Answered step by step

Verified Expert Solution

Question

1 Approved Answer

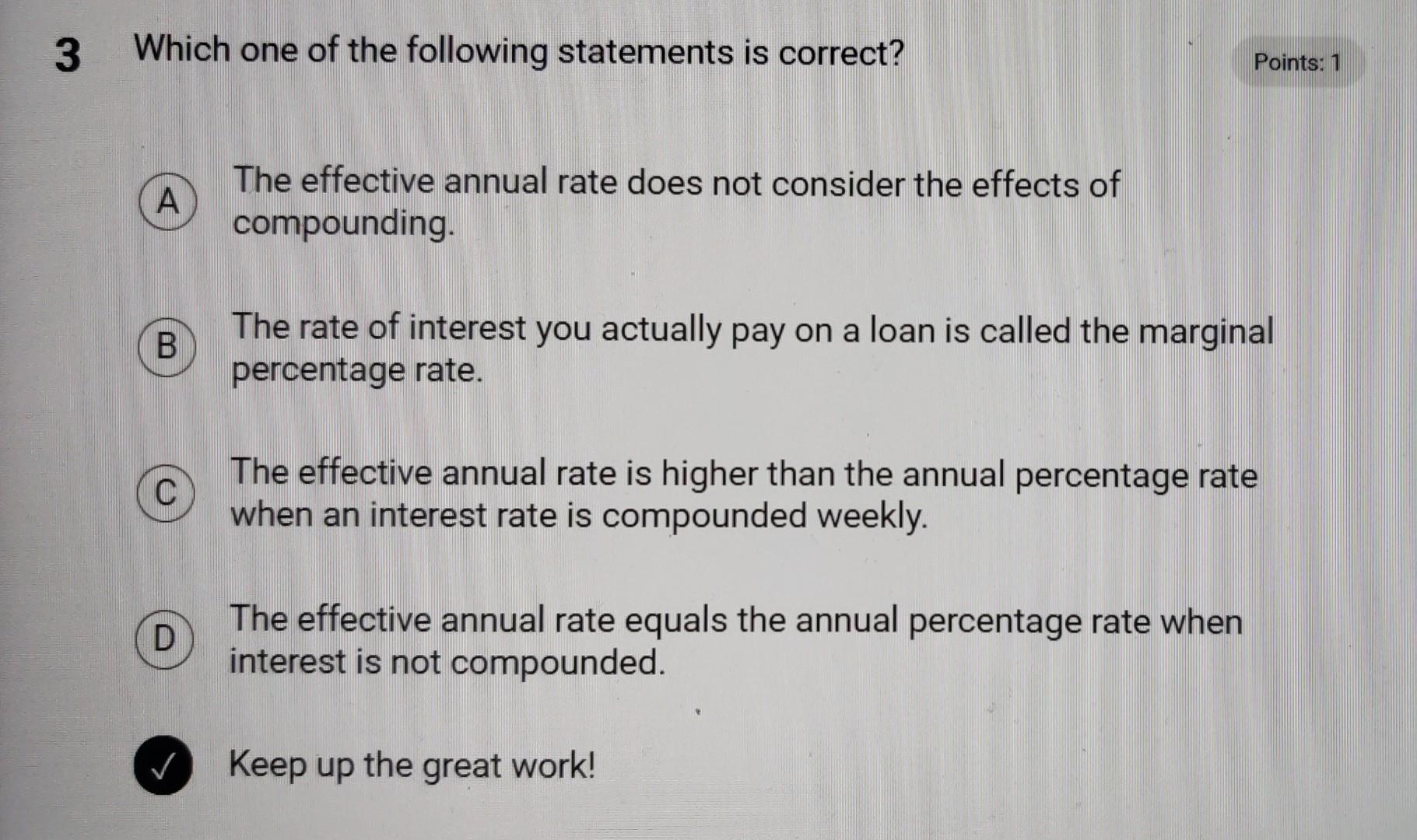

Which one of the following statements is correct? The effective annual rate does not consider the effects of compounding. The rate of interest you actually

