Question

Whispering Winds Corp. is facing a decision as to whether to purchase 40% of Kyla Corp.s shares for $1.20 million cash, giving Whispering Winds significant

Whispering Winds Corp. is facing a decision as to whether to purchase 40% of Kyla Corp.’s shares for $1.20 million cash, giving Whispering Winds significant influence over the investee company, or 60% of Kyla’s shares for $1.80 million cash, making Kyla a subsidiary company. The book value of Kyla’s net assets is $3.00 million (assets are $12 million and liabilities are $9.00 million).

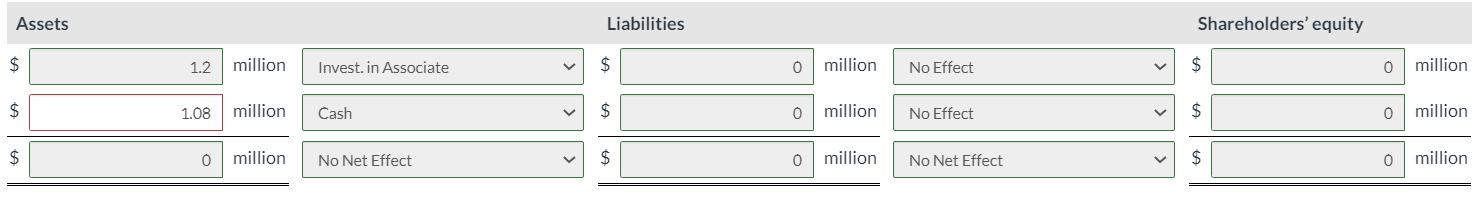

How will this investment affect Whispering Winds’s statement of financial position if Whispering Winds acquires a 40% interest, assuming Whispering Winds applies IFRS? Indicate the immediate effect on Whispering Winds’s total assets, total liabilities, and shareholders' equity.

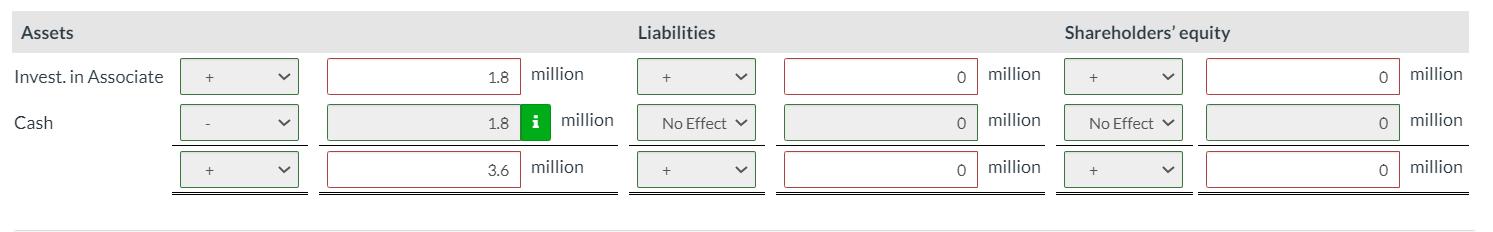

How will this investment affect Whispering Winds’s statement of financial position if Whispering Winds acquires a 60% interest, assuming Whispering Winds applies IFRS? Indicate the immediate effect on Whispering Winds’s total assets, total liabilities, and shareholders’ equity.

Assets Liabilities Shareholders' equity $ 1.2 million Invest. in Associate 2$ million No Effect $ million 2$ 1.08 million Cash 2$ million No Effect 2$ million 2$ million No Net Effect 2$ million No Net Effect 2$ million

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a If Whispering winds acquires 40 of Kyla Corps shares for 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started