Question

While Anna was parked at her job in Yorktown Heights on April 1, 2019, someone broke into her car and stole her laptop. She bought

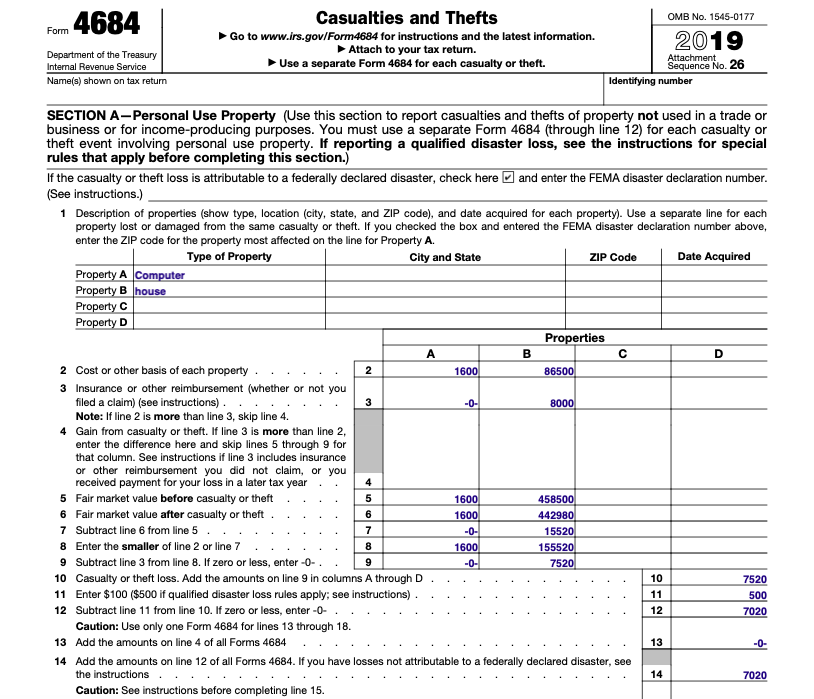

While Anna was parked at her job in Yorktown Heights on April 1, 2019, someone broke into her car and stole her laptop. She bought it for $1,600. Her insurance did not cover laptops.

During a hurricane on March 3, 2019, part of the house's roof collapsed, and it cost $18,000 to repair, and $7,980 to replace damaged furniture. Insurance only covered $8,000. It was such a bad hurricane, the president declared it a disaster area. The house cost $78,000. when they bought it in 1992. It was worth $450,000 and after the hurricane, it was worth $435,000. The furniture cost $8,500

Complete form tax form 4684

Form 4684 Department of the Treasury Internal Revenue Service Name(s) shown on tax return Casualties and Thefts Go to www.irs.gov/Form4684 for instructions and the latest information. Attach to your tax return. Use a separate Form 4684 for each casualty or theft. SECTION A-Personal Use Property (Use this section to report casualties and thefts of property not used in a trade or business or for income-producing purposes. You must use a separate Form 4684 (through line 12) for each casualty or theft event involving personal use property. If reporting a qualified disaster loss, see the instructions for special rules that apply before completing this section.) Property A Computer Property B house Property C Property D If the casualty or theft loss is attributable to a federally declared disaster, check here and enter the FEMA disaster declaration number. (See instructions.) 1 Description of properties (show type, location (city, state, and ZIP code), and date acquired for each property). Use a separate line for each property lost or damaged from the same casualty or theft. If you checked the box and entered the FEMA disaster declaration number above, enter the ZIP code for the property most affected on the line for Property A. Type of Property City and State Date Acquired 2 Cost or other basis of each property 3 Insurance or other reimbursement (whether or not you filed a claim) (see instructions). Note: If line 2 is more than line 3, skip line 4. 4 Gain from casualty or theft. If line 3 is more than line 2, enter the difference here and skip lines 5 through 9 for that column. See instructions if line 3 includes insurance or other reimbursement you did not claim, or you received payment for your loss in a later tax year 5 Fair market value before casualty or theft 6 Fair market value after casualty or theft. 7 Subtract line 6 from line 5. 2 Caution: Use only one Form 4684 for lines 13 through 18. 13 Add the amounts on line 4 of all Forms 4684 3 4 5 6 7 8 Enter the smaller of line 2 or line 7 8 9 Subtract line 3 from line 8. If zero or less, enter -0- 9 10 Casualty or theft loss. Add the amounts on line 9 in columns A through D 11 Enter $100 ($500 if qualified disaster loss rules apply; see instructions). 12 Subtract line 11 from line 10. If zero or less, enter -0- A 1600 -0- 1600 1600 -0- 1600 -0- B Properties 86500 Identifying number 8000 458500 442980 15520 155520 7520 ZIP Code OMB No. 1545-0177 2019 Attachment Sequence No. 26 14 Add the amounts on line 12 of all Forms 4684. If you have losses not attributable to a federally declared disaster, see the instructions. Caution: See instructions before completing line 15. 10 11 12 13 14 D 7520 500 7020 -0- 7020

Step by Step Solution

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

SECTION A Personal Use Property 1 Description of properties Type of PropertyCity and StateZIP CodeDate Acquired Property AComputerYorktown Heights NY10598April 1 2019 Property BHouse1992 Property C Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started