Answered step by step

Verified Expert Solution

Question

1 Approved Answer

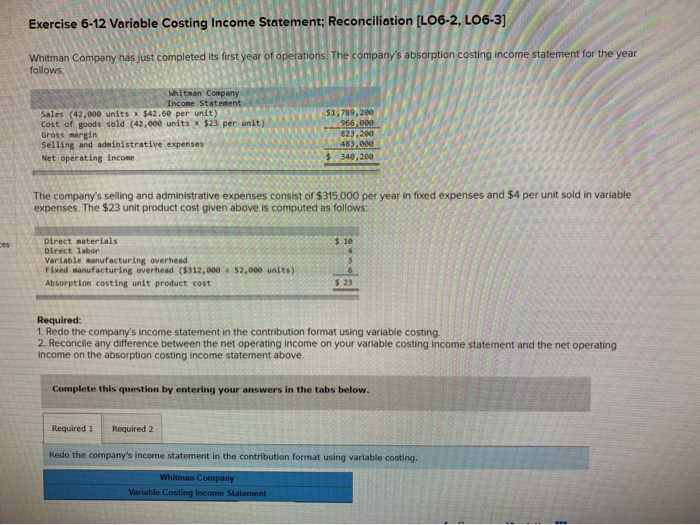

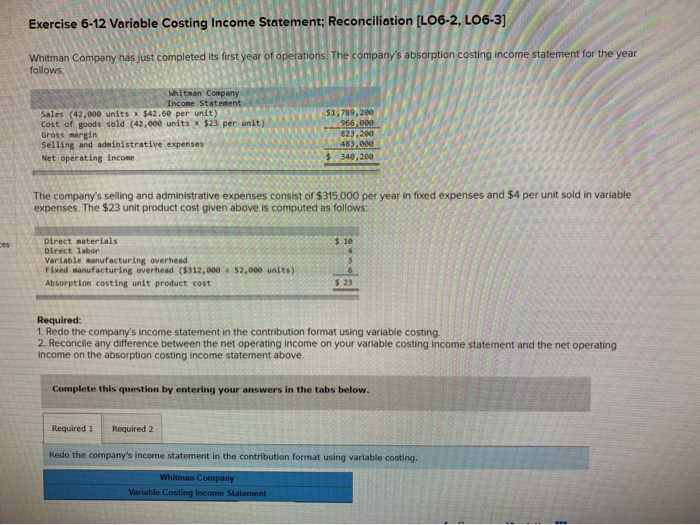

Whitman Company has just completed its first year of operations. The company's absorption costing income statement for the year follows: Exercise 6-12 Variable Costing Income

Whitman Company has just completed its first year of operations. The company's absorption costing income statement for the year follows:

