Question

While completing undergraduate school work in information systems, Dallin Bourne and Michael Banks decided to start a technology support company called eSys Answers. During year

While completing undergraduate school work in information systems, Dallin Bourne and Michael Banks decided to start a technology support company called eSys Answers. During year 1, they bought the following assets and incurred the following start-up fees: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.)

| Year 1 Assets | Purchase Date | Basis | |

| Computers (5-year) | October 30, Y1 | $ | 15,000 |

| Office equipment (7-year) | October 30, Y1 | 10,000 | |

| Furniture (7-year) | October 30, Y1 | 3,000 | |

| Start-up costs | October 30, Y1 | 17,000 | |

|

| |||

In April of Year 2, they decided to purchase a customer list from a company started by fellow information systems students preparing to graduate who provided virtually the same services. The customer list cost $10,000 and the sale was completed on April 30th. During their summer break, Dallin and Michael passed on internship opportunities in an attempt to really grow their business into something they could do full time after graduation. In the summer, they purchased a small van (for transportation, not considered a luxury auto) and a pinball machine (to help attract new employees). They bought the van on June 15, Y2, for $15,000 and spent $3,000 getting it ready to put into service. The pinball machine cost $4,000 and was placed in service on July 1, Y2.

| Year 2 Assets | Purchase Date | Basis | |

| Van | June 15, Y2 | $ | 18,000 |

| Pinball machine (7-year) | July 1, Y2 | 4,000 | |

| Customer list | April 30, Y2 | 10,000 | |

|

| |||

Assume that eSys Answers does not claim any 179 expense or bonus depreciation.

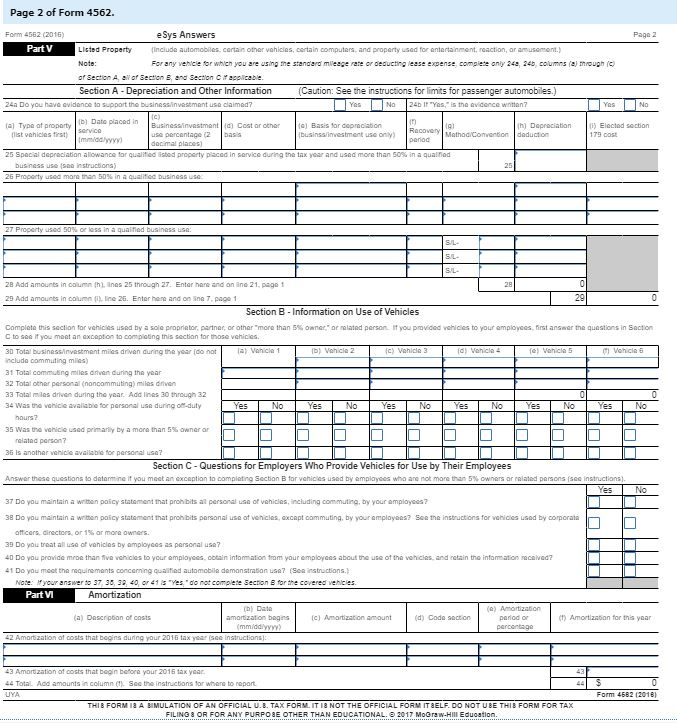

b. Complete eSys Answers' Form 4562 for Y1.

eSys Answers identifying number: 36-1238975

(Input all values as positive numbers. Use 2017 tax rules regardless of year on tax form.)

Page 2 of Form 4562. Form 562 (2016 eSys Answers Paga 2 Part V Licted Property(include automobiies cortain other vahicies, certain Note: of Secton A, aof Section B, end Section C recplicable. Section A Depreciation and Other Information For any vehicie or which you are using ne standerd milieage rate or deductino lease expense, compiete anly 24, 245, columns (a) mouph ( Caution: See the instructions for limits for passenger automobiles.) the businessinvastmant use cla (al Type at proparty) Dato placed in ) Cost ar ochar (2as h) Daprociaton) doduction () Basis for cepraciation Electod secion Racovery ist vahicles first) use percantage allowance tor qualit ed isted property paced in Service during the tax year and used more than 50% in a quarad business use (sno 2B Add amounts in column (hl Ines 25 thnough 27. Entar hane and on ine 21, page 29 Add amounts in coun ine 26. Enter ha and on ina 7, page 1 29 Section B Information on Use of Vehicles completo this section for vehicles used by sole propnator, partnar, or other more than 5% oner or n lated person C to see it you moat an excepton to complaing this sectian for those vahices you prov ded chides to your employees first answer the quastions in saction milas driven during thhe yoar [do not ncludo commuting milies) 31 Total commuting miles drivan during tha year 2 Total otnar personal (noncommuting) mls ave 3 Total mles drven during the year. Add ines 30 through 32 34 Was tha vahicie avalabile for parsonal use during o-duty 35 wasto va ce used primari, by a mora than 5% owner latad porso 36 Is anothar vahidle availsble for parsonal us0? Section C Questions for Employers Who Provide Vehicles for Use by Their Employees Answer these questions to datarmne if you meat an exception to completing S0cbon B lor varices used by mployees who are not more than 5% owners or raiated persons fse instructions 37 Do you maintain a whan poicy statament that proh bits al personal usa of vahicles, including commuting, by your omployees7 38 Do you maintain a win poscy statoment that proh bits parsonai use of venicles, axcapt commuting, by your amployos se he instructions for wahicies used by comporata officers, directors, or 1% ar mor oners. 39 Do you treat all uso of vaniclas by amploycos as personal ue 40 Do you pravide mroe than fiva vehicles to your amployess, obtain infamation from your employens about the use ot tha vohichas and netain the infomsation recaived 1 Do you meat tha nequinemants concerning quaitied automobile demanstration use7 (Sea instructions. answer to 37. 30, 32, 40, or1 Yesdo natcompiete Secron B forthe covered vehicies. Part M Amortization () Data (a) Dascrpoon of costs amorszation begns)Amartization amount (d) Codo sact on ) Amortizstian for this yoar 3 Amordzation of costs that bagin befora your 201 tax year 44 Total. Add amounts n column (1), S the instructions lor where to repot ANY PURPO3E OTHER THAN EDUOALe01Mor-HIlI l Eduostion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started