Answered step by step

Verified Expert Solution

Question

1 Approved Answer

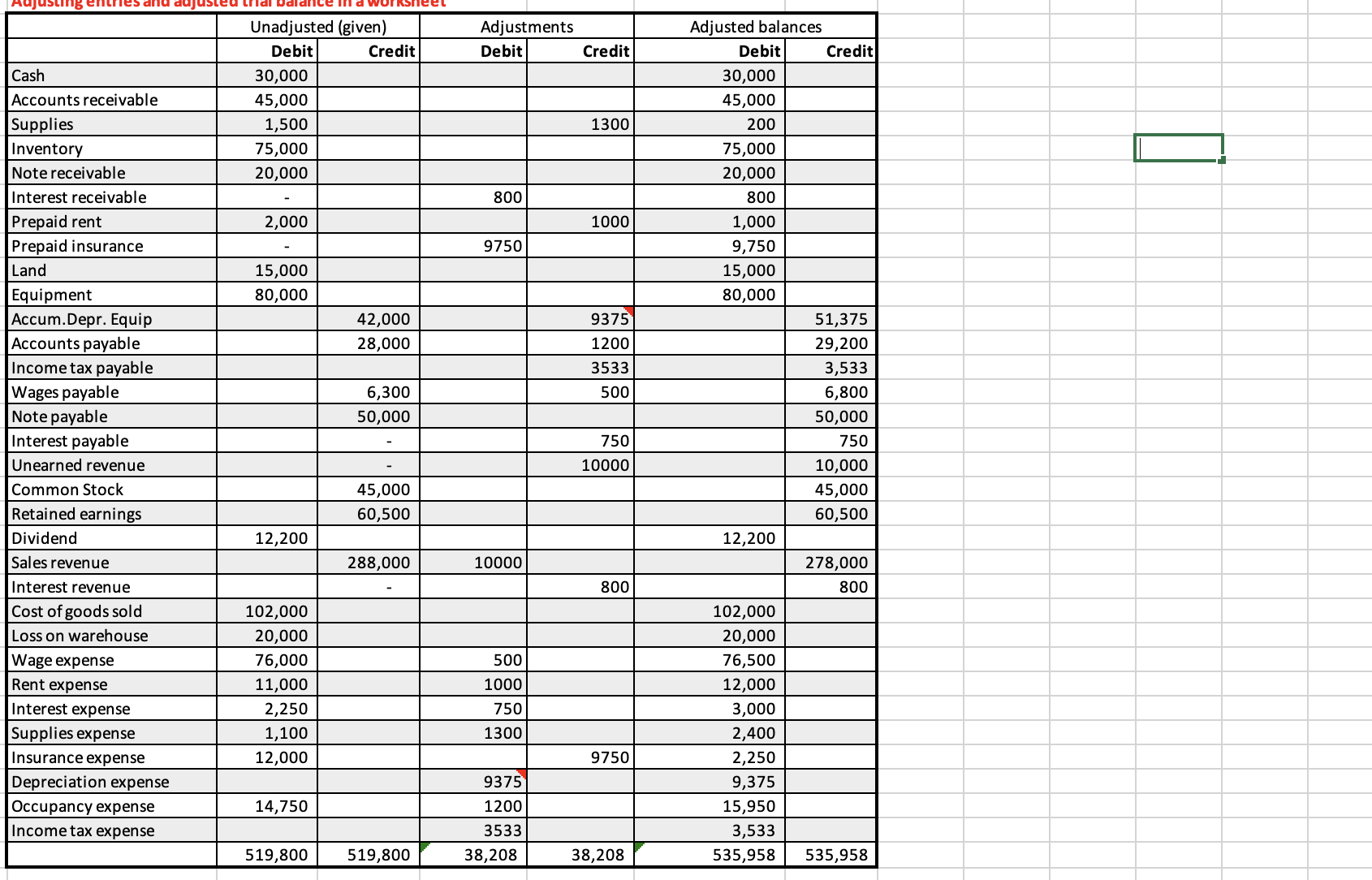

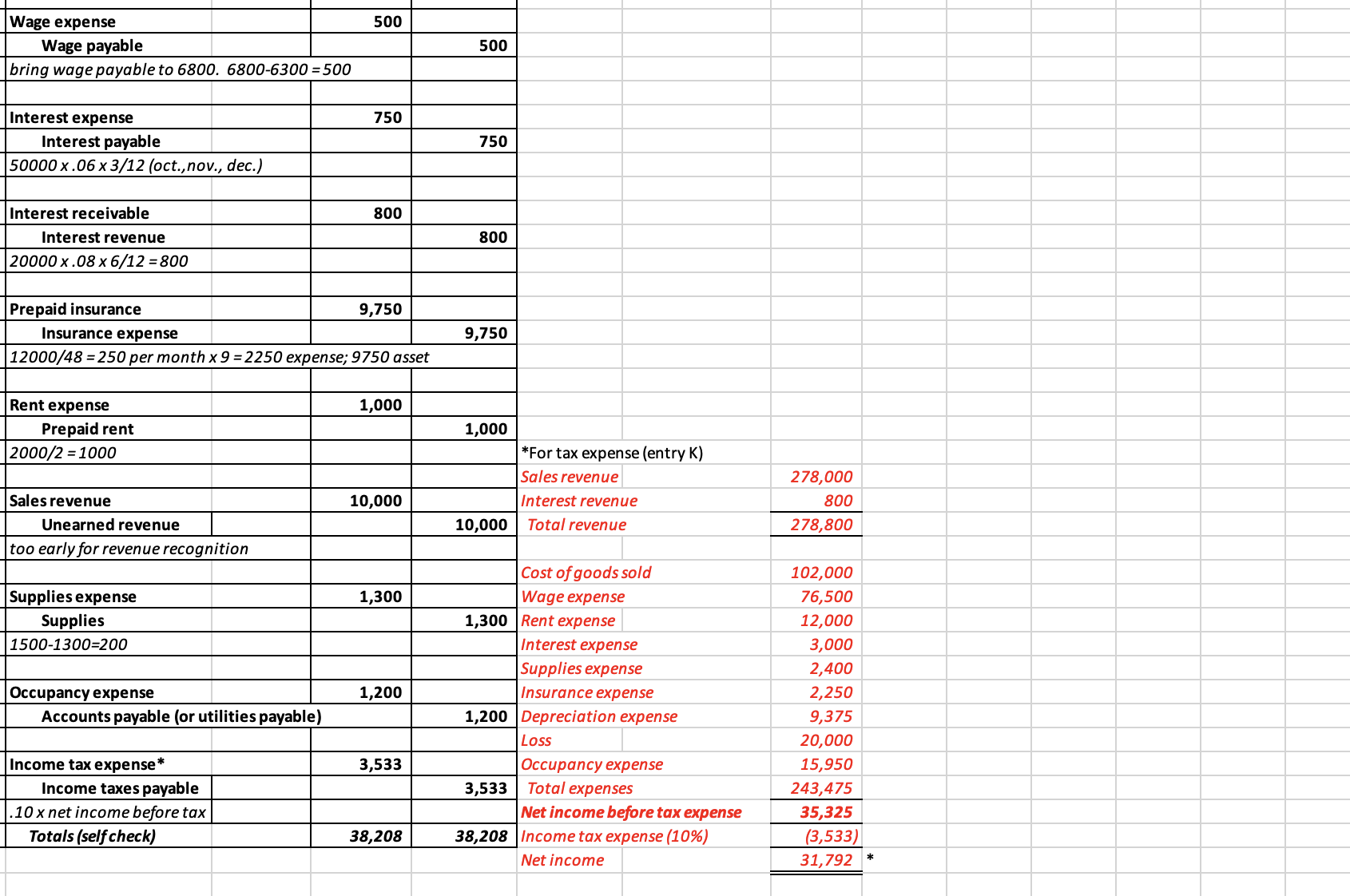

Using the data in the adjusted trial balance, prepare an income statement in good form for Benco?(just for this year, 20X3).? Assume the loss on

Using the data in the adjusted trial balance, prepare an income statement in good form for Benco?(just for this year, 20X3).? Assume the "loss on sale of warehouse" was actually a loss on the sale of a business component (a warehouse?division)? that qualifies as a discontinued operation.? The sale occurred?on the first?day of the year. (There were no other transactions for the warehouse?division.)

- Include subtotals for Gross profit and operating income as well as any other required subtotals and disclosures.

- Title and date your statement correctly-- this should look like a proper income statement.

- Do not combine income statement accounts from the?trial?balance.? Show each separately so that I can see what is being included.

Hint:

- Here, you are just changing the FORMAT to make it more useful.? Make sure your formulas make sense and that net income matches the solution.

- Because you have a discontinued operation, you need to compute tax expense for both continuing operations and the discontinued operation.? Total tax expense should not change from the adjusted trial balance, of course, it is just split up.

