Answered step by step

Verified Expert Solution

Question

1 Approved Answer

White down all givens and slove as soon as possible. Asap! Only use equations/formulas, Do not use excell. Thank you so so much. Consider the

White down all givens and slove as soon as possible. Asap! Only use equations/formulas, Do not use excell. Thank you so so much.

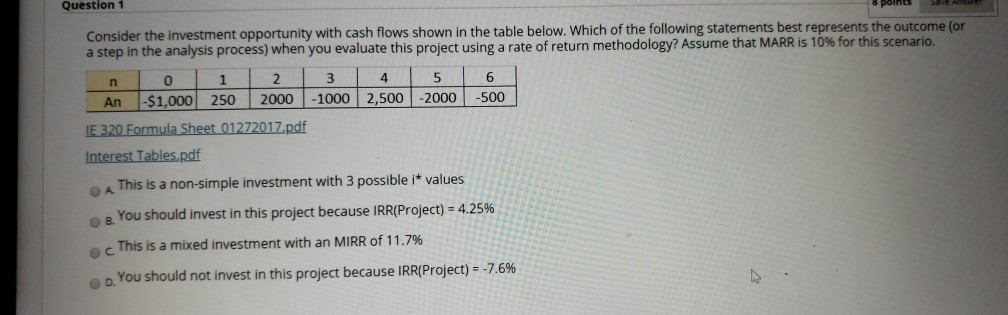

Consider the investment opportunity with cash flows shown in the table below. Which of the following statements best represents the outcome (or a step in the analysis process) when you evaluate this project using a rate of return methodology? Assume that MARR is 10% for this scenario. no 12 | 3 | 4 | 5 | 6 An -$1,000 250 2000 -1000 2,500 -2000 -500 IE 320 Formula Sheet 01272017.pdf Interest Tables.pdf A This is a non-simple investment with 3 possible i* values B. You should invest in this project because IRR(Project) = 4.25% This is a mixed investment with an MIRR of 11.7% D. You should not invest in this project because IRR(Project) = -7.6%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started