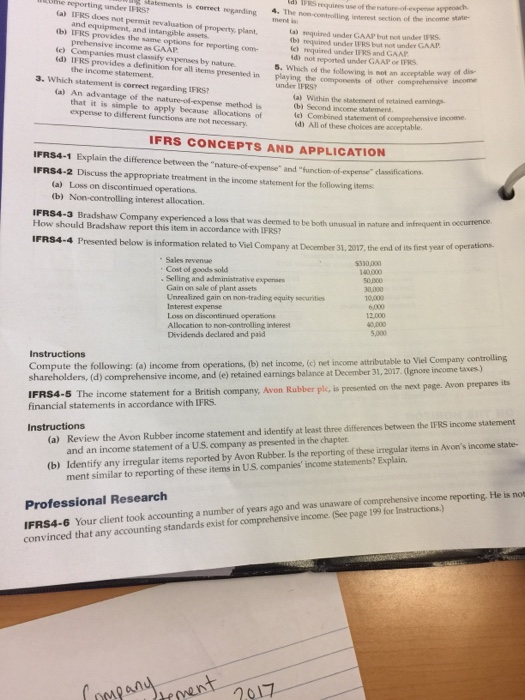

Which statement it correct regarding 1FKST An advantage of the nature-expense method is that it is simple to apply because allocations of expense to different functions are not necessary. The non-controlling interest section of the income statement is required under GAAP but not under IFRS. required under IFRS but not under GAAP. required under IFRS and GAAP. not reported under GAAP or IPRS. Which of the following is not an acceptable way of displaying the components of other comprehensive income under IFRS? Within the statement of retained earnings. Second income statement. Combined statement of comprehensive income. All of these choices are acceptable. IFRS CONCEPTS AND APPLICATION IFRS4-1 Explain the difference between the "nature-of-expense" and function of-classifications. IFRS4 -2 Discuss the appropriate treatment in the income statement for the following Items Loss on discontinued operations Non -controlling interest allocation. IFRS4-3 Bradshaw Company experienced a loss that was deemed to be both unusual in nature and infrequent in occurrence. How should Bradshaw report this item in accordance with IFRS Presented below is information related to Viel Company -December 31, 2017, the end of its first years of operations. Compute the following: income from operations, net income, net income attributable to Viel Company controlling shareholders, comprehensive income, and retained earnings balance at December 31.2017 (Ignore income taxes.) The income statement for a British company, Avon Rubber plc, is presented on the next page. Avon prepares its financial statements in accordance with IFRS. Review die Avon Rubber income statement and identify at least three differences between the IFRS income and an income statement of a U.S company as presented in the chapter Identify any irregular items reported by Avon Rubber. Is the reporting of these irregular items in Avon's income statement similar to reporting of these items in U.S. companies' income statements? Explain. Your client look accounting a number of yews ago and was unaware of comprehensive income reporting Hear convinced that am accounting standards exist for comprehensive income (See page 199 for Instructions.)