Answered step by step

Verified Expert Solution

Question

1 Approved Answer

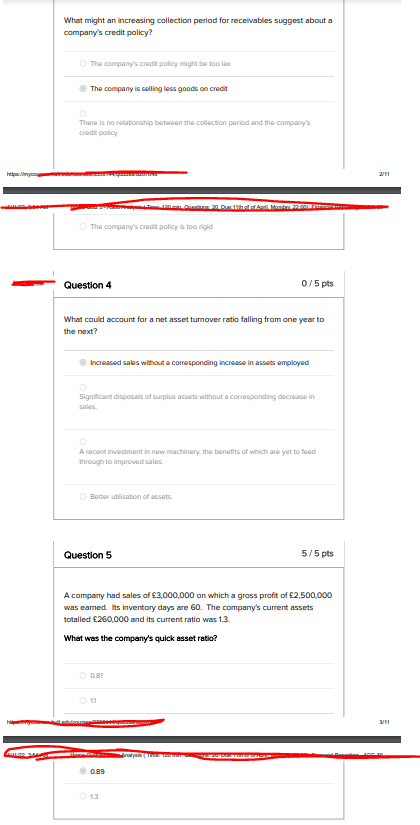

which options are correct, show claculations What might an increasing collection period for receivables suggest about a company's credit policy? The company's credit policy might

which options are correct, show claculations

What might an increasing collection period for receivables suggest about a company's credit policy? The company's credit policy might be too lae The company is selling less goods on credit There is no relationship between the collection period and the company's credit policy 2/11 The company's credit policy is too rigid Question 4 0/5 pts What could account for a net asset turnover ratio falling from one year to the next? Increased sales without a coresponding increase in assets employed Significant disposals of surplus assets without a corresponding decrease in sales A recent investment in new machinery, the benefits of which are yet to feed through to improved sales Bottor utilisation of assets Question 5 5/5 pts A company had sales of 3,000,000 on which a gross profit of 2,500,000 was earned. Its inventory days are 60. The company's current assets totalled 260,000 and its current ratio was 1.3. What was the company's quick asset ratio? 0.81 0.89 13Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started