- ?Another hint: Don't?forget EPS!?There are 1,000 common stock shares outstanding throughout 20X3.??

and adj alance in a wo Unadjusted (given) Adjustments Adjusted balances Debit Credit Debit Credit Debit Credit Cash 30,000 30,000 Accounts receivable 45,000 45,000 Supplies 1,500 1300 200 Inventory 75,000 75,000 Note receivable 20,000 20,000 Interest receivable 800 800 Prepaid rent 2,000 1000 1,000 Prepaid insurance 9750 9,750 Land 15,000 15,000 Equipment 80,000 80,000 Accum.Depr. Equip 42,000 9375 51,375 Accounts payable 28,000 1200 29,200 Income tax payable 3533 3,533 Wages payable Note payable Interest payable 6,300 500 6,800 50,000 50,000 Unearned revenue 750 10000 750 10,000 Common Stock 45,000 45,000 Retained earnings 60,500 60,500 Dividend 12,200 12,200 Sales revenue 288,000 10000 278,000 Interest revenue 800 800 Cost of goods sold 102,000 102,000 Loss on warehouse 20,000 20,000 Wage expense 76,000 500 76,500 Rent expense 11,000 1000 12,000 Interest expense 2,250 750 3,000 Supplies expense 1,100 1300 2,400 Insurance expense 12,000 9750 2,250 Depreciation expense 9375 9,375 Occupancy expense 14,750 1200 15,950 Income tax expense 3533 3,533 519,800 519,800 38,208 38,208 535,958 535,958

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Income Statement for Benco Year 20X3 Revenue Sales Revenue 278...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started