ed/ba-oe-stone-solvadi-drug-pricing-20160705-snap-story.html 3http://www.enbc.com/2016/09/16/hereshow- we-break-the-cycle-of-outrageous-drug-price-increases-commentaryhtml.Drug Prices The prices of paten ted drugs varied from country to country and depended on various factors, such as the regulatory environment, the drug distribution systems, the degree to which buyers are public or private, and the nature of health care and insurance systems. U.S. prices were almost always the highest. For example, one study looked at prices in the U.S. and Norway, a country with a much higher GDP per capita than the U.S., and found that U.S. prices were higher than Norwegian prices for 93% of 40 top-branded drugs available in both countries.' In many countries, including Norway, a government health care system negotiated drug prices and in some cases opted not to buy certain drugs if there were questions about their eficacy. In the U.S., governments were not involved in drug-pricing decisions. The pharmaceutical companies defended their U .S. pricing practices as necessary to recover the costs of drug development and testing. Companies argued that if the U.S. had pricing controls like Europe and Canada, R& D spending would be cut and fewer new drugs would be developed. Tanner Pharmaceuticals Inc. Tanner was founded in 1961 in Morristown New Jersey as a pharmaceutical products distributor. In 1965 the company began manufacturing OTC health products such as cough syrup. In 1966 Tanner received approval from the FDA to manufacture its first medicine, Penicillin G. The company broadened its product line to include other generic antibiotics as well asanalgesics, antihistamines, diuretics, and tranquilizers. These products were sold to other pharmaceutical companies as private label products. In 1984 the company introduced its first branded generic product. Between 1993 and 1999, the company reduced its private labelling business and i nor eased the number of branded products. In 2004 the company's revenue was more than $1.3 billion and its stock was added to the S&P500. In 2008 the company acquired Signet Laboratories, a company focused on vaccines. The Signet deal was Tanner's entry into pharmaceutical R&D and proprietary drugs. Tanner's mission statement was as follows: Our aspiration is to be at the forefront of our industry in bringing complex products to patients in the markets we serve. With our research-driven specialty businesses, we help patients, customers, partners, and our communities around the world to live a better life. We deliver entrepreneurial success through innovation. In 2017 Tanner was involved in a complex transaction involving the acquisition of the generics business of UK-based Tysol, the creation of a holding company in the Netherlands, and a large transfer of Tanner stock to a Dutch foundation called a stichting. The transaction, known in the U.S. as an inversion, shifted Tanner's tax domicile to the Netherlands and lowered U.S. corporate income taxes. Exhibit 1 shows summary financial information for Tanner. Zorstat Price In 2015 the nulux virus began spreading to many other countries, including the U.S. In 2020 Tanner received FDA approval for a new nulux vaccine, which was branded as Zorstat. The company launched the product simultaneously in the U.S. and many other countries. The controversy over the Zorstat price erupted in 2024 after a review by a drug-pricing analytics firm. The firm reported that in the past two years Tanner had doubled the price of a single vaccine dose from $50 to $100, and that since the drug was introduced, the price had risen 550%. Prices outside the U.S. were much lower. In Brazil a single dose could be purchased from a doctor for less than $20. In some countries in Africa, the price was even lower. Exhibit 2 shows some excerpts from media articles about pharmaceutical prices. Tanner CEO Susan Stewart, who was paid $21.6 million in 2023, defended the U.S. price increases in an interview. She blamed high patient costs on insurers and drug-benefit managers who make money by negotiating bigger discounts off increasing list prices. She also said, "You can do good and do well, and I think we strike that balance around the globe. I am running a business. I am a for-profit business. I am not hiding from that."