Answered step by step

Verified Expert Solution

Question

1 Approved Answer

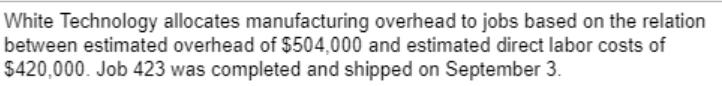

White Technology allocates manufacturing overhead to jobs based on the relation between estimated overhead of $504,000 and estimated direct labor costs of $420,000. Job

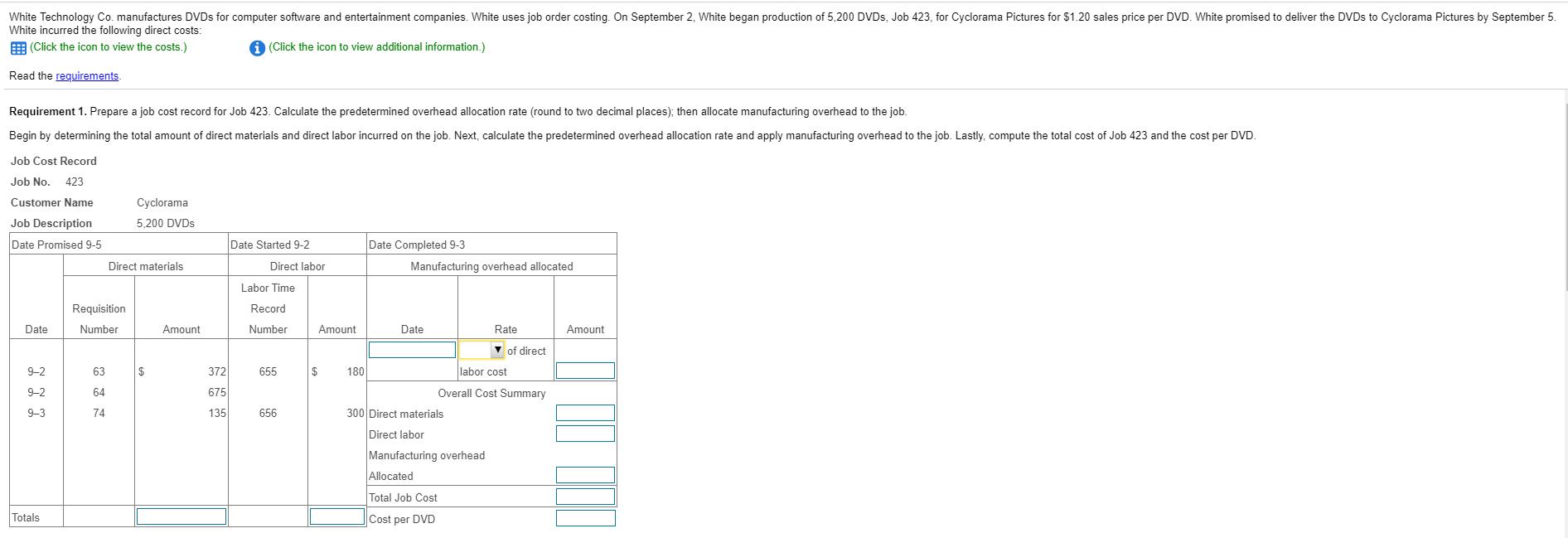

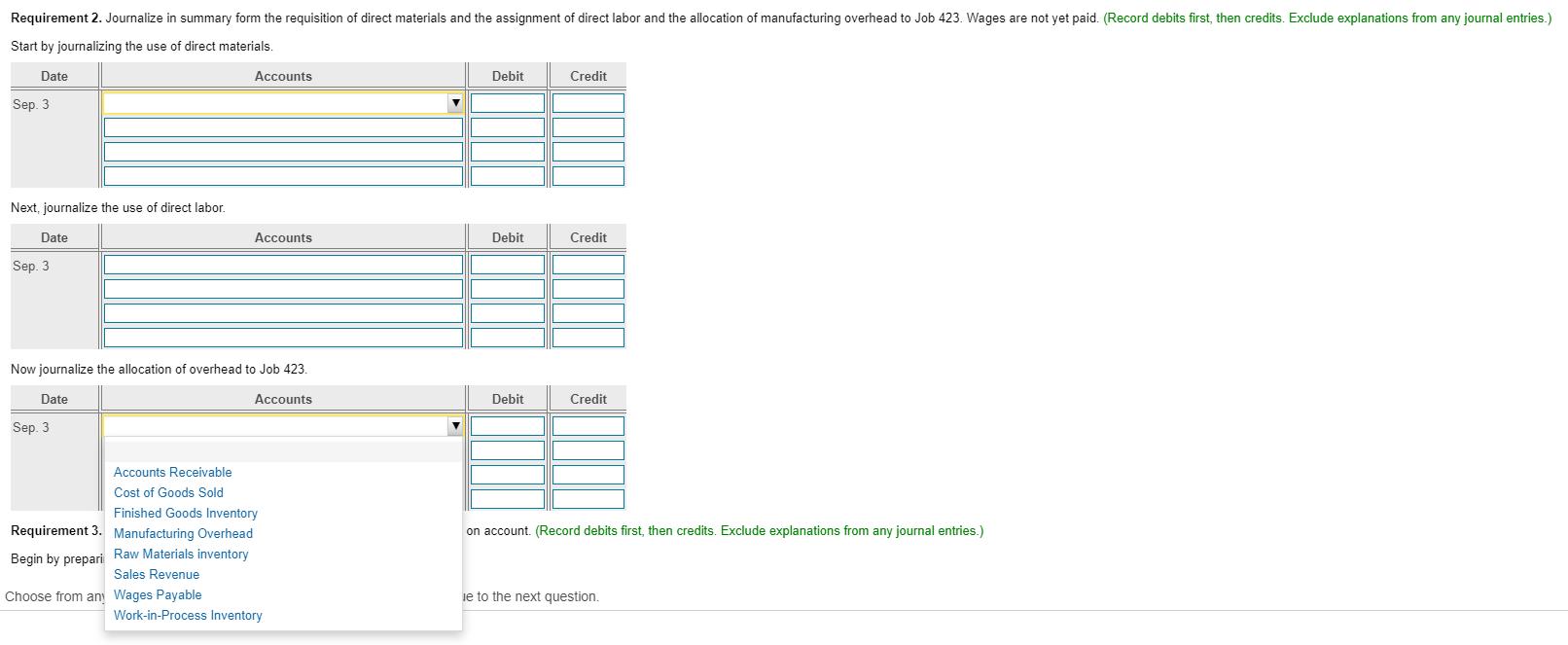

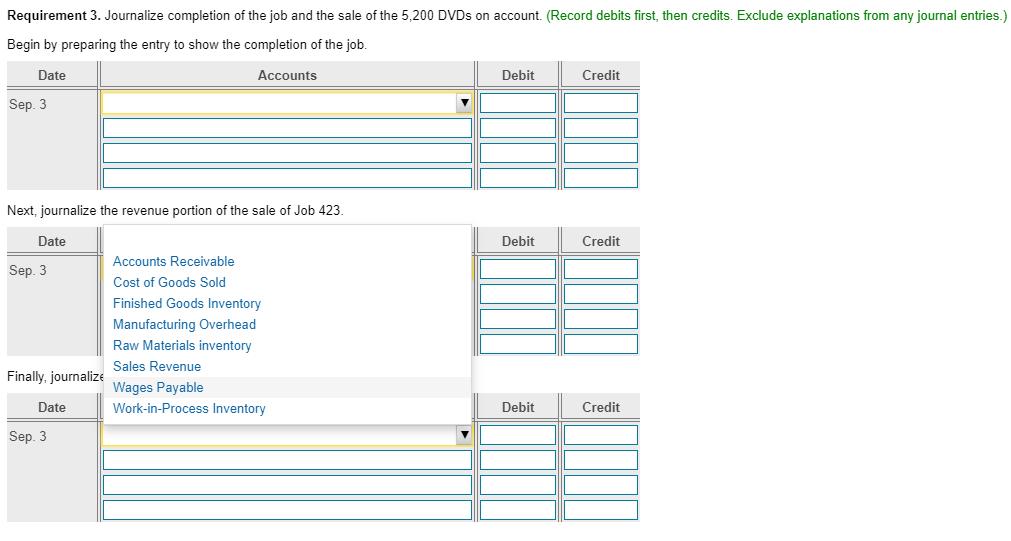

White Technology allocates manufacturing overhead to jobs based on the relation between estimated overhead of $504,000 and estimated direct labor costs of $420,000. Job 423 was completed and shipped on September 3. Date Labor Time Record No. Description Amount 9/02 655 10 hours @ $18 per hour $ 180 9/03 656 20 hours @ $15 per hour 300 Materials Requisition Date No. Description Amount 9/02 63 31 Ibs. polycarbonate plastic @ $12 per lb. 372 9/02 64 25 Ibs. acrylic plastic @ $27 per Ib. 675 9/03 74 3 Ibs. refined aluminum @ $45 per lb. 135 White Technology Co. manufactures DVDS for computer software and entertainment companies. White uses job order costing. On September 2, White began production of 5,200 DVDS, Job 423, for Cyclorama Pictures for $1.20 sales price per DVD. White promised to deliver the DVDS to Cyclorama Pictures by September 5. White incurred the following direct costs: E (Click the