which one??

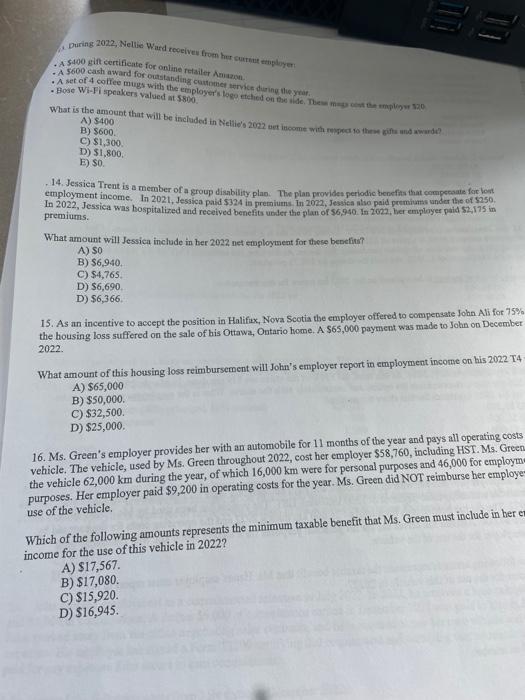

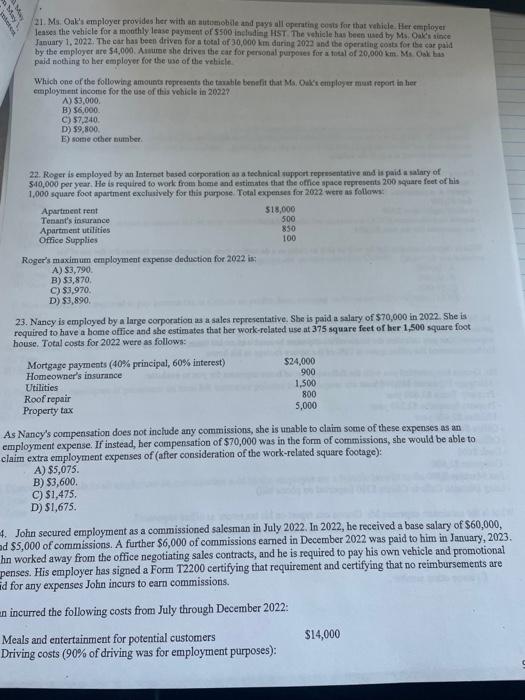

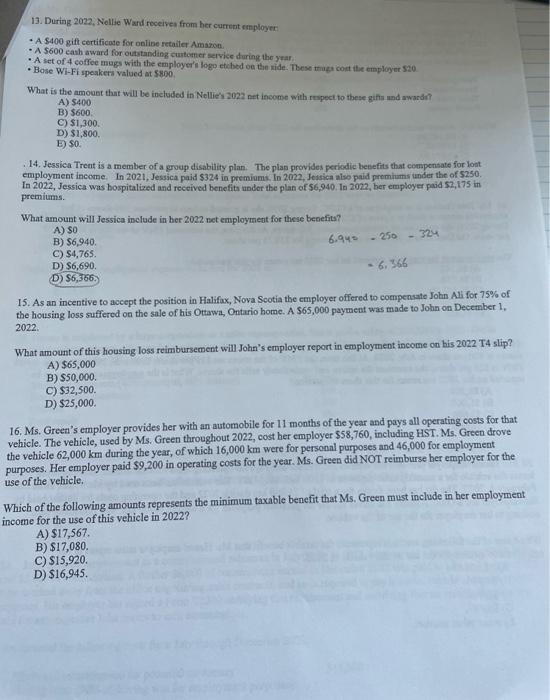

What is the amount that will be included in Netlie's 2022 uet income with ropped fo thene kifte mid awarde? A) $400 C) $1,300 D) 51,800 E) $0. 14. Jessica Trent is a member of a group disability plao. The plan providea periodie beneffit that cempenaate foc lost employment income. In 2021, Jessica paid 5324 in premiums. In 2022, Jessiea also paid permiums under the of $250. In 2022, Jessica was hospitalized and recelyed benefits under the plan of 56,940 . In 2022 , ler employer peid 52,175 in premiums. What amount will Jessiea include in ber 2022 net employment for these benefins? A) 50 B) $6.940 C) $4,765 D) $6,690 D) $6,366 15. As an incentive to accept the position in Halifix, Nova Seotia the employer offered to compenaste John Ali for 75% the housing loss suffered on the sale of his Ottawa, Ontario home. A $65,000 payment was made to John on Decembet 2022. What amount of this housing loss reimbursement will John's employer report in employment income on his 2022 T4 A) $65,000 B) $50,000. C) $32,500. D) $25,000. 16. Ms. Green's employer provides her with an automobile for 11 months of the year and pays all operating costs vehicle. The vehicle, used by Ms. Green throughout 2022, cost her employer $58,760, including HST. Ms. Green the vehicle 62,000km during the year, of which 16,000km were for personal purposes and 46,000 for employm purposes. Her employer paid $9,200 in operating costs for the year. Ms. Green did NOT reimburse ber employe use of the vehicle. Which of the following amounts represents the minimum taxable benefit that Ms. Green must include in ber income for the use of this vehicle in 2022 ? A) $17,567. B) $17,080. C) $15,920. D) 516,945 . 21. Ma. Oak'a employer provides hist with an autsmobsle and pays all operating covis for that vahicle. Her empioyer leases the vehicle for a monthly lease payment of 5500 inoloditid HST The vetricle has bees uatd by Ms. Oales aince Japuary 1, 2022. The car has been driven for a total of 30,000km duting 2022 and the operating costa for the car paid by the employer ate 54,000 . Aasume she drives the car for peracoal pupeses for a total of 20,000km. M. Oak bis paid nothing to ber employor for the uso of the rehiele. Which one of the following amounts ropresentu the tanable benefit that Ms. Onkt cmplog wr muat report in her employment income for the use of this vehicle in 2522 ? A) 53,000. B) 36,000 . C) 57,240 D) 59,800 E) sorte other number: 22. Roger is eaployed by an Isterpet based corporation as a teehnical support representative and is paid in salary of 1,000 square foot apartment exclustivdy for this purpose Total expenses for 2022 were as folkows: Roger's maximum employment expense dedisetion for 2022 is: A) $3,790 B) $3,870 C) 53,970 D) 53,890 . 