Answered step by step

Verified Expert Solution

Question

1 Approved Answer

redo incorrect boxes pls S Safari File Edit View History Bookmarks Window Help lobble Cash Short-term investments Accounts receivable Interest receivable Supplies Prepaid expenses Land

redo incorrect boxes pls

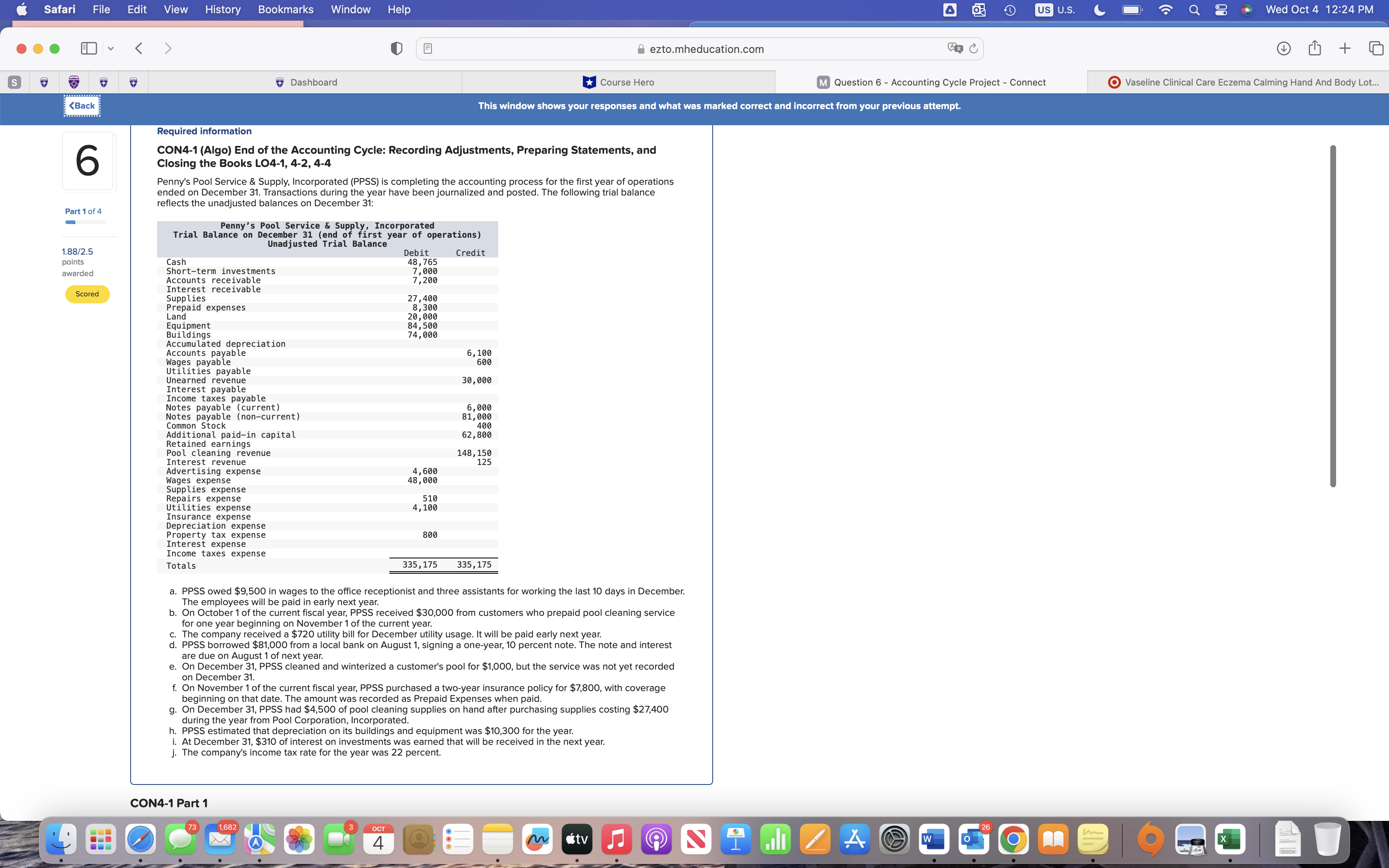

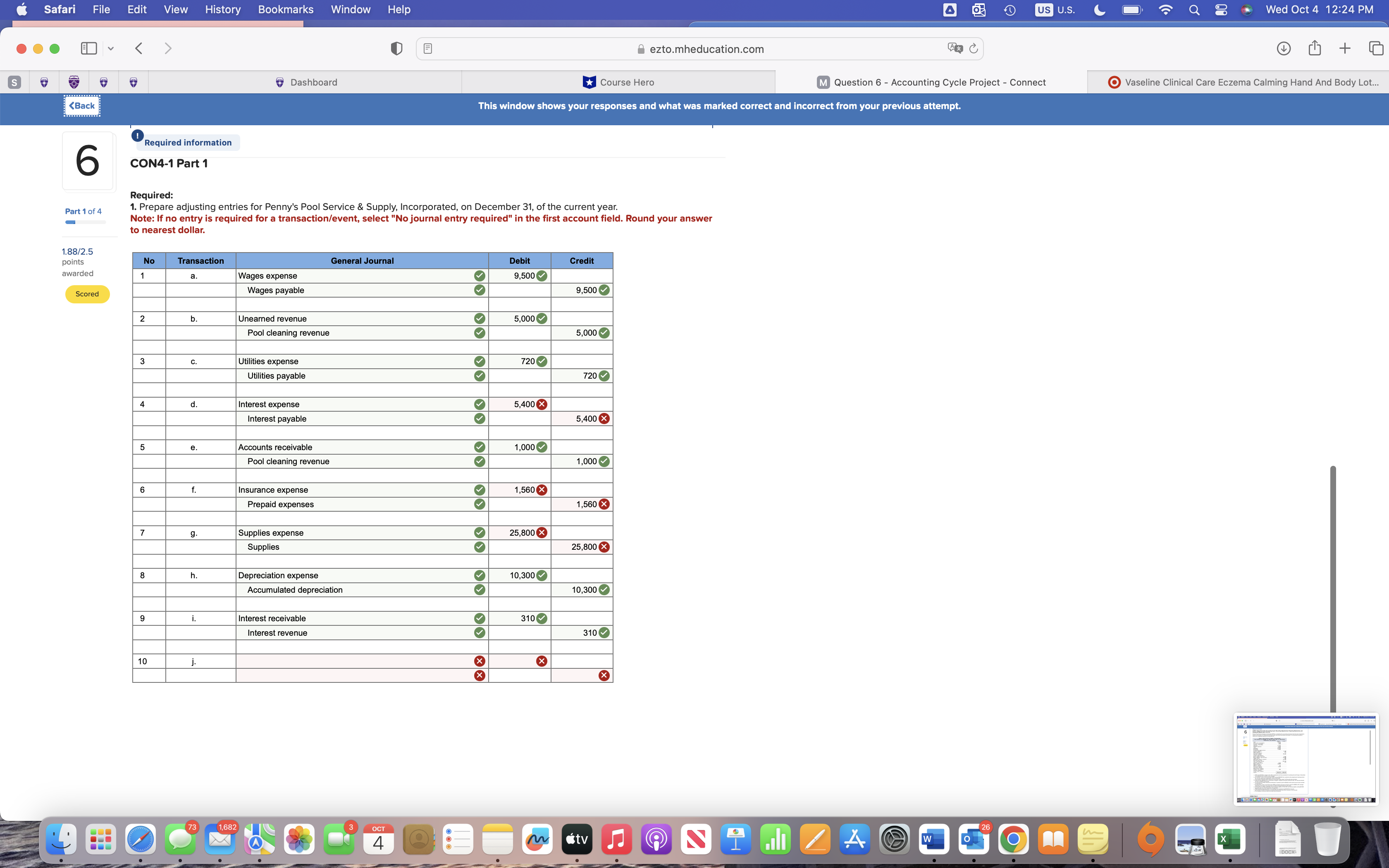

S Safari File Edit View History Bookmarks Window Help lobble Cash Short-term investments Accounts receivable Interest receivable Supplies Prepaid expenses Land Required information CON4-1 (Algo) End of the Accounting Cycle: Recording Adjustments, Preparing Statements, and Closing the Books LO4-1, 4-2, 4-4 Penny's Pool Service & Supply, Incorporated Trial Balance on December 31 (end of first year of operations) Unadjusted Trial Balance Equipment Buildings Accumulated depreciation Accounts payable Wages payable Utilities payable Unearned revenue Interest payable Penny's Pool Service & Supply, Incorporated (PPSS) is completing the accounting process for the first year of operations ended on December 31. Transactions during the year have been journalized and posted. The following trial balance reflects the unadjusted balances on December 31: Income taxes payable Notes payable (current) Notes payable (non-current) Common Stock Dashboard Additional paid-in capital Retained earnings Pool cleaning revenue Interest revenue Advertising expense Wages expense Supplies expense Repairs expense Utilities expense Insurance expense Depreciation expense Property tax expense Interest expense Income taxes expense Totals CON4-1 Part 1 73 1,682 Debit 48,765 7,000 7,200 3 27,400 8,300 20,000 84,500 74,000 OCT 4 4,600 48,000 510 4,100 800 This window shows your responses and what was marked correct and incorrect from your previous attempt. Credit 