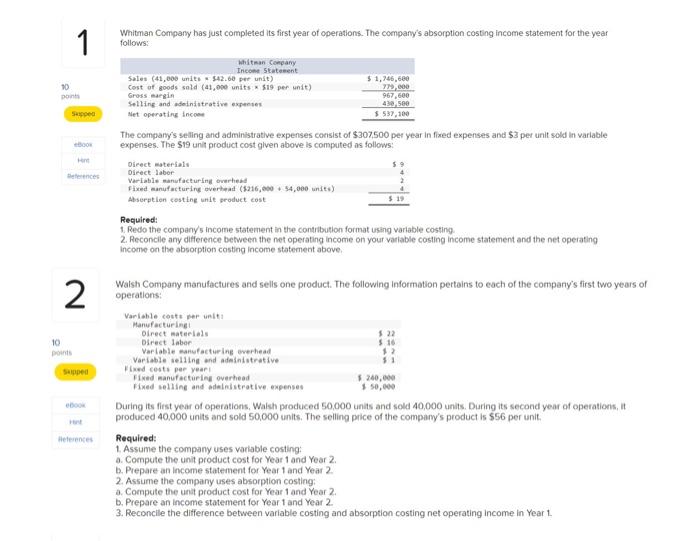

Whitman Company has just completed its first year of operations. The company's absorption costing income statement for the year follows: The company's seling and administrative expenses consist of $307,500 per year in fixed expenses and $3 per unit sold in variable expenses. The $19 unit product cost glven above is computed as follows: Recuired: 1. Redo the company's income statement in the contribution format using variable costing 2. Reconcle any difference between the net operating income on your variable costing income statement and the net operating income on the absorption costing income statement above. Waish Company manufactures and sells one product. The following information pertains to each of the company's first two years of operations: During its first year of operations, Walsh produced 50,000 units and sold 40,000 units. During its second year of operations, it produced 40,000 units and sold 50,000 units. The selling price of the compary's product is 556 per unit. Required: 1. Assume the company uses variable costing: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for Year 1 and Year 2. 2. Assime the company uses absorption costing: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for Year 1 and Year 2 3. Reconcile the difference between variable costing and absorption costing net operating income in Year 1 Whitman Company has just completed its first year of operations. The company's absorption costing income statement for the year follows: The company's seling and administrative expenses consist of $307,500 per year in fixed expenses and $3 per unit sold in variable expenses. The $19 unit product cost glven above is computed as follows: Recuired: 1. Redo the company's income statement in the contribution format using variable costing 2. Reconcle any difference between the net operating income on your variable costing income statement and the net operating income on the absorption costing income statement above. Waish Company manufactures and sells one product. The following information pertains to each of the company's first two years of operations: During its first year of operations, Walsh produced 50,000 units and sold 40,000 units. During its second year of operations, it produced 40,000 units and sold 50,000 units. The selling price of the compary's product is 556 per unit. Required: 1. Assume the company uses variable costing: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for Year 1 and Year 2. 2. Assime the company uses absorption costing: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for Year 1 and Year 2 3. Reconcile the difference between variable costing and absorption costing net operating income in Year 1