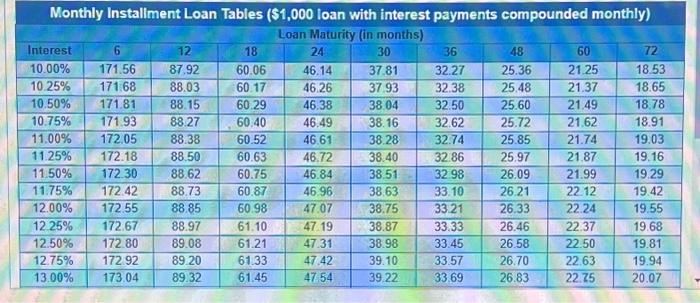

Which results in a lower total interest charge, borrowing 51,400 to be repaid 12 months later as a single-payment laan of borrowing 51,400 to be ropaid as a 12 -month instaliment loan? Assume a simple interest method of calculation at 12.25 percent interest. Defend your answer Click on the table icon to view the Monthly Installment Loan Payment Factor (MILPF) table. The amount of interest on the single-payment loan is s (Round to the nearest cent) The amount of interest on the 12 -month instalimont loan is s (Round to the nearest cent) Why does the 12-month instalment loan result in lower interest charges? (Select the best chaice below) A. Interest costs are lowet when you have the use of the entire $1,400 for the full year (the single-payment loan) With installment payments, the principal is gradually being repaid and interest it paid only on the unpaid balance of the loan. B. Interest costs are higher when you have the use of the entire $1,400 for the full year (the single-payment loan). Whth instalment payments the principal is gradualy being repaid and interest is paid only on the unpaid balance of the loan. Monthly Instaliment Loan Tables (\$1,000 loan with interest payments compounded monthly) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline Interest & 6 & 12 & 18 & 24 & 30 & 36 & 48 & 60 & \multicolumn{10}{|c|}{ Loan Maturity (in months) } \\ \hline 10.00% & 171.56 & 87.92 & 60.06 & 46.14 & 37.81 & 32.27 & 25.36 & 21.25 & 18.53 \\ \hline 10.25% & 171.68 & 88.03 & 60.17 & 46.26 & 37.93 & 32.38 & 25.48 & 21.37 & 18.65 \\ \hline 10.50% & 171.81 & 88.15 & 60.29 & 46.38 & 38.04 & 32.50 & 25.60 & 21.49 & 18.78 \\ \hline 10.75% & 171.93 & 88.27 & 60.40 & 46.49 & 38.16 & 32.62 & 25.72 & 21.62 & 18.91 \\ \hline 11.00% & 172.05 & 88.38 & 60.52 & 46.61 & 38.28 & 32.74 & 25.85 & 21.74 & 19.03 \\ \hline 11.25% & 172.18 & 88.50 & 60.63 & 46.72 & 38.40 & 32.86 & 25.97 & 21.87 & 19.16 \\ \hline 11.50% & 172.30 & 88.62 & 60.75 & 46.84 & 38.51 & 32.98 & 26.09 & 21.99 & 19.29 \\ \hline 11.75% & 172.42 & 88.73 & 60.87 & 46.96 & 38.63 & 33.10 & 26.21 & 22.12 & 19.42 \\ \hline 12.00% & 172.55 & 88.85 & 60.98 & 47.07 & 38.75 & 33.21 & 26.33 & 22.24 & 19.55 \\ \hline 12.25% & 172.67 & 88.97 & 61.10 & 47.19 & 38.87 & 33.33 & 26.46 & 22.37 & 19.68 \\ \hline 12.50% & 172.80 & 89.08 & 61.21 & 47.31 & 38.98 & 33.45 & 26.58 & 22.50 & 19.81 \\ \hline 12.75% & 172.92 & 89.20 & 61.33 & 47.42 & 39.10 & 33.57 & 26.70 & 22.63 & 19.94 \\ \hline 13.00% & 173.04 & 89.32 & 61.45 & 47.54 & 39.22 & 33.69 & 26.83 & 22.75 & 20.07 \\ \hline \end{tabular}