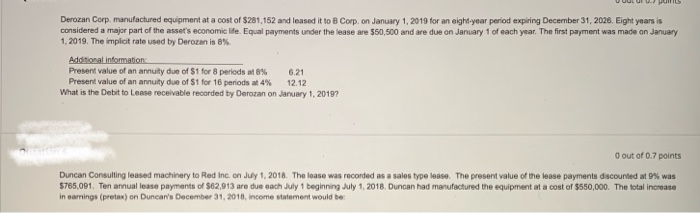

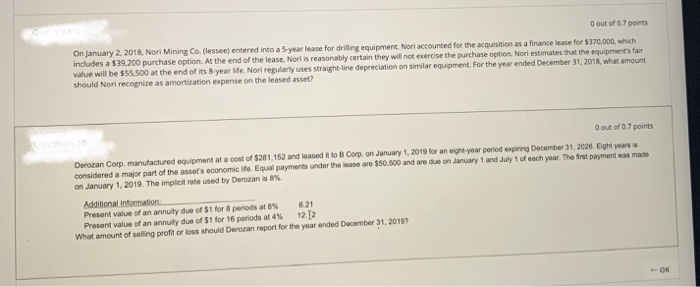

WHICS Derozan Corp. manufactured equipment at a cost of $281,152 and leased it to B Corp. on January 1, 2019 for an eight-year period expiring December 31, 2026. Eight years is considered a major part of the asset's economic life. Equal payments under the lease are $50,500 and are due on January 1 of each year. The first payment was made on January 1, 2019. The implicit rate used by Derozan is 8% Additional information: Present value of an annuity due of $1 for 8 periods at 8% Present value of an annuity due of $1 for 16 periods at 4% 12.12 What is the Debit to Lease receivable recorded by Derozan on January 1, 2019? O out of 0.7 points Duncan Consulting leased machinery to Red Inc. on July 1, 2018. The lease was recorded as a sales type lease. The present value of the lease payments discounted at 9% was $765,091. Ten annual lease payments of $62,913 are due each July 1 beginning July 1, 2018. Duncan had manufactured the equipment at a cost of $550,000. The total increase in earnings (pretax) on Duncan's December 31, 2018, income statement would be: O out of 0.7 points On January 2, 2018, Nori Mining Co. (lessee) entered into a 5 year lease for drilling equipment. Nori accounted for the acquisition as a finance lease for $370,000, which includes a $39.200 purchase option. At the end of the lease, Nori is reasonably certain they will not exercise the purchase option. Nori estimates that the equipment's fair value will be $55.500 at the end of its Byear life. Nori regularly uses straight-line depreciation on similar equipment. For the year ended December 31, 2018, what amount should Nori recognize as amortization expense on the leased asset? O out of 0.7 points Derozan Corp. manufactured equipment at a cost of $281,152 and leased it to B Corp. on January 1, 2019 for an eight-year period expiring December 31, 2020. Eight years is considered a major part of the asset's economice Equal payments under the lease are $60.500 and are due on January 1 and July 1 of each year. The first payment was made on January 1, 2019. The implicit rate used by Derzan is 8% Additional information: Present value of an annuity due of $1 for 8 periods at 8% 621 Present value of an annuity due of $1 for 16 periods at 4% 12.12 What amount of selling profit or loss should Derozan report for the year ended December 31, 2017 WHICS Derozan Corp. manufactured equipment at a cost of $281,152 and leased it to B Corp. on January 1, 2019 for an eight-year period expiring December 31, 2026. Eight years is considered a major part of the asset's economic life. Equal payments under the lease are $50,500 and are due on January 1 of each year. The first payment was made on January 1, 2019. The implicit rate used by Derozan is 8% Additional information: Present value of an annuity due of $1 for 8 periods at 8% Present value of an annuity due of $1 for 16 periods at 4% 12.12 What is the Debit to Lease receivable recorded by Derozan on January 1, 2019? O out of 0.7 points Duncan Consulting leased machinery to Red Inc. on July 1, 2018. The lease was recorded as a sales type lease. The present value of the lease payments discounted at 9% was $765,091. Ten annual lease payments of $62,913 are due each July 1 beginning July 1, 2018. Duncan had manufactured the equipment at a cost of $550,000. The total increase in earnings (pretax) on Duncan's December 31, 2018, income statement would be: O out of 0.7 points On January 2, 2018, Nori Mining Co. (lessee) entered into a 5 year lease for drilling equipment. Nori accounted for the acquisition as a finance lease for $370,000, which includes a $39.200 purchase option. At the end of the lease, Nori is reasonably certain they will not exercise the purchase option. Nori estimates that the equipment's fair value will be $55.500 at the end of its Byear life. Nori regularly uses straight-line depreciation on similar equipment. For the year ended December 31, 2018, what amount should Nori recognize as amortization expense on the leased asset? O out of 0.7 points Derozan Corp. manufactured equipment at a cost of $281,152 and leased it to B Corp. on January 1, 2019 for an eight-year period expiring December 31, 2020. Eight years is considered a major part of the asset's economice Equal payments under the lease are $60.500 and are due on January 1 and July 1 of each year. The first payment was made on January 1, 2019. The implicit rate used by Derzan is 8% Additional information: Present value of an annuity due of $1 for 8 periods at 8% 621 Present value of an annuity due of $1 for 16 periods at 4% 12.12 What amount of selling profit or loss should Derozan report for the year ended December 31, 2017