Question

While collecting the first data set, Julie Jordan, the lead Cost Accountant for DTC, also collected some additional information over the 48 observations. Alfred Olson

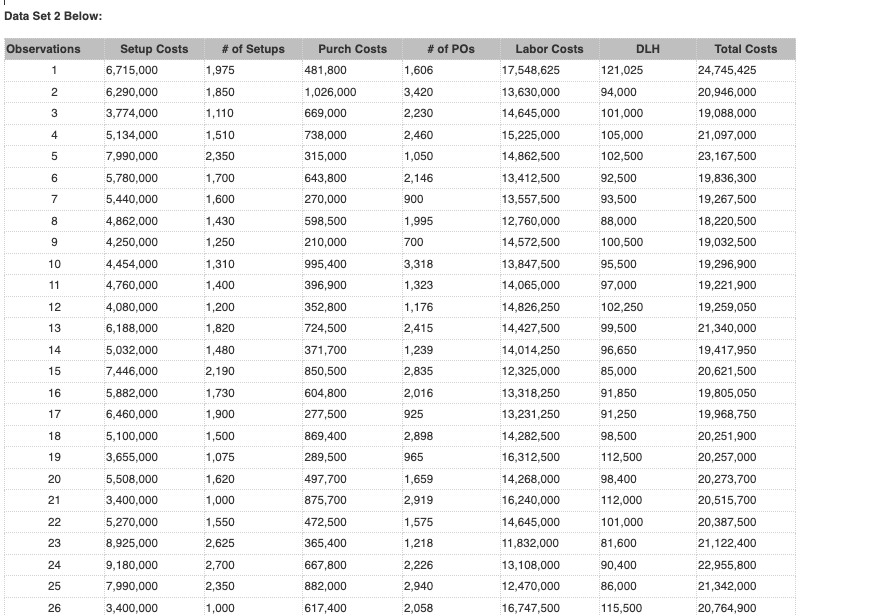

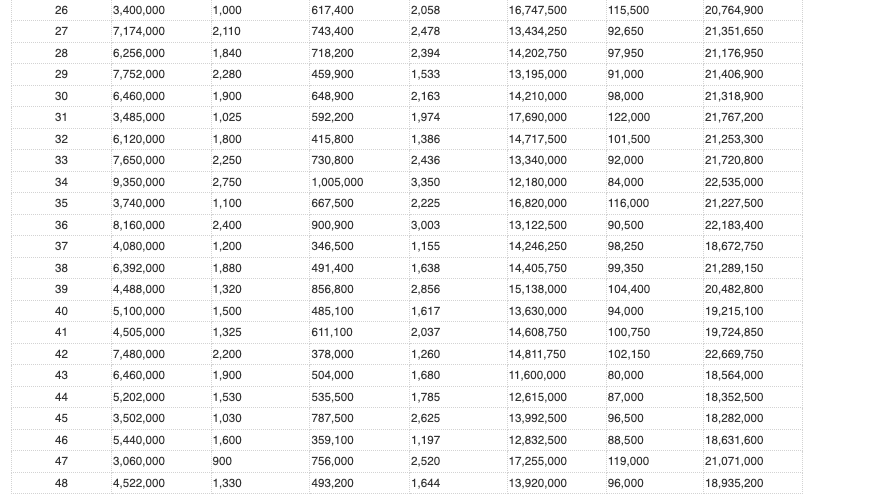

While collecting the first data set, Julie Jordan, the lead Cost Accountant for DTC, also collected some additional information over the 48 observations. Alfred Olson is Julies direct supervisor. When Julie was a student at the University of Memphis, she studied activity-based costing in her cost accounting class. Like Alfred, she thought that only part of the conversion costs (labor-related costs such as wages, benefits, etc.) appeared to be related to direct labor hours. After further study, it appeared that some batch-related costs in the conversion costs were related to the number of setups, and another portion of conversion costs was related to the number of orders made to purchase direct materials for the tires.

Data Set 2 provides additional information for the 48 observations collected by Julie. It includes information for setup costs, purchasing costs, labor-related costs, and total conversion costs. The total conversion costs are equal to the sum of setup costs, purchasing costs and labor-related costs. Julie also provides you with the number of setups, the number of purchase orders, and direct labor hours used for products DTC/A105 and DTC/B107.

| Product | # of Setups | # of POs | DLHs |

| DTC/A105 | 40 | 50 | 14,000 |

| DTC/B107 | 160 | 225 | 3,500 |

Julie Jordan is concerned that the relationship between conversion costs and direct labor hours has weakened since automation, given the significant decrease in the required number of direct labor hours. At the same time, overhead costs resulting from the new automation has increased dramatically. Thus, Julie has asked you to compile some additional information for her next meeting with the CEO next week.

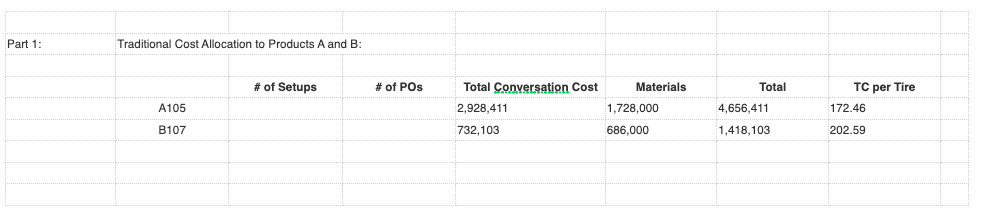

1. recalculate the product costs for DTC/A105 and DTC/B107 using activity-based costing and compare them to those costs calculated in Case 1.

