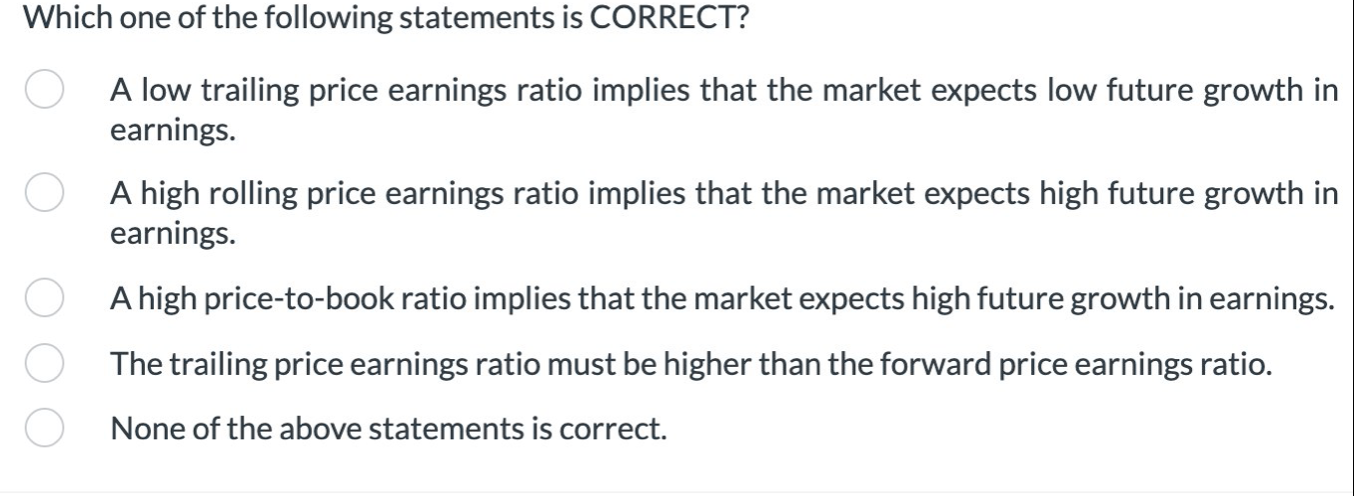

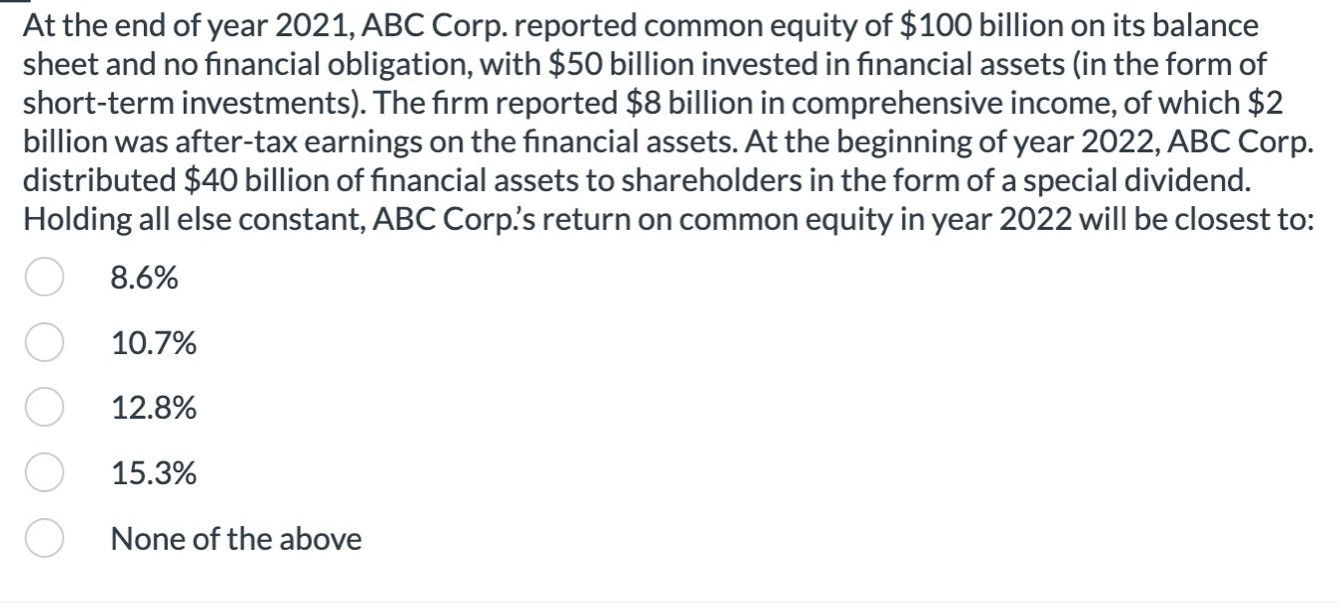

Which one of the following statements is CORRECT? A low trailing price earnings ratio implies that the market expects low future growth in earnings. A high rolling price earnings ratio implies that the market expects high future growth in earnings. A high price-to-book ratio implies that the market expects high future growth in earnings. The trailing price earnings ratio must be higher than the forward price earnings ratio. None of the above statements is correct. At the end of year 2021, ABC Corp. reported common equity of $100 billion on its balance sheet and no financial obligation, with $50 billion invested in financial assets (in the form of short-term investments). The firm reported $8 billion in comprehensive income, of which $2 billion was after-tax earnings on the financial assets. At the beginning of year 2022, ABC Corp. distributed $40 billion of financial assets to shareholders in the form of a special dividend. Holding all else constant, ABC Corp.'s return on common equity in year 2022 will be closest to: 8.6% 10.7% 12.8% 15.3% None of the above Which one of the following statements is CORRECT? A low trailing price earnings ratio implies that the market expects low future growth in earnings. A high rolling price earnings ratio implies that the market expects high future growth in earnings. A high price-to-book ratio implies that the market expects high future growth in earnings. The trailing price earnings ratio must be higher than the forward price earnings ratio. None of the above statements is correct. At the end of year 2021, ABC Corp. reported common equity of $100 billion on its balance sheet and no financial obligation, with $50 billion invested in financial assets (in the form of short-term investments). The firm reported $8 billion in comprehensive income, of which $2 billion was after-tax earnings on the financial assets. At the beginning of year 2022, ABC Corp. distributed $40 billion of financial assets to shareholders in the form of a special dividend. Holding all else constant, ABC Corp.'s return on common equity in year 2022 will be closest to: 8.6% 10.7% 12.8% 15.3% None of the above