Answered step by step

Verified Expert Solution

Question

1 Approved Answer

White Industries started their operations on January 1 , Year 1 and recorded $ 4 0 0 , 0 0 0 in warranty expense during

White Industries started their operations on January Year and recorded $ in warranty expense during the year. Warranty expense was the only difference between the company's pretax financial income and its tax return income of $ White will be required to pay these warranties at a rate of $ per year beginning in Year Although White fully expects to earn in excess of $ in Year and Year the company believes it is more likely than not that it will incur a loss after Year The enacted tax rate is in current and future periods. What will White record as its income tax expense in Year

$ $ $ $

Solution

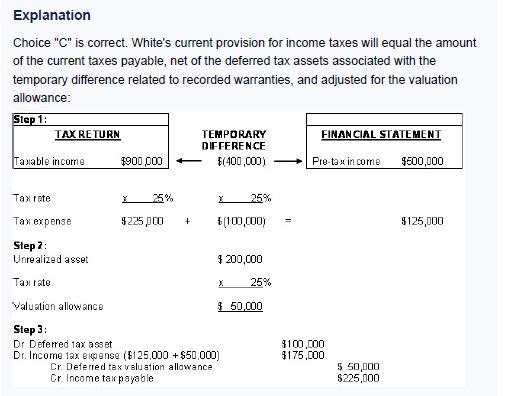

White's current provision for income taxes will equal the amount

of the current taxes payable, net of the deferred tax assets associated with the

temporary difference related to recorded warranties, and adjusted for the valuation

allowance:The Answer is $

Note:

Please provide detail explanation on each step of calculation, along with details on the reasons behind creation of VALUATION Account.

"Simple words detail explanation".

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started