Answered step by step

Verified Expert Solution

Question

1 Approved Answer

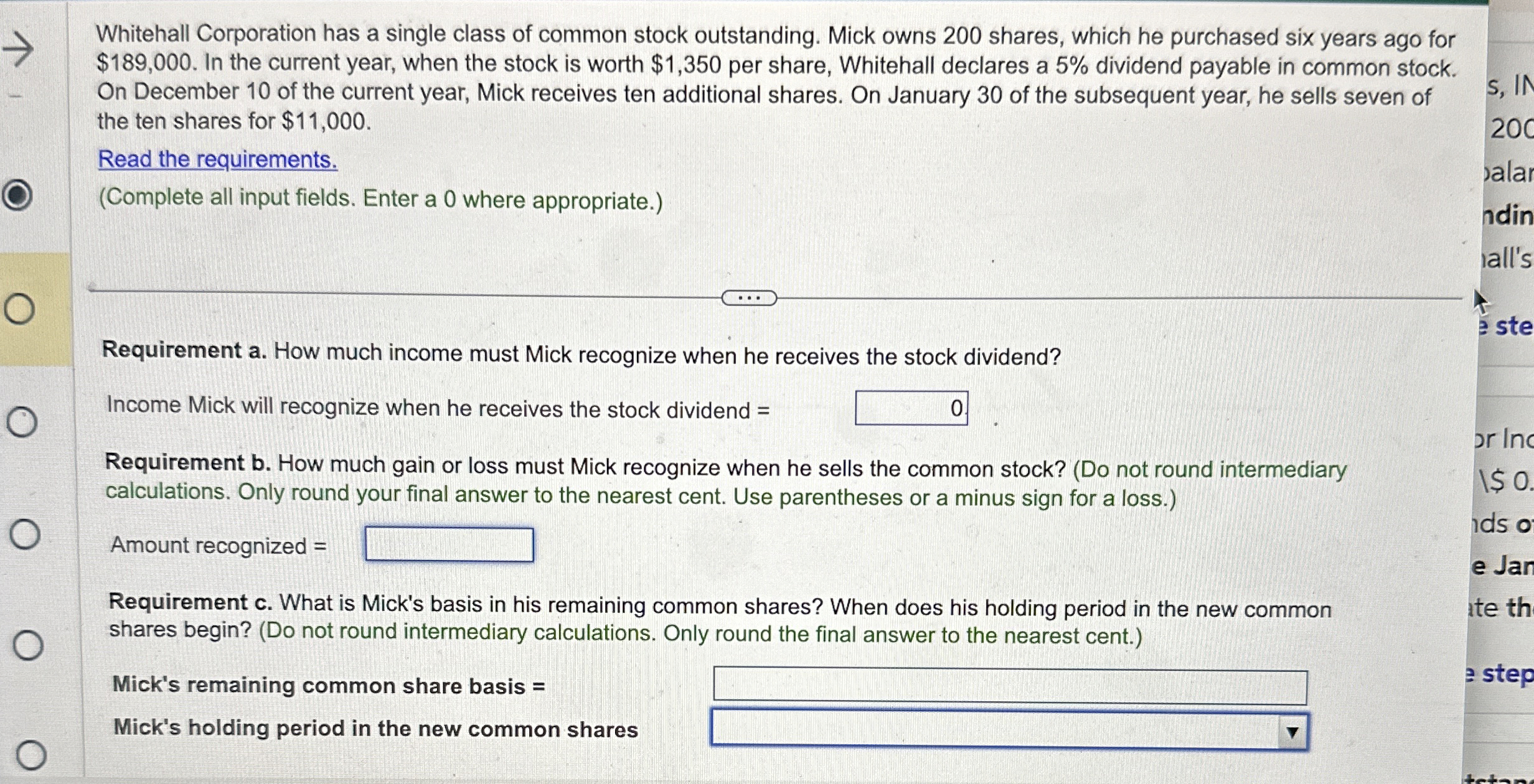

Whitehall Corporation has a single class of common stock outstanding. Mick owns 2 0 0 shares, which he purchased six years ago for $ 1

Whitehall Corporation has a single class of common stock outstanding. Mick owns shares, which he purchased six years ago for $ In the current year, when the stock is worth $ per share. Whitehall declares a dividend payable in common stock. On December of the current year, Mick receives ten additional shares. On January of the subsequent year, he sells seven of the ten shares for $

Read the requirements.

Complete all input fields. Enter a where appropriate.

Requirement a How much income must Mick recognize when he receives the stock dividend?

Income Mick will recognize when he receives the stock dividend

Requirement b How much gain or loss must Mick recognize when he sells the common stock? Do not round intermediary calculations. Only round your final answer to the nearest cent. Use parentheses or a minus sign for a loss.

Amount recognized

Requirement c What is Mick's basis in his remaining common shares? When does his holding period in the new common shares begin? Do not round intermediary calculations. Only round the final answer to the nearest cent.

Mick's remaining common share basis

Mick's holding period in the new common shares

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started