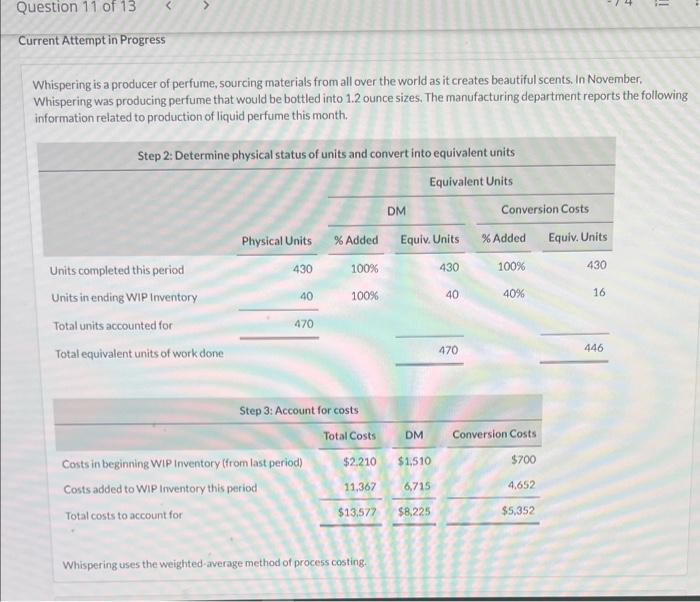

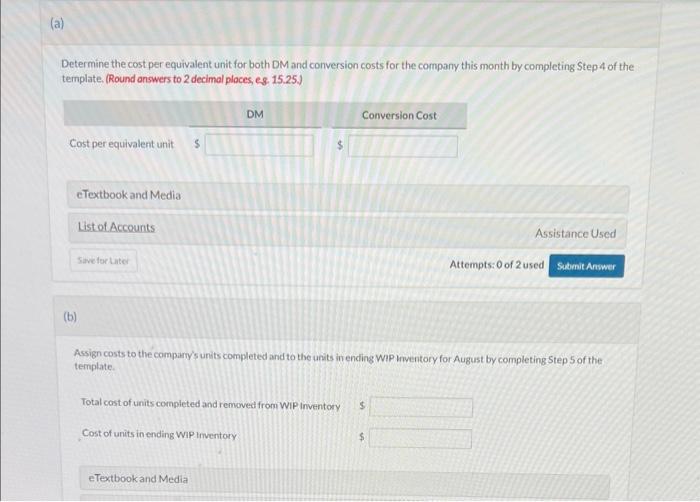

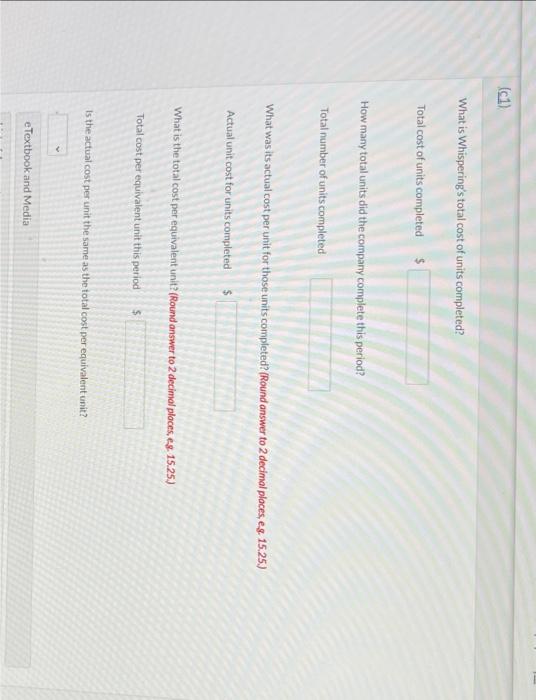

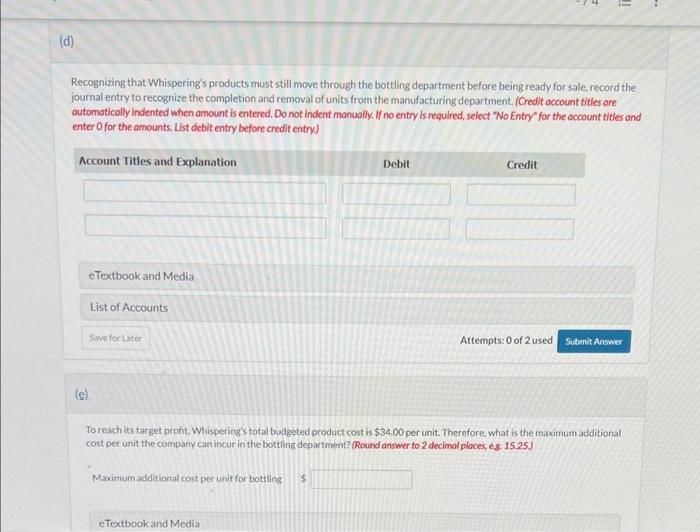

Whispering is a producer of perfume, sourcing materials from all over the world as it creates beautiful scents. In November. Whispering was producing perfume that would be bottled into 1.2 ounce sizes. The manufacturing department reports the following information related to production of liquid perfume this month. Whispering uses the weighted-average method of process costing. Determine the cost per equivalent unit for both DM and conversion costs for the company this month by completing Step 4 of the template. (Round answers to 2 decimal ploces, es. 15.25.) (b) Assign costs to the compary's units completed and to the units in ending WiP inventory for August by completing Step 5 of the template. Total cost of units completed and removed from WIP inventory Cost of units in ending WIP lmventory What is Whispering's total cost of units completed? Total cost of units completed How many total units did the company complete this period? Total number of units completed What was its actual cost per unit for those units completed? (Round answer to 2 decimal places, eg. 15.25) Actual unit cost for units completed What is the total cost per equivalent unit? (Round answer to 2 decimol ploces, es. 15.25.) Total cost per equivalent unit this period $ Is the actual cost per unit the same as the total cost per equivalent unit? Recognizing that Whispering's products must still move through the bottling department before being ready for sale, record the journal entry to recognize the completion and removal of units from the manufacturing department. (Credit account titles are outomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) eTextbook and Media List of Accounts Attempts: 0 of 2 used (e). To reach its target profit, Whispering's total budgeted product cost is $34.00 per unit. Therefore, what is the maximum additional cost per unit the company can incur in the bottling department? (Round