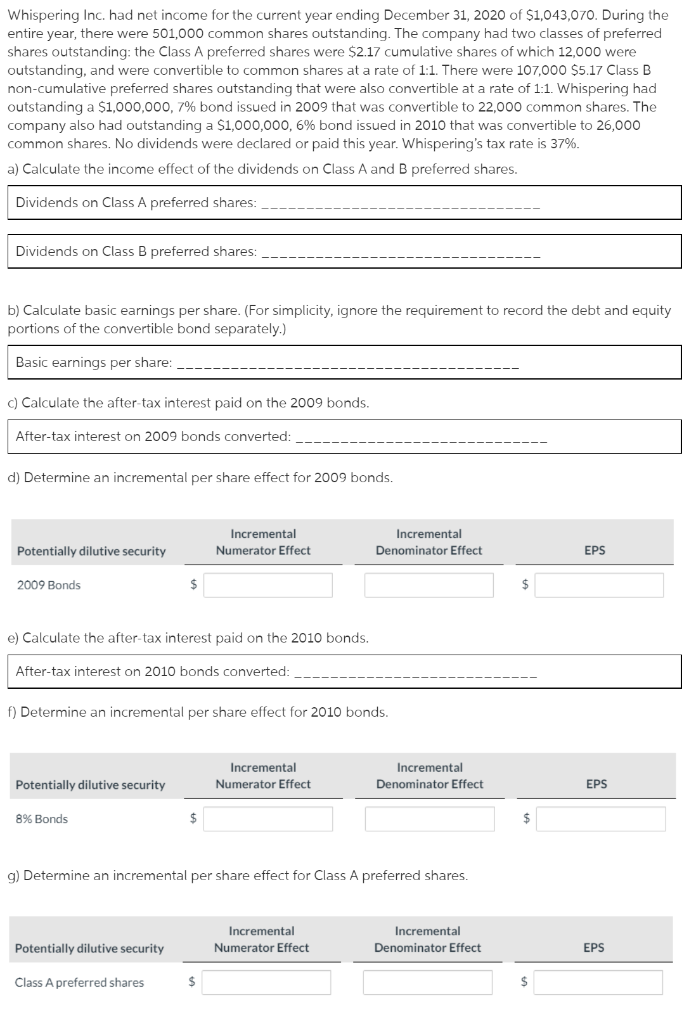

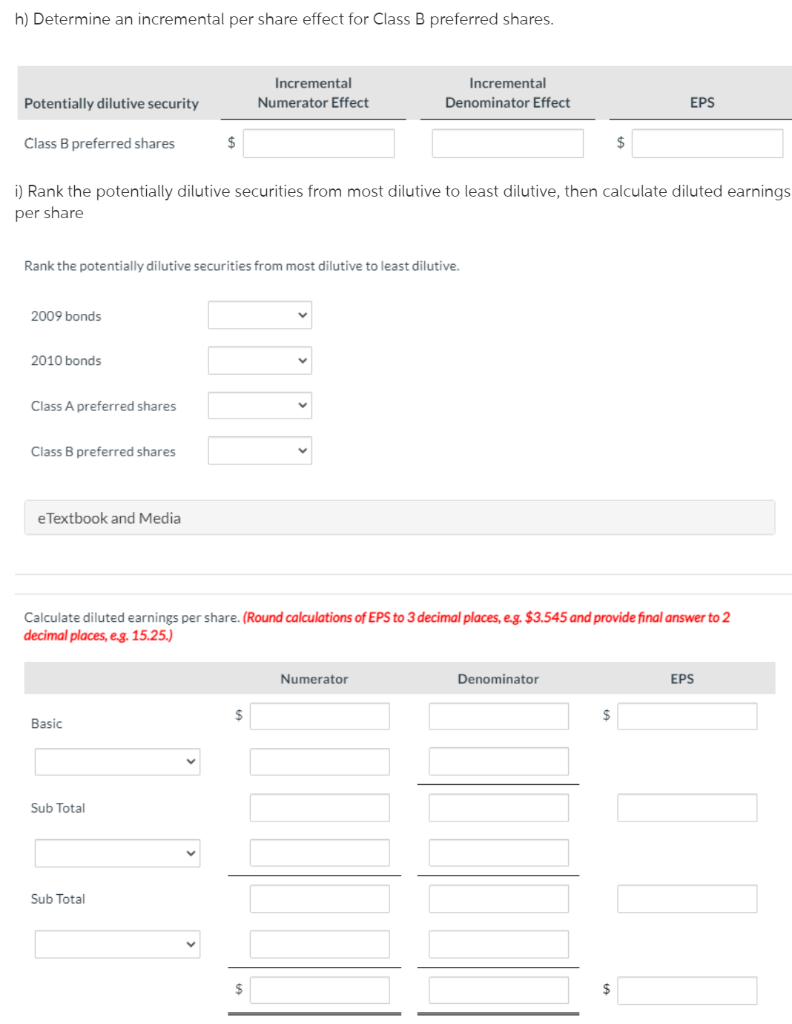

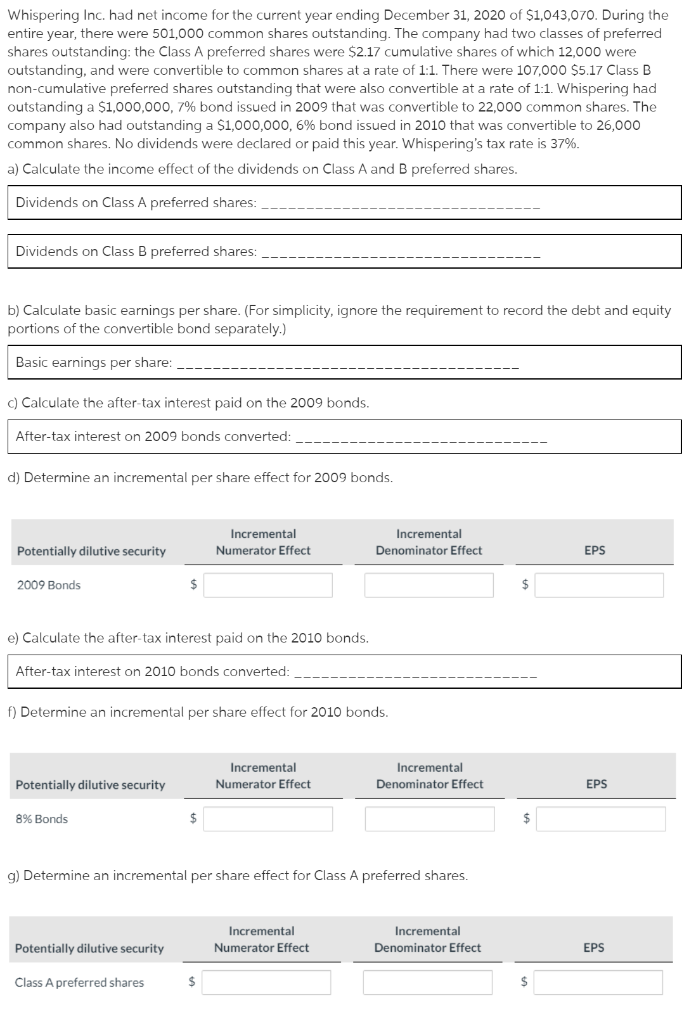

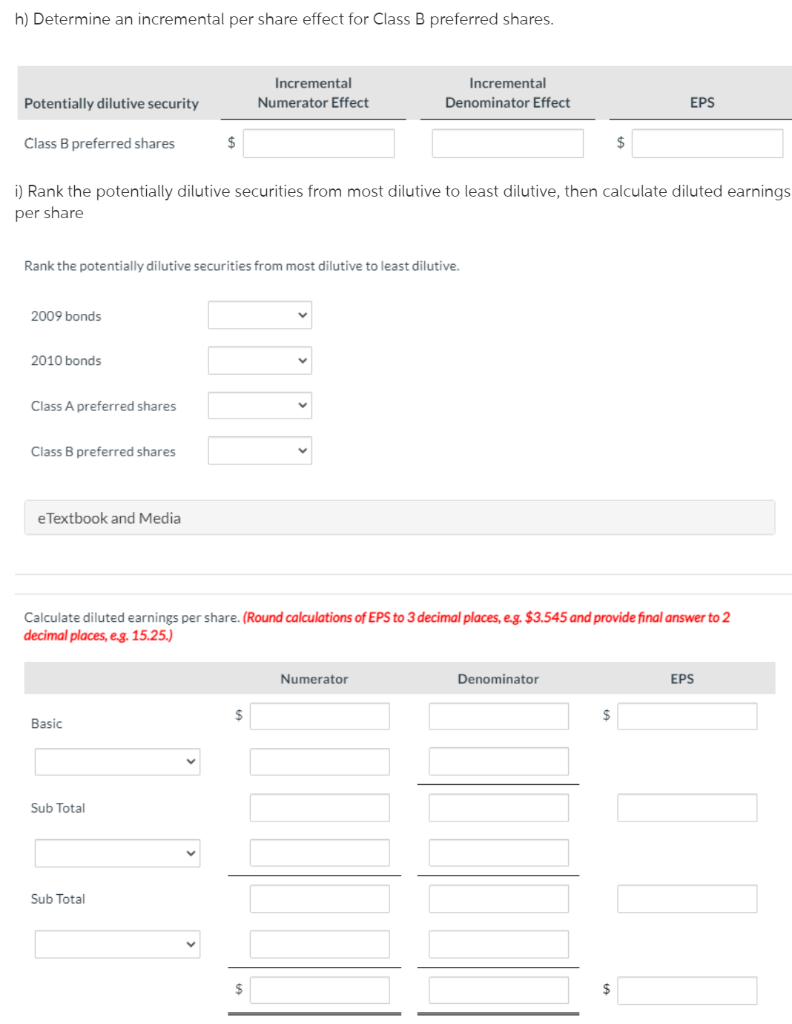

Whispering Inc. had net income for the current year ending December 31, 2020 of $1,043,070. During the entire year, there were 501,000 common shares outstanding. The company had two classes of preferred shares outstanding: the Class A preferred shares were $2.17 cumulative shares of which 12,000 were outstanding, and were convertible to common shares at a rate of 1:1. There were 107,000 $5.17 Class B non-cumulative preferred shares outstanding that were also convertible at a rate of 1:1. Whispering had outstanding a $1,000,000, 7% bond issued in 2009 that was convertible to 22,000 common shares. The company also had outstanding a $1,000,000, 6% bond issued in 2010 that was convertible to 26,000 common shares. No dividends were declared