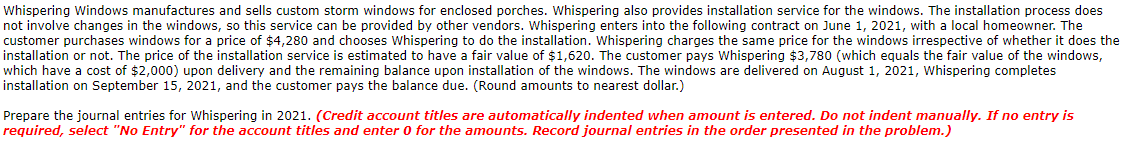

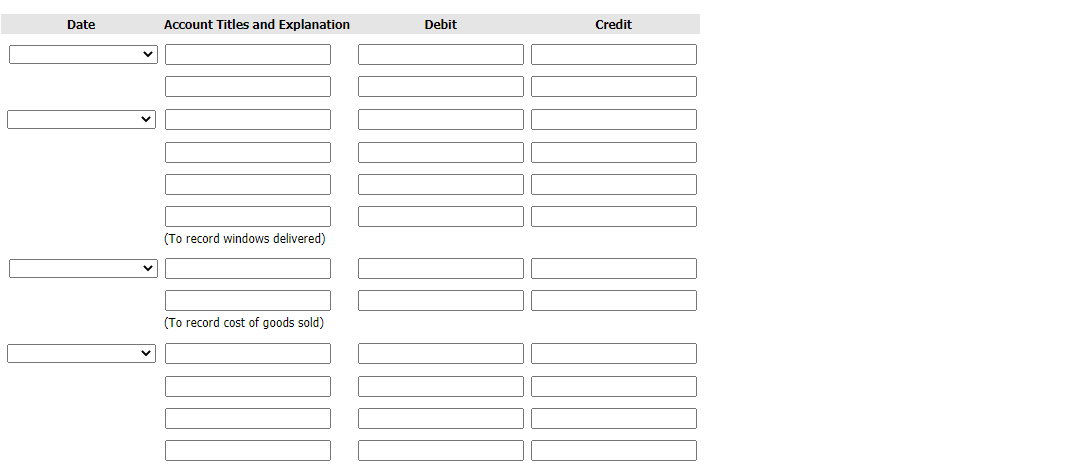

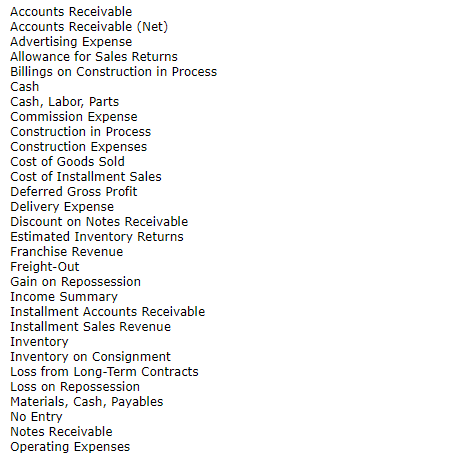

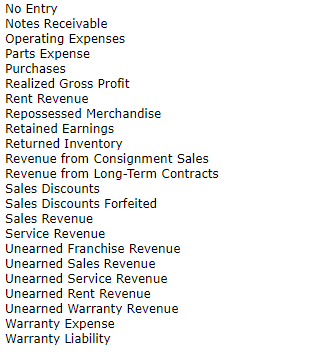

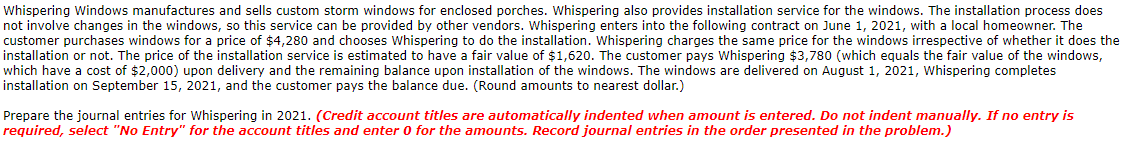

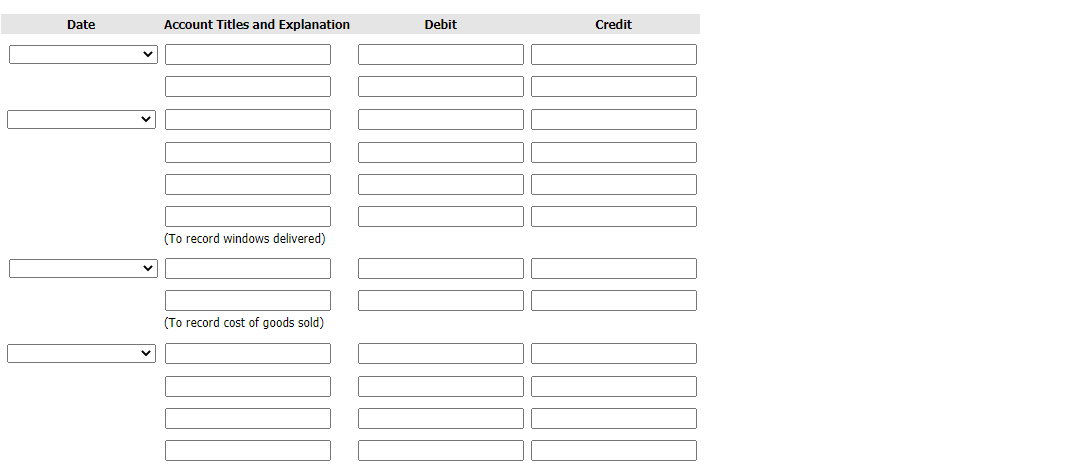

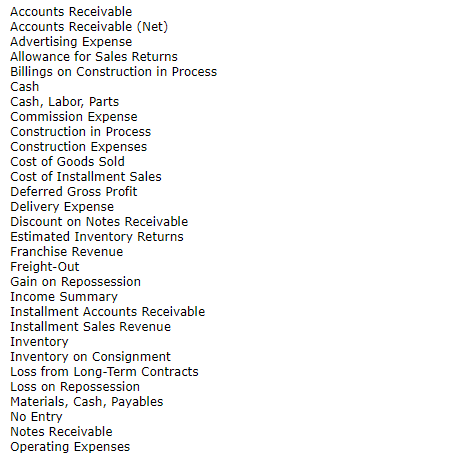

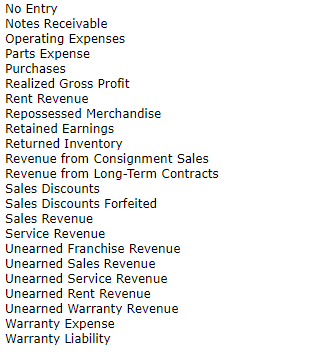

Whispering Windows manufactures and sells custom storm windows for enclosed porches. Whispering also provides installation service for the windows. The installation process does not involve changes in the windows, so this service can be provided by other vendors. Whispering enters into the following contract on June 1, 2021, with a local homeowner. The customer purchases windows for a price of $4,280 and chooses Whispering to do the installation. Whispering charges the same price for the windows irrespective of whether it does the installation or not. The price of the installation service is estimated to have a fair value of $1,620. The customer pays Whispering $3,780 (which equals the fair value of the windows, which have a cost of $2,000) upon delivery and the remaining balance upon installation of the windows. The windows are delivered on August 1, 2021, Whispering completes installation on September 15, 2021, and the customer pays the balance due. (Round amounts to nearest dollar.) Prepare the journal entries for Whispering in 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To record windows delivered) (To record cost of goods sold) Accounts Receivable Accounts Receivable (Net) Advertising Expense Allowance for Sales Returns Billings on Construction in Process Cash Cash, Labor, Parts Commission Expense Construction in Process Construction Expenses Cost of Goods Sold Cost of Installment Sales Deferred Gross Profit Delivery Expense Discount on Notes Receivable Estimated Inventory Returns Franchise Revenue Freight-Out Gain on Repossession Income Summary Installment Accounts Receivable Installment Sales Revenue Inventory Inventory on Consignment Loss from Long-Term Contracts Loss on Repossession Materials, Cash, Payables No Entry Notes Receivable Operating Expenses No Entry Notes Receivable Operating Expenses Parts Expense Purchases Realized Gross Profit Rent Revenue Repossessed Merchandise Retained Earnings Returned Inventory Revenue from Consignment Sales Revenue from Long-Term Contracts Sales Discounts Sales Discounts Forfeited Sales Revenue Service Revenue Unearned Franchise Revenue Unearned Sales Revenue Unearned Service Revenue Unearned Rent Revenue Unearned Warranty Revenue Warranty Expense Warranty Liability