icon to view the costs.) A (Click the icon to view additional information.) Read the requirements Requirement 1. Prepare a job cost record for Job 423. Calculate the predetermined overhead allocation rate (round to two decimal places); then allocate manufacturing overhead to the job. Begin by determining the total amount of direct materials and direct labor incurred on the job. Next, calculate the predetermined overhead allocation rate and apply manufacturing overhead to the job. Lastly, compute the total cost of Job 423 and the cost per DVD. Job Cost Record Job No. 423 Customer Name Cyclorama Job Description 5,200 DVDS Date Promised 9-5 Date Started 9-2 Date Completed 9-3 Direct materials Direct labor Manufacturing overhead allocated Labor Time Requisition Record Date Number Amount Number Amount Date Rate Amount v of direct 9-2 63 $ 372 655 $ 180 labor cost 9-2 64 675 Overall Cost Summary 9-3 74 135 656 300 Direct materials Direct labor Manufacturing overhead Allocated Total Job Cost Totals Cost per DVD Requirement 2. Journalize in summary form the requisition of direct materials and the assignment of direct labor and the allocation of manufacturing overhead to Job 423. Wages are not yet paid. (Record debits first, then credits. Exclude explanations from any journal entries.) Start by journalizing the use of direct materials. Date Accounts Debit Credit Sep. 3 Next, journalize the use of direct labor, Date Accounts Debit Credit Sep. 3 Now journalize the allocation of overhead to Job 423. Date Accounts Debit Credit Sep. 3 Accounts Receivable Cost of Goods Sold Finished Goods Inventory Requirement 3. Manufacturing Overhead on account. (Record debits first, then credits. Exclude explanations from any journal entries.) Begin by prepari Raw Materials inventory Sales Revenue Choose from an Wages Payable je to the next question. Work-in-Process Inventory Requirement 3. Journalize completion of the job and the sale of the 5,200 DVDS on account. (Record debits first, then credits. Exclude explanations from any journal entries.) Begin by preparing the entry to show the completion of the job. Date Accounts Debit Credit Sep. 3 Next, journalize the revenue portion of the sale of Job 423 Date Debit Credit Accounts Receivable Sep. 3 Cost of Goods Sold Finished Goods Inventory Manufacturing Overhead Raw Materials inventory Sales Revenue Finally, journalize Wages Payable Date Work-in-Process inventory Debit Credit Sep. 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Predetermined overhead rate based on DLC Esti OverheadEsti DLC 504000 420000 12 per DLC Req ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started