Question

Which of the two bond has lower price per bond. Bond X that pay 6% annual coup-on (semi-annually) that will mature in 14 years.

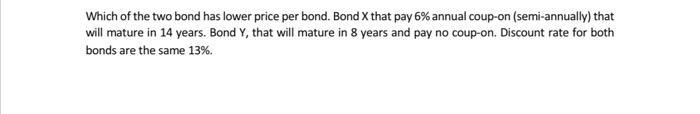

Which of the two bond has lower price per bond. Bond X that pay 6% annual coup-on (semi-annually) that will mature in 14 years. Bond Y, that will mature in 8 years and pay no coup-on. Discount rate for both bonds are the same 13%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Bond X Par Value Lets assume 1000 Coupon Rate 6 annually Coupon Payment 6 of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

13th International Edition

1265533199, 978-1265533199

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App