or paid this year. Whispering's tax rate is 37%. a) Calculate the income effect of the dividends on Class A and B preferred shares. Dividends on Class A preferred shares: Dividends on Class B preferred shares: b) Calculate basic earnings per share. (For simplicity, ignore the requirement to record the debt and equity portions of the convertible bond separately.) Basic earnings per share: C) Calculate the after-tax interest paid on the 2009 bonds. After-tax interest on 2009 bonds converted: d) Determine an incremental per share effect for 2009 bonds. Incremental Numerator Effect Incremental Denominator Effect Potentially dilutive security EPS 2009 Bonds $ $ e) Calculate the after-tax interest paid on the 2010 bonds. After-tax interest on 2010 bonds converted: f) Determine an incremental per share effect for 2010 bonds. Incremental Numerator Effect Incremental Denominator Effect Potentially dilutive security EPS 8% Bonds $ $ g) Determine an incremental per share effect Class A preferred shares. Incremental Numerator Effect Incremental Denominator Effect Potentially dilutive security EPS Class A preferred shares $ $ h) Determine an incremental per share effect for Class B preferred shares. Incremental Numerator Effect Incremental Denominator Effect Potentially dilutive security EPS Class B preferred shares $ i) Rank the potentially dilutive securities from most dilutive to least dilutive, then calculate diluted earnings per share Rank the potentially dilutive securities from most dilutive to least dilutive. 2009 bonds 2010 bonds Class A preferred shares Class B preferred shares e Textbook and Media Calculate diluted earnings per share. (Round calculations of EPS to 3 decimal places, eg. $3.545 and provide final answer to 2 decimal places, e.g. 15.25.) Numerator Denominator EPS $ Basic Sub Total Sub Total