6,100 600 30,000 6,000 81,000 400 62,800 a. PPSS owed $9,500 in wages to the office receptionist and three assistants for working the last 10 days in December. The employees will be paid in early next year. b. On October 1 of the current fiscal year, PPSS received $30,000 from customers who prepaid pool cleaning service for one year beginning on November 1 of the current year. c. The company received a $720 utility bill for December utility usage. It will be paid early next year. d. PPSS borrowed $81,000 from a local bank on August 1, signing a one-year, 10 percent note. The note and interest are due on August 1 of next year. e. On December 31, PPSS cleaned and winterized a customer's pool for $1,000, but the service was not yet recorded on December 31. ezto.mheducation.com Course Hero 148, 150 125 f. On November 1 of the current fiscal year, PPSS purchased a two-year insurance policy for $7,800, with coverage beginning on that date. The amount was recorded as Prepaid Expenses when paid. g. On December 31, PPSS had $4,500 of pool cleaning supplies on hand after purchasing supplies costing $27,400 during the year from Pool Corporation, Incorporated. h. PPSS estimated that depreciation on its buildings and equipment was $10,300 for the year. i. At December 31, $310 of interest on investments was earned that will be received in the next year. j. The company's income tax rate for the year was 22 percent. 335, 175 335, 175 tv M Question 6 - Accounting Cycle Project - Connect Si ZA O W 26 US U.S. O A Vaseline Clinical Care Eczema Calming Hand And Body Lot... O ad Wed Oct 4 12:24 PM X DOCX U

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Pennys Pool Service Supply Incorporated General Journal Adjusting Entries Date December 31 Year End ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started