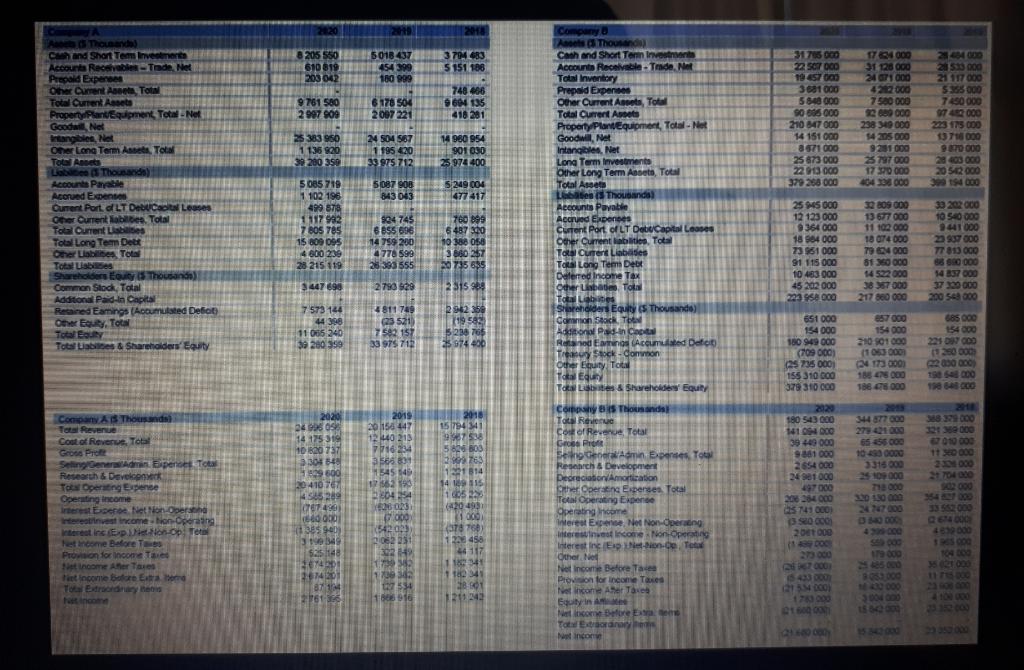

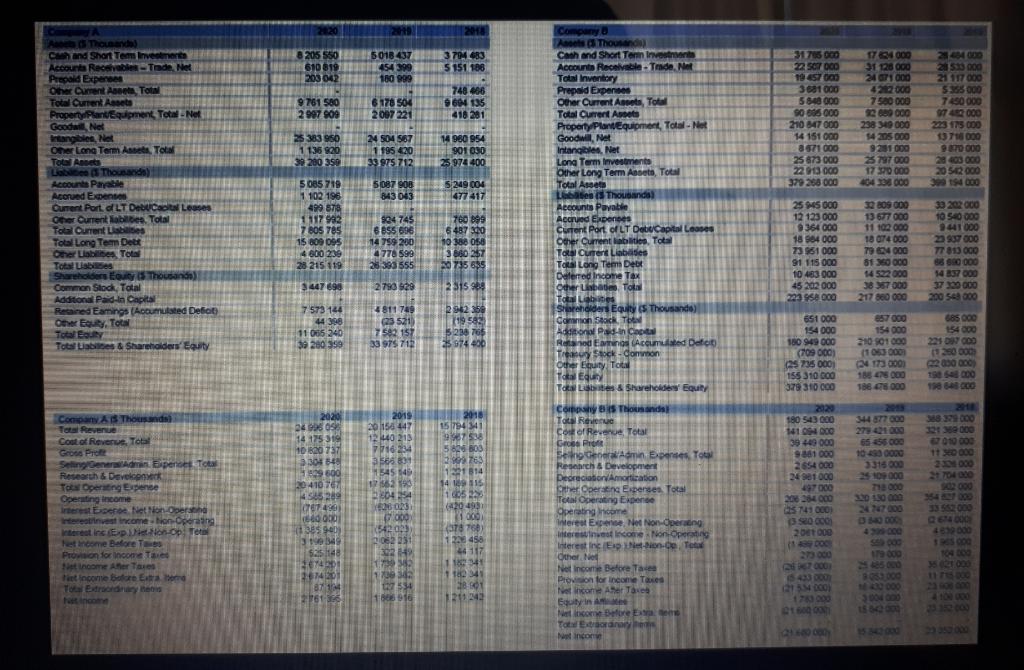

Which of the two companies A and B would you assign a better credit rating? Comment on your choice

