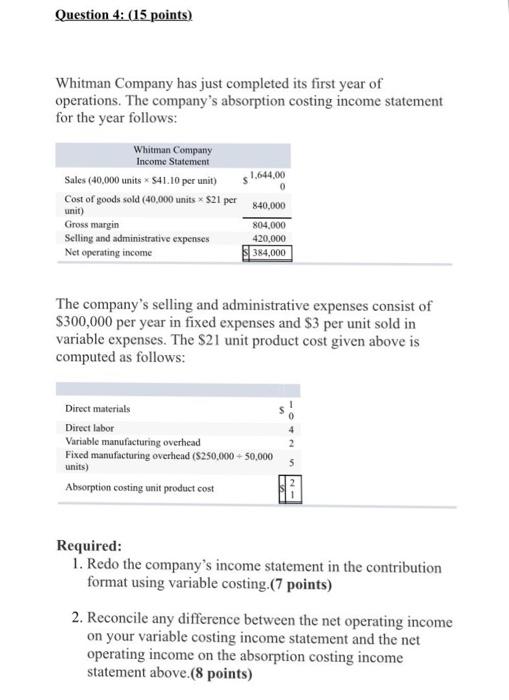

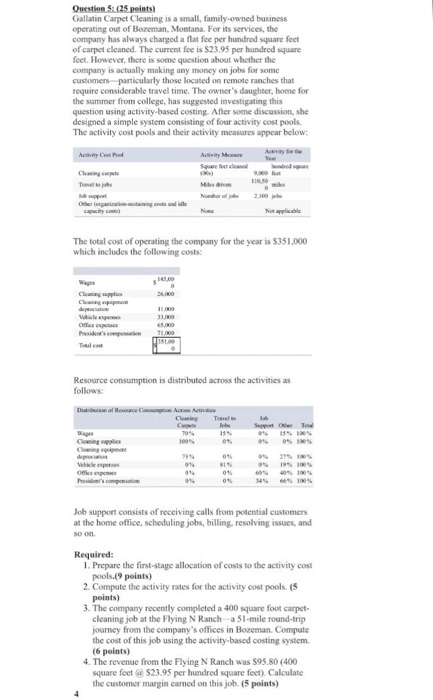

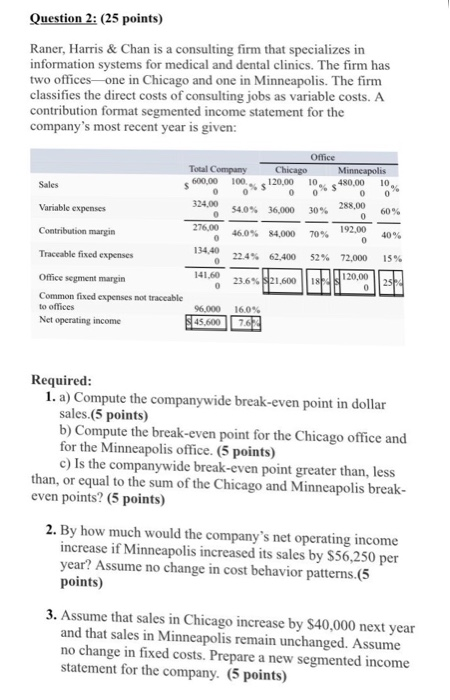

Whitman Company has just completed its first year of operations. The company's absorption costing income statement for the year follows Whitman Company Income Statement 1,644,00 Sales (40,000 units x S41.10 per unit)$ Cost of goods sold (40,000 units x $21 per unit) Gross margin Selling and administrative expenses Net operating income 840,000 804,000 420,000 384,000 The company's selling and administrative expenses consist of S300,000 per year in fixed expenses and $3 per unit sold in variable expenses. The $21 unit product cost given above is computed as follows Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead (S250,000+50,000 units) CH Absorption costing unit product cost Required 1. Redo the company's income statement in the contribution format using variable costing.(7 points) 2. Reconcile any difference between the net operating income on your variable costing income statement and the net operating income on the absorption costing income statement above.(8 points) Question S(25 peints Gallatin Carpet Cleaning is a small, family-owned business operating out of Bozeman, Montana. For its services, the company has always charged a flat fee per hundred square feet of carpet cleaned. The current fee is $23.95 per hundred squane feet. However, there is some question about whether the company is actually making any moncy on jobs for some customers particularly those located on remote ranches that require considerable travel time. The owner's daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below Chaning cpts Not applicable The total cost of operating the company for the year is $351,000 which includes the following costs: 26,000 11000 Resource consumption is distributed across the activities as follows: Cleaning sgples 100. Vehkle expenses 100% Job support consists of receiving calls from potential customers at the home office, scheduling jobs, billing, resolving issues, and so on Required 1. Prepare the first-stage allocation of costs to the activity cost 2. Compute the activity rates for the activity cost pools. (S 3. The company recently completed a 400 square foot carpet- pools.(9 points) points) cleaning job at the Flying N Ranch -a51-mile round-trip journey from the company's offices in Bozeman. Compute the cost of this job using the activity-based costing system. (6 peints) 4. The revenue from the Flying N Ranch was $95.80 (400 square feet $23.95 per hundred square feet) Calculate the customer margin carned on this job. (5 points) Question 2: (25 points) Raner, Harris & Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices- one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given: Total Company ChicagoMinneapolis 600,00 100 120,00 10 480,00 10 288,00 60% 54,0% 36,000 30% 460% 84,000 70% 192.00 22.4% 62,400 52% 72,000 15% 3.6% 21,600 Variable expenses 30% 276,00 40% Traceable fixed expenses Office segment margin Common fixed expenses not traceable 120,00 to offices 96,000 16.0% Net operating income Required 1. a) Compute the companywide break-even point in dollar sales.(5 points) b) Compute the break-even point for the Chicago office and for the Minneapolis office. (5 points) c) Is the companywide break-even point greater than, less than, or equal to the sum of the Chicago and Minneapolis break even points? (5 points) 2. By how much would the company's net operating income increase if Minneapolis increased its sales by $56,250 per year? Assume no change in cost behavior patterns.(5 points) 3. Assume that sales in Chicago increase by $40,000 next year and that sales in Minneapolis remain unchanged. Assume no change in fixed costs. Prepare a new segmented income statement for the company. (5 points)