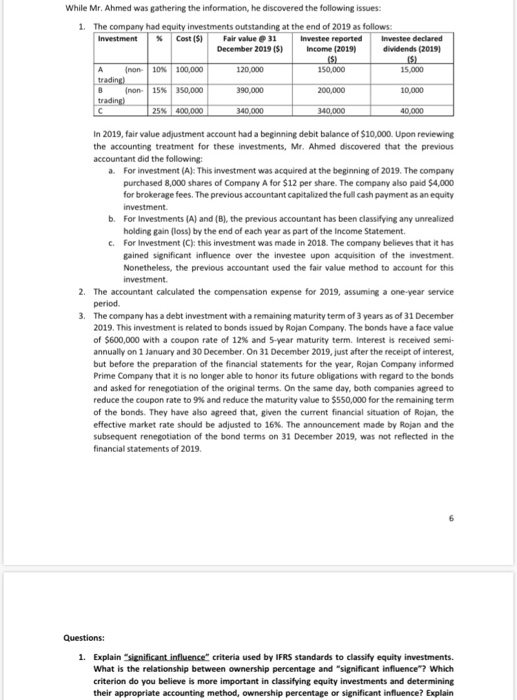

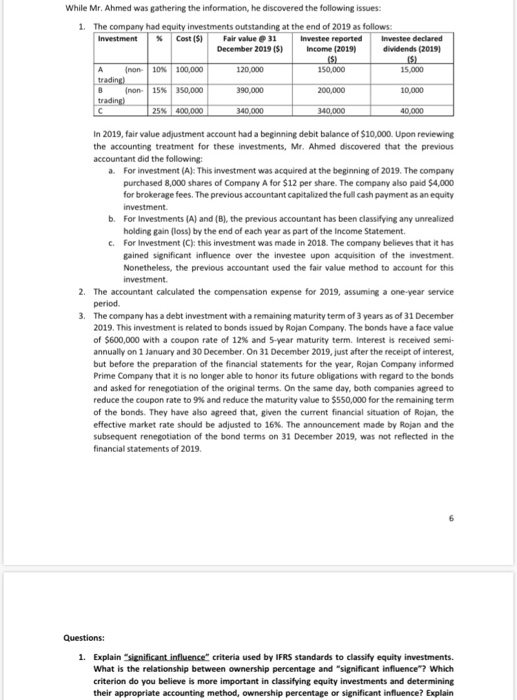

While Mr. Ahmed was gathering the information, he discovered the following issues: 1. The company had equity investments outstanding at the end of 2019 as follows: Investment Cost($) Fair value 31 Investee reported investee declared December 2019 (5) Income (2019) dividends (2019) non 10 100 000 120.000 150.000 15.000 trading non 15% 350.000 390,000 200,000 10,000 trading 25% 400000 340.000 340.000 101000 In 2019, fair value adjustment account had a beginning debit balance of $10,000. Upon reviewing the accounting treatment for these investments, Mr. Ahmed discovered that the previous accountant did the following a. For investment (A): This investment was acquired at the beginning of 2019. The company purchased 8,000 shares of Company A for $12 per share. The company also paid $4,000 for brokerage fees. The previous accountant capitalized the full cash payment as an equity investment b. For Investments (A) and (B), the previous accountant has been classifying any unrealized holding gain (loss) by the end of each year as part of the income Statement c. For Investment (C): this investment was made in 2018. The company believes that it has gained significant influence over the investee upon acquisition of the investment Nonetheless, the previous accountant used the fair value method to account for this investment 2. The accountant calculated the compensation expense for 2019, assuming a one-year service period. 3. The company has a debt investment with a remaining maturity term of 3 years as of 31 December 2019. This investment is related to bonds issued by Rojan Company. The bonds have a face value of $600,000 with a coupon rate of 12% and 5-year maturity term. Interest is received semi- annually on 1 January and 30 December. On 31 December 2019, just after the receipt of interest, but before the preparation of the financial statements for the year, Rojan Company informed Prime Company that it is no longer able to honor its future obligations with regard to the bonds and asked for renegotiation of the original terms. On the same day, both companies agreed to reduce the coupon rate to 9% and reduce the maturity value to $550,000 for the remaining term of the bonds. They have also agreed that, given the current financial situation of Rojan, the effective market rate should be adjusted to 16%. The announcement made by Rojan and the subsequent renegotiation of the bond terms on 31 December 2019, was not reflected in the financial statements of 2019 Questions: 1. Explain significant influence criteria used by IFRS standards to classify equity investments What is the relationship between ownership percentage and significant influence? Which criterion do you believe is more important in classifying equity investments and determining their appropriate accounting method, ownership percentage or significant influence? Explain