Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which transaction we need adjusting journal entry? Transactions: 1/07 The business owner invested $100,000 cash to commence the business. (From: David Sacks, Reference: 010) 1/07

Which transaction we need adjusting journal entry?

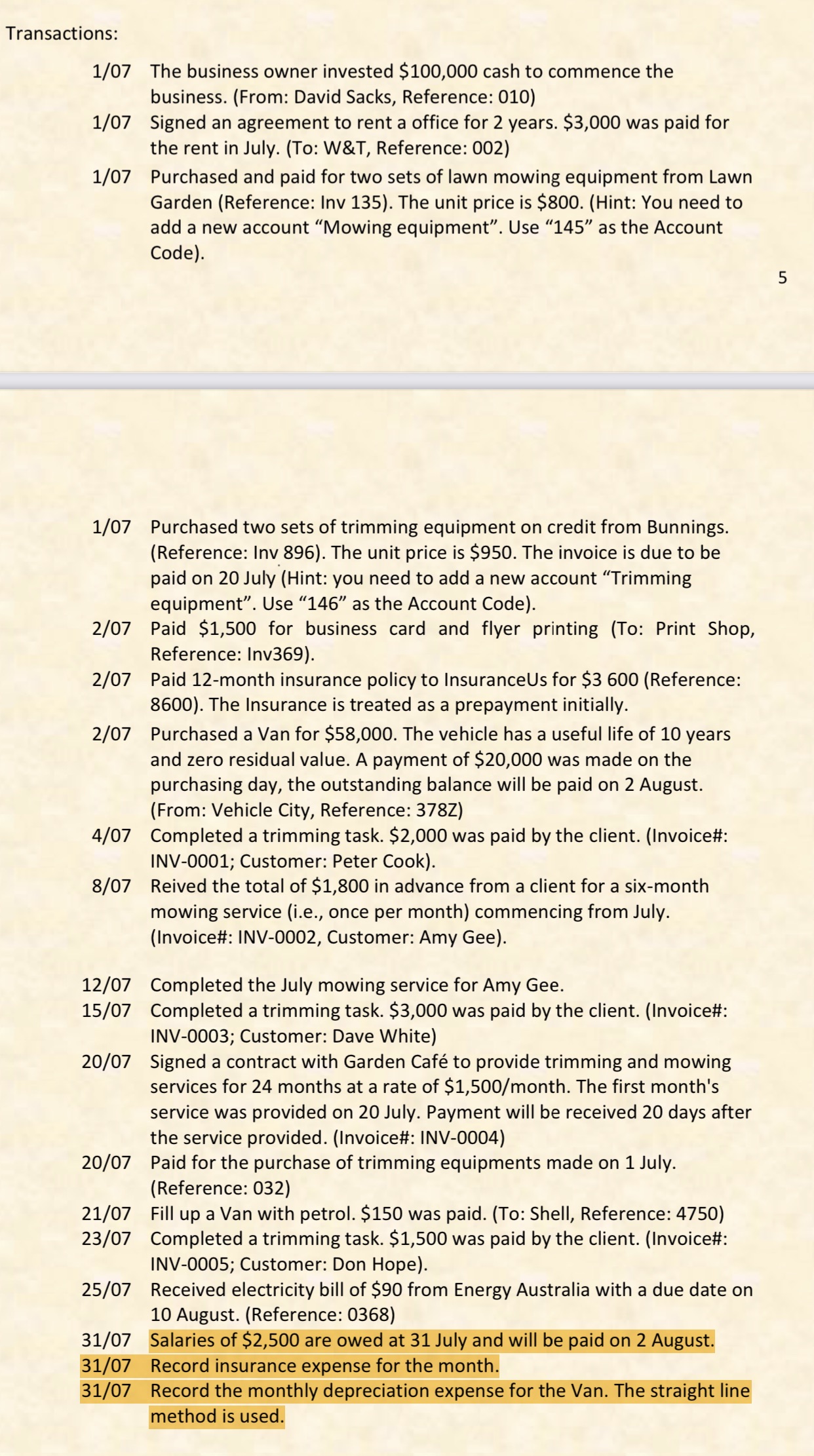

Transactions: 1/07 The business owner invested $100,000 cash to commence the business. (From: David Sacks, Reference: 010) 1/07 Signed an agreement to rent a office for 2 years. $3,000 was paid for the rent in July. (To: W&T, Reference: 002) 1/07 Purchased and paid for two sets of lawn mowing equipment from Lawn Garden (Reference: Inv 135). The unit price is $800. (Hint: You need to add a new account "Mowing equipment". Use "145" as the Account Code). 1/07 Purchased two sets of trimming equipment on credit from Bunnings. (Reference: Inv 896). The unit price is $950. The invoice is due to be paid on 20 July (Hint: you need to add a new account "Trimming equipment". Use 146 as the Account Code). Paid $1,500 for business card and flyer printing (To: Print Shop, Reference: Inv369). 2/07 2/07 2/07 4/07 8/07 Paid 12-month insurance policy to InsuranceUs for $3 600 (Reference: 8600). The Insurance is treated as a prepayment initially. Purchased a Van for $58,000. The vehicle has a useful life of 10 years and zero residual value. A payment of $20,000 was made on the purchasing day, the outstanding balance will be paid on 2 August. (From: Vehicle City, Reference: 378Z) Completed a trimming task. $2,000 was paid by the client. (Invoice#: INV-0001; Customer: Peter Cook). Reived the total of $1,800 in advance from a client for a six-month mowing service (i.e., once per month) commencing from July. (Invoice#: INV-0002, Customer: Amy Gee). 12/07 Completed the July mowing service for Amy Gee. 15/07 Completed a trimming task. $3,000 was paid by the client. (Invoice#: INV-0003; Customer: Dave White) 20/07 Signed a contract with Garden Caf to provide trimming and mowing services for 24 months at a rate of $1,500/month. The first month's service was provided on 20 July. Payment will be received 20 days after the service provided. (Invoice#: INV-0004) 20/07 Paid for the purchase of trimming equipments made on 1 July. (Reference: 032) 21/07 Fill up a Van with petrol. $150 was paid. (To: Shell, Reference: 4750) 23/07 Completed a trimming task. $1,500 was paid by the client. (Invoice#: INV-0005; Customer: Don Hope). 25/07 Received electricity bill of $90 from Energy Australia with a due date on 10 August. (Reference: 0368) 31/07 Salaries of $2,500 are owed at 31 July and will be paid on 2 August. 31/07 Record insurance expense for the month. 31/07 Record the monthly depreciation expense for the Van. The straight line method is used. 5

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the transactions that need adjusting journal entries as of July 31st2023 1 Prep...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started