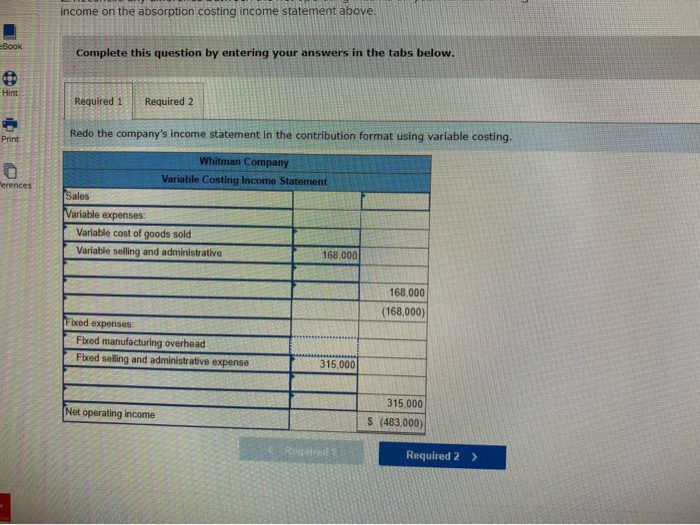

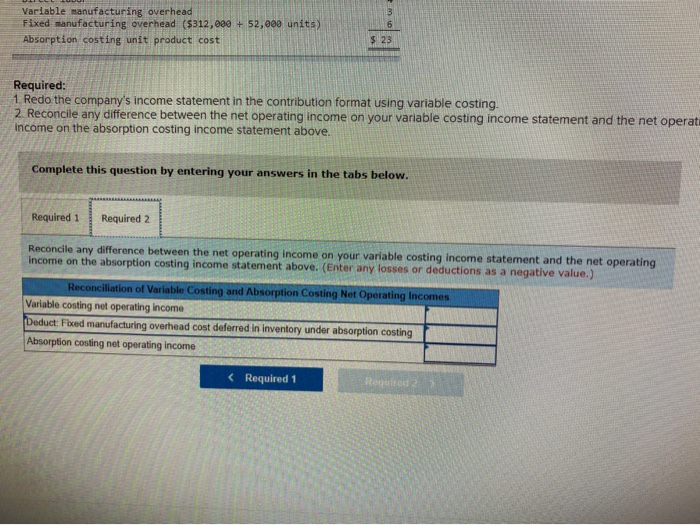

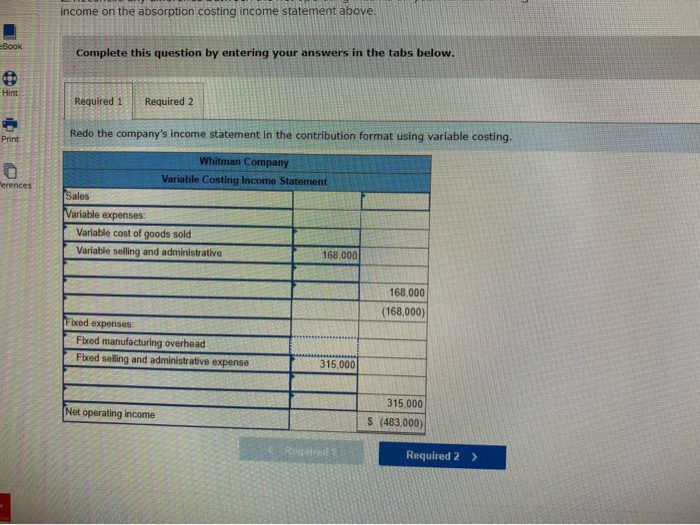

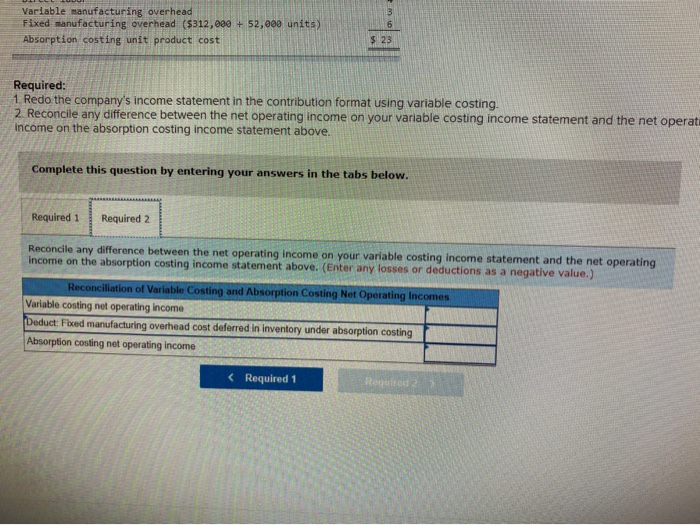

Exercise 6-12 Variable Costing Income Statement; Reconciliation (L06-2, LO6-3) Whitman Company has just completed its first year of operations. The company's absorption costing income statement for the year follows Whitman Company Income Statement Sales (42,800 units X $42.60 per unit) Cost of goods sold (42,000 units X $23 per unit) Gross margin Selling and administrative expenses Net operating income $1,789,200 966,000 823,200 483,000 $ 340,200 The company's selling and administrative expenses consist of $315,000 per year in fixed expenses and $4 per unit sold in variable expenses. The $23 unit product cost given above is computed as follows: $ 10 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead (5312,000 52,000 units) Absorption costing unit product cost $ 23 Required: 1. Redo the company's income statement in the contribution format using variable costing. 2. Reconcile any difference between the net operating income on your variable costing income statement and the net operating income on the absorption costing income statement above, Complete this question by entering your answers in the tabs below. Required 1 Required 2 Redo the company's income statement in the contribution format using variable costing. Whitman Company Variable Costing Income Statement income on the absorption costing income statement above. eBook Complete this question by entering your answers in the tabs below. Hint Required 1 Required 2 Print Redo the company's income statement in the contribution format using variable costing. o Terences Whitman Company Variable Costing Income Statement Sales Variable expenses Variable cost of goods sold Variable selling and administrative 168,000 168,000 (168,000) Fored expenses Fixed manufacturing overhead Fixed selling and administrative expense 315,000 Net operating income 315.000 $ (483,000) Required 2 > Variable manufacturing overhead Fixed manufacturing overhead (5312,000 + 52,000 units) Absorption costing unit product cost $ 23 Required: 1 Redo the company's income statement in the contribution format using variable costing. 2 Reconcile any difference between the net operating income on your variable costing income statement and the net operati income on the absorption costing income statement above. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Reconcile any difference between the net operating income on your variable costing income statement and the net operating income on the absorption costing income statement above. (Enter any losses or deductions as a negative value.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Variable costing net operating income Deduct: Fixed manufacturing overhead cost deferred in inventory under absorption costing Absorption costing net operating income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started