1. recalculate the product costs for DTC/A105 and DTC/B107 using activity-based costing and compare them to those costs calculated in Case 1.

Case 1 Below:

1.1 What can you tell Julie and Alfred about the relationships between the different costs and the cost drivers? What happens when you calculate the correlations or perform some simple regressions between the different costs and the cost drivers?

Data Set 2 Below: Observations # of POs 1 1,606 # of Setups 1,975 1,850 1,110 2 3 3,420 2,230 2,460 1,050 DLH 121,025 94,000 101,000 105,000 102,500 92,500 4 1,510 5 Purch Costs 481,800 1,026,000 669,000 738,000 315,000 643,800 270,000 598,500 210,000 995,400 396,900 2,350 6 1,700 2,146 7 1,600 900 93,500 8 1,995 1,430 1,250 88,000 100,500 9 700 10 1,310 3,318 95,500 11 1,400 1,323 12 1,200 1,176 Setup Costs 6,715,000 6,290,000 3,774,000 5,134,000 7,990,000 5,780,000 5,440,000 4,862,000 4,250,000 4,454,000 4,760,000 4,080,000 6,188,000 5,032,000 7,446,000 5,882,000 6,460,000 5,100,000 3,655,000 5,508,000 3,400,000 5,270,000 8,925,000 9,180,000 7,990,000 3,400,000 13 Labor Costs 17,548,625 13,630,000 14,645,000 15,225,000 14,862,500 13,412,500 13,557,500 12,760,000 14,572,500 13,847,500 14,065,000 14,826,250 14,427,500 14,014,250 12,325,000 13,318,250 13,231,250 14,282,500 16,312,500 14,268,000 16,240,000 14,645,000 11,832,000 13,108,000 12,470,000 1,820 352,800 724,500 371,700 850,500 2,415 97,000 102,250 99,500 96,650 85,000 91,850 Total Costs 24,745,425 20,946,000 19,088,000 21,097,000 23,167,500 19,836,300 19,267,500 18,220,500 19,032,500 19,296,900 19,221,900 19,259,050 21,340,000 19,417,950 20,621,500 19,805,050 19,968,750 20,251,900 20,257,000 20,273,700 20,515,700 20,387,500 21, 122,400 22,955,800 21,342,000 20,764,900 14 1,239 1,480 2,190 15 2,835 16 2,016 1,730 1,900 17 604,800 277,500 869,400 925 91,250 18 1,500 2,898 98,500 19 1,075 289,500 965 20 1,620 1,000 1,659 2,919 21 112,500 98,400 112,000 101,000 81,600 22 1,575 497,700 875,700 472,500 365,400 667,800 882,000 1,550 2,625 23 1,218 24 2,700 2,226 90,400 86,000 25 2,350 2,940 26 1,000 617,400 2,058 16,747,500 115,500 26 1,000 617,400 2,058 115,500 27 2,110 743,400 2,478 92,650 28 1,840 2,394 29 2,280 1,533 30 1,900 2,163 1,974 31 1,025 718,200 459,900 648,900 592,200 415,800 730,800 1,005,000 667,500 97,950 91,000 98,000 122,000 101,500 92,000 84,000 116,000 32 1,800 1,386 33 2,250 2,436 34 2,750 3,350 2,225 35 1,100 36 3,400,000 7,174,000 6,256,000 7,752,000 6,460,000 3,485,000 6,120,000 7,650,000 9,350,000 3,740,000 8,160,000 4,080,000 6,392,000 4,488,000 5,100,000 4,505,000 7,480,000 6,460,000 5,202,000 3,502,000 5,440,000 3,060,000 4,522,000 2,400 1,200 900,900 346,500 3,003 1,155 37 16,747,500 13,434,250 14,202,750 13,195,000 14,210,000 17,690,000 14,717,500 13,340,000 12,180,000 16,820,000 13,122,500 14,246,250 14,405,750 15,138,000 13,630,000 14,608,750 14,811,750 11,600,000 12,615,000 13,992,500 12,832,500 17,255,000 13,920,000 90,500 98,250 20,764,900 21,351,650 21,176,950 21,406,900 21,318,900 21,767,200 21,253,300 21,720,800 22,535,000 21,227,500 22,183,400 18,672,750 21,289,150 20,482,800 19,215,100 19,724,850 22,669,750 18,564,000 18,352,500 18,282,000 18,631,600 21,071,000 18,935,200 38 1,880 1,638 39 1,320 2,856 40 1,617 41 99,350 104,400 94,000 100,750 102,150 80,000 1,500 1,325 2,200 1,900 2,037 42 1,260 491,400 856,800 485,100 611,100 378,000 504,000 535,500 787,500 359,100 756,000 493,200 43 1,680 44 1,530 1,785 87,000 45 1,030 2,625 46 1,600 1,197 96,500 88,500 119,000 47 900 2,520 48 1,330 1,644 96,000 Part 1: Traditional Cost Allocation to Products A and B: # of Setups # of POS Total Conversation Cost 2,928,411 732, 103 Materials 1,728,000 Total 4,656,411 TC per Tire 172.46 A105 B107 686,000 1,418,103 202.59Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started