8205 550 610 819 203 042 5018 437 454 399 100 999 3704683 5 151 156 9.761 580 2 997 900 6178 504 2007 221 748 466 0614135 410 281 317050 22 SCT OCO 19 657000 3681000 5 840 000 so 05.000 210 847 000 14 151 000 8 571000 25673 000 22913 000 379 260 000 17 000 31 126 000 24 GT1000 4202000 7520 000 200 000 238 340 000 54 205 000 9231 000 3797 000 1790 000 40438 000 250 000 21 117 000 5355 000 7400 000 97 400 000 223 175 000 13 716 000 9.870 000 25 383 950 1135 620 39 200 350 24 504 567 1.795 420 33 975 712 14 960 954 901030 25 974 400 20 50 000 14 000 Tonando Cash and Short Term Investment Account ReceTode Net Prepaid Expenses Ohe Current Asset To Total Current este Property Plant Equipment Total-Net Good Nel aangebies Nel Other Long Term Asse. To Total Anne Lab Thousands) Accounts Payable Acored Expenses Cunet Port LT DECool Lesses One Current Robbies. Total Total Current Les Total Long Term Deck Other Liabetes Tota Tots Usbes Shareholders Eur Thousand) Common Stock Total Additional Pad-la Capital Recained Earings (Accumulated Defit Other E Total Total Euty Totes tibies & Shareholders' Equity 5087 908 843 043 5 249004 477 417 5 085 719 1 102 196 499 878 1117982 7 806 785 16 809 095 4 600 236 28 215 119 Company Ants Thousands Cash and Short Teman Investment Accounts Receivable-Trade Net Total Inventory Prepaid Expenses Other Current Assets, Total Total Current Assets Property PlantEquipment, Totale Goodwill, Net Intangibles, Net Long Term investments Other Long Term Assets, Total Total Aseet Les Thousands Accounts Payable Accued Expenses Current Port of LT DeliCapital Leaves other Oument bic. Tota Total Current Labebes Tou Long Term Deer Deferred Income Tax Other Libati To Tobies Shareholders Equitys Thousando) Common Sock YON As ons in Cap Behold Eng. Accumulated Detet Tre rock-common Other Equity Total To Eque Tol Labe & Shareholders' Equity 934 745 6895 696 14 759 200 778 599 25 393555 760 899 6 487 400 10 388 058 3810257 20735835 255 000 12 123 000 9364 000 18 984 000 7351 000 91 115 000 10 483 000 45 202 000 23.95900 0809 000 13 677 000 11 100 000 18 OT 4 000 79 4 000 81 30 000 14 522 000 38 357000 217 860 000 30 202 000 10 50 000 9441 000 23 937 000 TT 813 OCO 86 800 000 14 837 000 37299 000 200 543 000 447698 2790 529 231593 57000 685 600 7 573 124 44 398 11005 240 39 280 399 4811749 (23 521 7592 157 33 976 712 2942358 (19583 5258766 25 974 400 225 DN GOD 651 000 154 000 1 949 000 (709 000) 5 735 000) 155 310 000 379 310 000 210 901 000 11 000 000 4 173 000) 1884 000 188 000 180 648 000 344 877 000 388329 0g 327 369 000 2020 2400 14 15 16 10 820 757 301 BA 9 600 410 767 65 55 000 10 400 0000 2015 20156 447 12440 213 7716234 a 586 800 545 549 62190 804254 2003 2018 151794 341 9987538 5826 800 38.763 131 314 14 1915 1605 23 420493 Com A Thousands Total Revenue Cost of Revenue, Total GoPro Seng Generdman perset Total Research & Development Te Derating Expense Coerating income mere per Neon Opera Interestinvest income-hion Operating interest in Epito-op. Tete het income Before To Proson for Income Taxe income Aner Taxes antincore bored Tour Edredetis Fortino 11 000 2300000 21704000 2 000 3540000 180 54000 141 ON DOO 39 449 000 981000 2 654 000 2401 000 497000 200 254000 15141 30 000 200 000 SUS 220 130 000 COTO Co To Rue Colof Revenue, Total Geces Pro Berger Am podes Total Research & Development Depreciation Amortization ther Operating Expenses Total Total Operating Expende Operating income Interest Expense Net Non-Operaeng Interest Income Non-Operating Interesting Epon. To Other Net Income Before Tace Provision for Income Taxes Ne income Are The Equity in come Before Today incon 54203 2062251 3029 es 90 1993 $25 1128 78 768) 22 455 46117 273000 000 104 00 35 31000 30000 2014201 BI 2176138 170834 7534 1806918 1234 3801 1211242 5.43 DO 21500)