Answered step by step

Verified Expert Solution

Question

1 Approved Answer

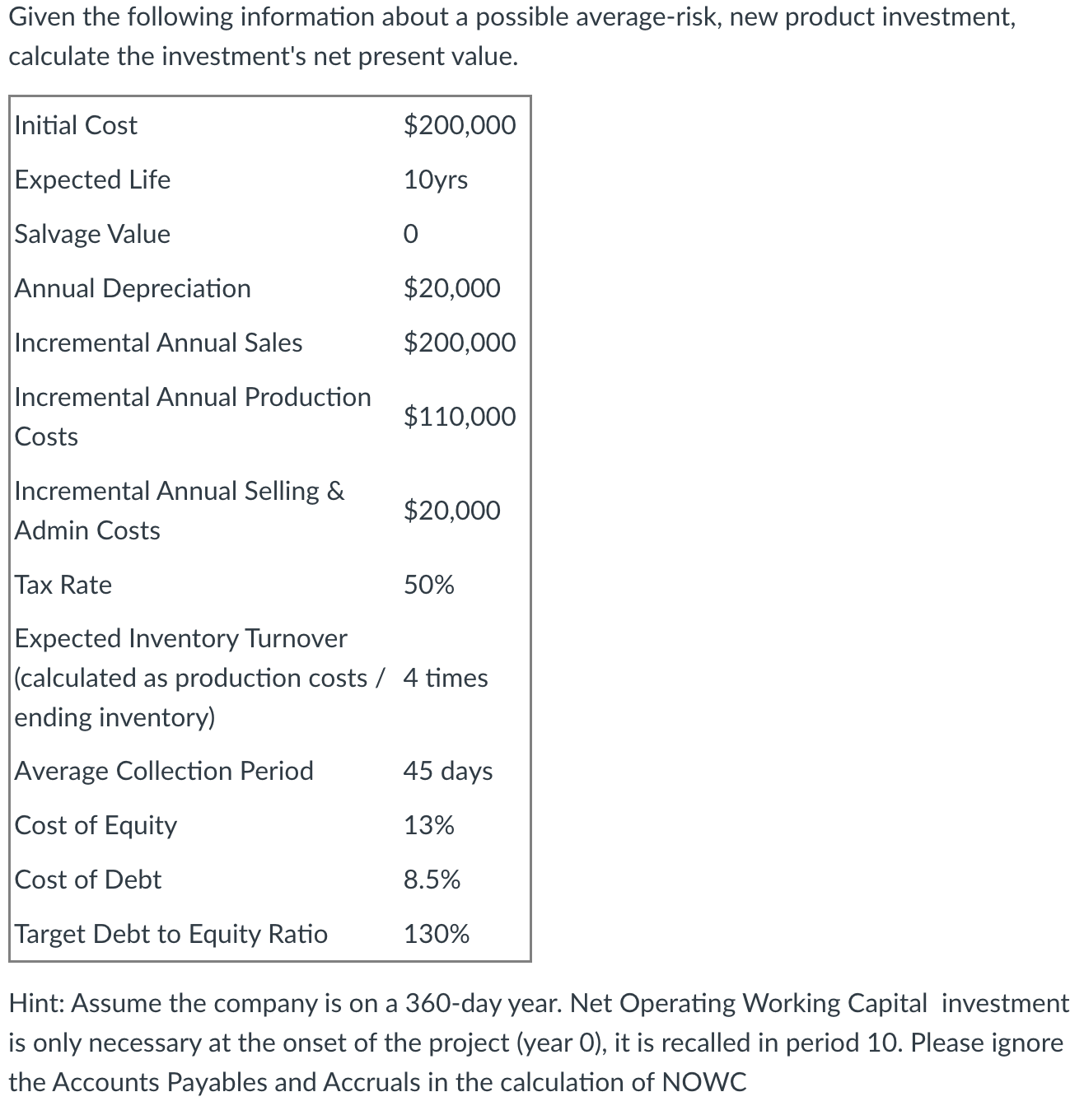

Given the following information about a possible average-risk, new product investment, calculate the investment's net present value. Initial Cost $200,000 Expected Life 10yrs Salvage

Given the following information about a possible average-risk, new product investment, calculate the investment's net present value. Initial Cost $200,000 Expected Life 10yrs Salvage Value 0 Annual Depreciation $20,000 Incremental Annual Sales $200,000 Incremental Annual Production $110,000 Costs Incremental Annual Selling & $20,000 Admin Costs 50% Tax Rate Expected Inventory Turnover (calculated as production costs / 4 times ending inventory) Average Collection Period 45 days Cost of Equity 13% Cost of Debt 8.5% Target Debt to Equity Ratio 130% Hint: Assume the company is on a 360-day year. Net Operating Working Capital investment is only necessary at the onset of the project (year 0), it is recalled in period 10. Please ignore the Accounts Payables and Accruals in the calculation of NOWC

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV of the investment we need to calculate the cash flows for eac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started