answer to 2 decimal places, eg. 15.25.) Maximum additional cost per unit for bottling $ Whispering is a producer of perfume, sourcing materials from all over the world as it creates beautiful scents. In November. Whispering was producing perfume that would be bottled into 1.2 ounce sizes. The manufacturing department reports the following information related to production of liquid perfume this month. Whispering uses the weighted-average method of process costing. Determine the cost per equivalent unit for both DM and conversion costs for the company this month by completing Step 4 of the template. (Round answers to 2 decimal ploces, es. 15.25.) (b) Assign costs to the compary's units completed and to the units in ending WiP inventory for August by completing Step 5 of the template. Total cost of units completed and removed from WIP inventory Cost of units in ending WIP lmventory What is Whispering's total cost of units completed? Total cost of units completed How many total units did the company complete this period? Total number of units completed What was its actual cost per unit for those units completed? (Round answer to 2 decimal places, eg. 15.25) Actual unit cost for units completed What is the total cost per equivalent unit? (Round answer to 2 decimol ploces, es. 15.25.) Total cost per equivalent unit this period $ Is the actual cost per unit the same as the total cost per equivalent unit? Recognizing that Whispering's products must still move through the bottling department before being ready for sale, record the journal entry to recognize the completion and removal of units from the manufacturing department. (Credit account titles are outomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) eTextbook and Media List of Accounts Attempts: 0 of 2 used (e). To reach its target profit, Whispering's total budgeted product cost is $34.00 per unit. Therefore, what is the maximum additional cost per unit the company can incur in the bottling department? (Round answer to 2 decimal places, eg. 15.25.) Maximum additional cost per unit for bottling $