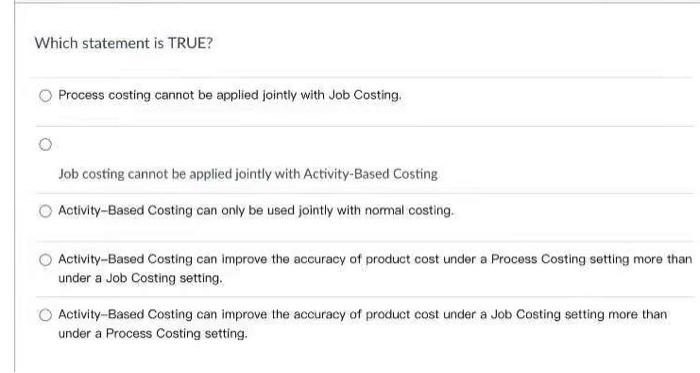

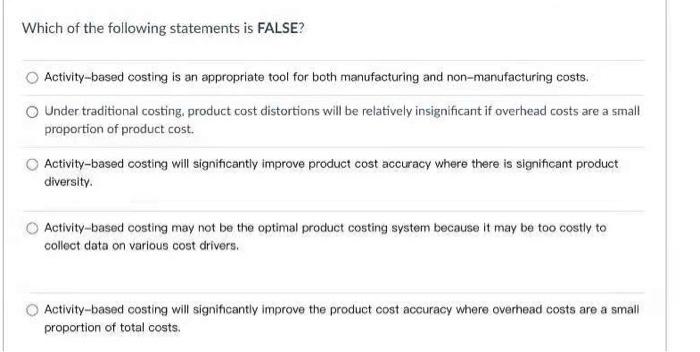

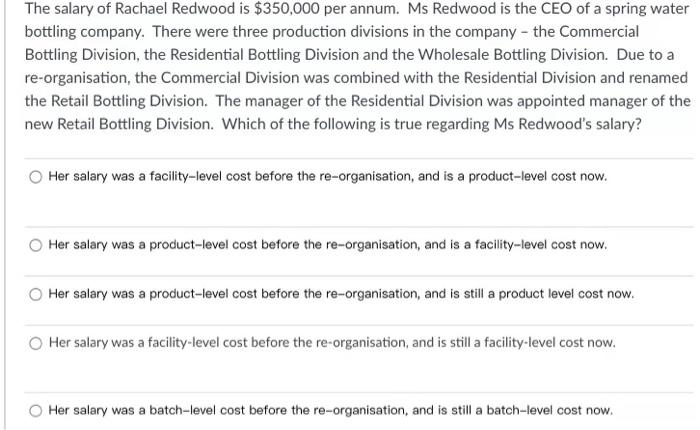

Which statement is TRUE? Process costing cannot be applied jointly with Job Costing, Job costing cannot be applied jointly with Activity-Based Costing Activity-Based Costing can only be used jointly with normal costing. Activity-Based Costing can improve the accuracy of product cost under a Process Costing setting more than under a Job Costing setting. Activity-Based Costing can improve the accuracy of product cost under a Job Costing setting more than under a Process Costing setting. Which of the following statements is FALSE? Activity-based costing is an appropriate tool for both manufacturing and non-manufacturing costs. Under traditional costing, product cost distortions will be relatively insignificant if overhead costs are a small proportion of product cost. Activity-based costing will significantly improve product cost accuracy where there is significant product diversity Activity-based costing may not be the optimal product costing system because it may be too costly to collect data on various cost drivers. Activity-based costing will significantly improve the product cost accuracy where overhead costs are a small proportion of total costs. The salary of Rachael Redwood is $350,000 per annum. Ms Redwood is the CEO of a spring water bottling company. There were three production divisions in the company - the Commercial Bottling Division, the Residential Bottling Division and the Wholesale Bottling Division. Due to a re-organisation, the Commercial Division was combined with the Residential Division and renamed the Retail Bottling Division. The manager of the Residential Division was appointed manager of the new Retail Bottling Division. Which of the following is true regarding Ms Redwood's salary? Her salary was a facility-level cost before the re-organisation, and is a product-level cost now. Her salary was a product-level cost before the re-organisation, and is a facility-level cost now. Her salary was a product-level cost before the re-organisation, and is still a product level cost now. Her salary was a facility-level cost before the re-organisation, and is still a facility-level cost now. Her salary was a batch-level cost before the re-organisation, and is still a batch-level cost now