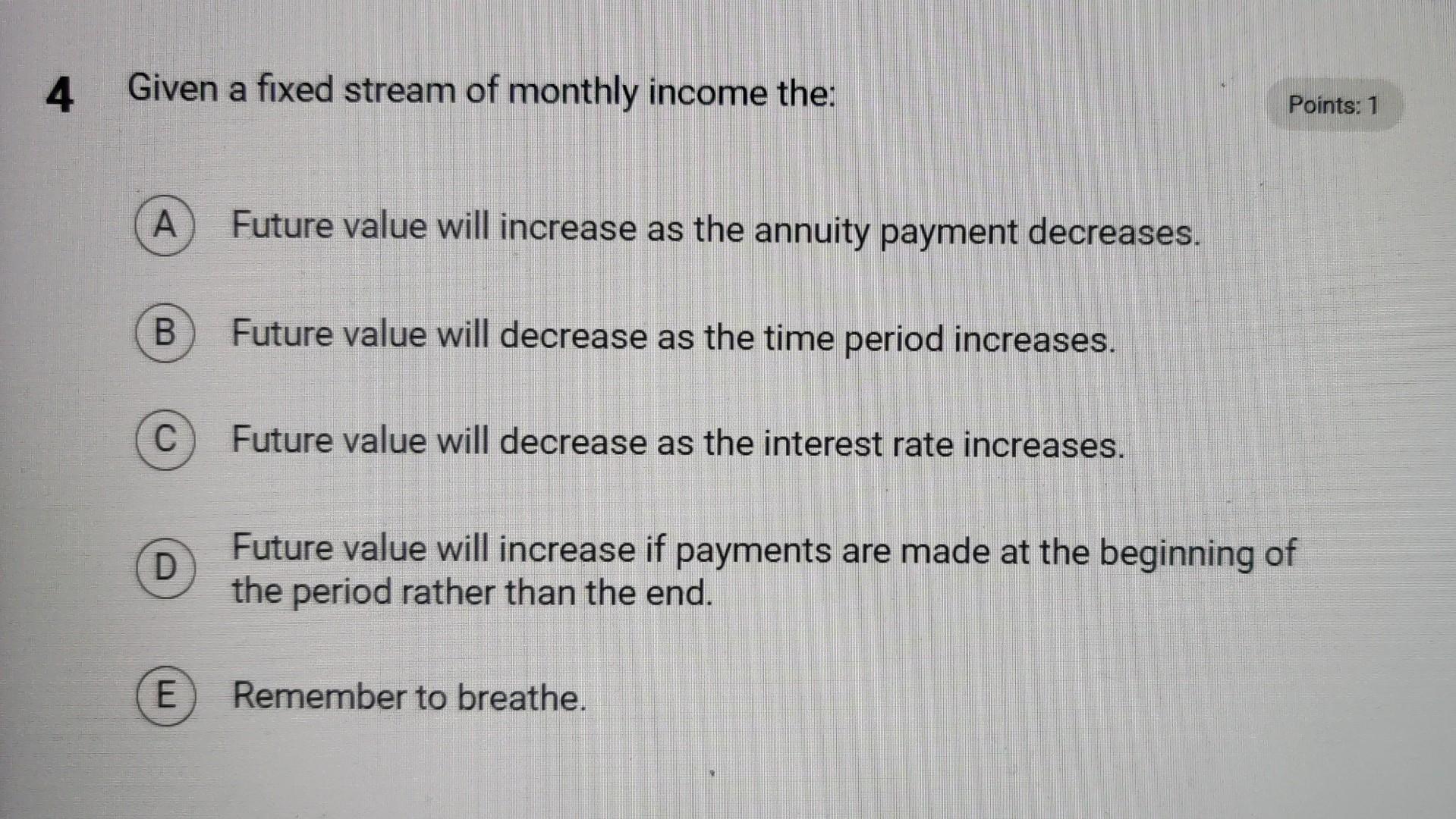

Which one of the following statements is correct? The effective annual rate does not consider the effects of compounding. The rate of interest you actually pay on a loan is called the marginal percentage rate. The effective annual rate is higher than the annual percentage rate when an interest rate is compounded weekly. The effective annual rate equals the annual percentage rate when interest is not compounded. Keep up the great work! Given a fixed stream of monthly income the: Future value will increase as the annuity payment decreases. Future value will decrease as the time period increases. Future value will decrease as the interest rate increases. Future value will increase if payments are made at the beginning of the period rather than the end. Remember to breathe

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started