23. Nancy is employed by a large corporation as a sales reprerentative. She is paid a salary of $70,000 in 2022 : $ be is required to have a bome office and she estimates that ber work-rolated use at 375 square feet of her 1 , 500 square foot hoese. Total costs for 2022 were as follows: As Nancy's compensation does not inchude any commissions, she is table to claim some of these expenses as an employment expense. If instead, ber compensation of $70,000 was in the form of commissions, she would be able to claim extra employment expenses of (after consideration of the work-related square footage): A) 35,075 B) $3,600. C) 51,475 , D) $1,675. 4. John secured employment as a commissioned salesman in July 2022, In 2022, he received a base salary of 560,000 , 4. Jonn secured employment as a commissioned safesman in July 2022 of commissions. A further $6,000 of commissions earmed in December 2022 was paid to him in Janury, 2023 . hn worked away from the office negotiating sales contracts, and he is required to pay his own vehicle and promotional penses. His employer has signed a Form T2200 certifying that requirement and certifying that no reimbursements are id for any expenses John incurs to earm commissions. - A $400 gift certificote for onlibe retailer Amazon. - A 5600 cash award for outstanding cuntemer sevvice during the y rar. - A set of 4 coffee mugs with the employer'i logo etched oe tie side. Tbese truge cont the employer 520 - Bose Wi-Fi speaker valued at 5890 . What is the amouet that will be included in Nellie's 2022 net income with rropect to these giff mand awardin A) $400 B) $600 C) $1,300. D) $1,800. E) 50 14. Jessica Treat is a member of a group disability plan. The plan provides periodic beenefits that compensate for lont. employment income. In 2021, Jessica paid $324 in premiums. In 2022, Jeasica also paid premiums inder the of 5250 . In 2022, Jessica was bospitalized and received benefits under the plan of 56,940 . In 2022, ber employer paid 52,175 in premitms. What amount will Jessica include in ber 2022 net employment for these benefit? A) $0 B) $6,940. C) $4,765. D) $6,690. (D) 56,356. 15. As an incentive to accept the position in Halifix, Nova Scotia the employer offered to coenpensate Jolan All for 75% of the housing loss suffered on the sale of his Ottawa, Ontario home. A $65,000 paymeat was made to John on December 1 . 2022. What amount of this housing loss reimbursement will John's employer report in employment income on his 2022 T4 slip? A) $65,000 B) $50,000. C) $32,500. D) $25,000. 16. Ms. Green's employer provides her with an automobile for 11 months of the year and pays all operating costs for that vehicle. The vehiele, used by Ms. Green throughout 2022, cost her employer $58,760, including HST. Ms, Green drove the vehicle 62,000km during the year, of which 16,000km were for personal purposes and 46,000 for employment purposes. Her employer paid $9,200 in operating costs for the year. Ms. Green did NOT reimburse her employer for the use of the vehicle. Which of the following amounts represents the minimum taxable benefit that Ms. Green mast include in her employment income for the use of this vehicle in 2022 ? A) $17,567. B) $17,080. C) $15,920. D) $16,945