Answered step by step

Verified Expert Solution

Question

1 Approved Answer

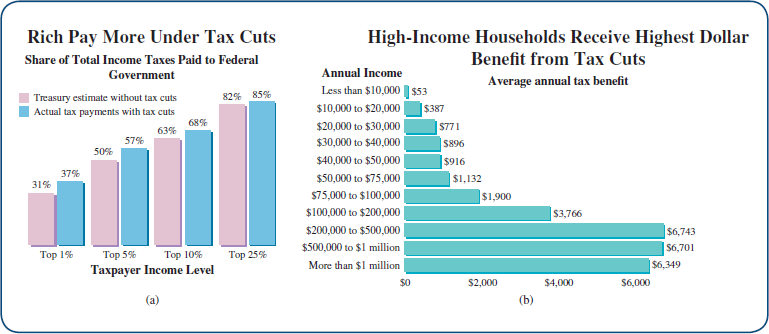

Who Benefits from a Tax Cut Do you think either of chartfairly communicates the impact of the proposed tax cut? If so, which one and

Who Benefits from a Tax Cut

- Do you think either of chartfairly communicates the impact of the proposed tax cut? If so, which one and why? If not, why not? Can you think of a way to present the numbers more fairly?

Rich Pav More Under Tax Cuts High-Income Households Receive Highest Dollar Benefit from Tax Cuts Average annual tax benefit Share of Total Income Taxes Paid to Federal Annual Income Treasury estimate Less than $10.00 $53 $10,000 to $20,000 $387 85% without tax cuts Actual tax payments with tax cuts 63% 82% 68% $20,000 to $30,000 S771 $30,000 to $40,000 896 $916 57% 50% $40,000 to $50,000 $50,000 to $75,000 $75,000 to $100,000 $100,000 to $200,000 $200,000 to $500,000 $500,000 to $1 million More than $1 million 37% $1,132 31% $1,900 $3,766 $6,743 6,701 Top 5% Taxpayer Income Level Top 1% Top 10% Top 25% $6,349 $0 $2,000 $4,000 $6,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started