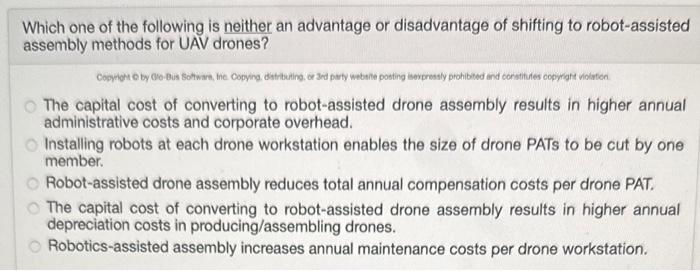

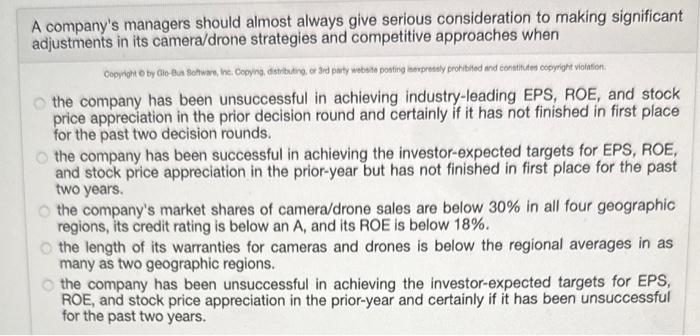

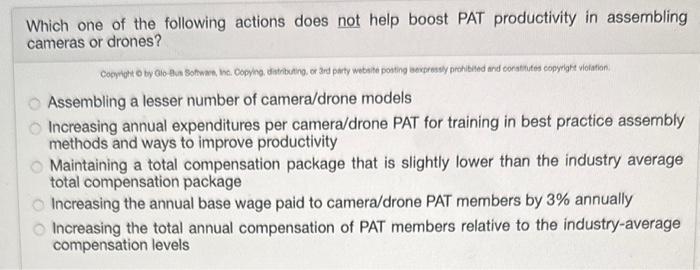

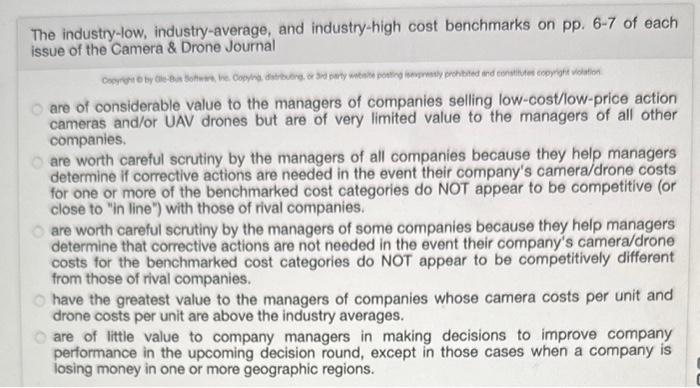

Which one of the following is neither an advantage or disadvantage of shifting to robot-assisted assembly methods for UAV drones? The capital cost of converting to robot-assisted drone assembly results in higher annual administrative costs and corporate overhead. Installing robots at each drone workstation enables the size of drone PATs to be cut by one member. Robot-assisted drone assembly reduces total annual compensation costs per drone PAT. The capital cost of converting to robot-assisted drone assembly results in higher annual depreciation costs in producing/assembling drones. Robotics-assisted assembly increases annual maintenance costs per drone workstation. A company's managers should almost always give serious consideration to making significant adjustments in its camera/drone strategies and competitive approaches when the company has been unsuccessful in achieving industry-leading EPS, ROE, and stock price appreciation in the prior decision round and certainly if it has not finished in first place for the past two decision rounds. the company has been successful in achieving the investor-expected targets for EPS, ROE, and stock price appreciation in the prior-year but has not finished in first place for the past two years. the company's market shares of camera/drone sales are below 30% in all four geographic regions, its credit rating is below an A, and its ROE is below 18%. the length of its warranties for cameras and drones is below the regional averages in as many as two geographic regions. the company has been unsuccessful in achieving the investor-expected targets for EPS, ROE, and stock price appreciation in the prior-year and certainly if it has been unsuccessful for the past two years. Which one of the following actions does not help boost PAT productivity in assembling cameras or drones? Assembling a lesser number of camera/drone models Increasing annual expenditures per camera/drone PAT for training in best practice assembly methods and ways to improve productivity Maintaining a total compensation package that is slightly lower than the industry average total compensation package Increasing the annual base wage paid to camera/drone PAT members by 3% annually Increasing the total annual compensation of PAT members relative to the industry-average compensation levels The industry-low, industry-average, and industry-high cost benchmarks on pp. 6-7 of each issue of the Camera \& Drone Journal are of considerable value to the managers of companies selling low-cost/low-price action cameras and/or UAV drones but are of very limited value to the managers of all other companies. are worth careful scrutiny by the managers of all companies because they help managers determine if corrective actions are needed in the event their company's camera/drone costs for one or more of the benchmarked cost categories do NOT appear to be competitive (or close to "in line") with those of rival companies. are worth careful scrutiny by the managers of some companies because they help managers determine that corrective actions are not needed in the event their company's camera/drone costs for the benchmarked cost categories do NOT appear to be competitively different from those of rival companies. have the greatest value to the managers of companies whose camera costs per unit and drone costs per unit are above the industry averages. are of little value to company managers in making decisions to improve company performance in the upcoming decision round, except in those cases when a company is losing money in one or more geographic regions. A company's EPS can most always be bolstered by managerial actions to achieve an A+ credit rating-the resulting lower interest rates on borrowings help drive increases in EPS allocate some of the company's earnings to purchasers of the company's shares of common stock, ideally most every year. offer more camera/drone models to buyers than rivals; 7 models is ideal. allocate significant cash flows from operations to repurchasing shares of common stock, ideally most every year. allocate significant cash from new loan issues to repurchasing shares of common stock, often every year or so