Answered step by step

Verified Expert Solution

Question

1 Approved Answer

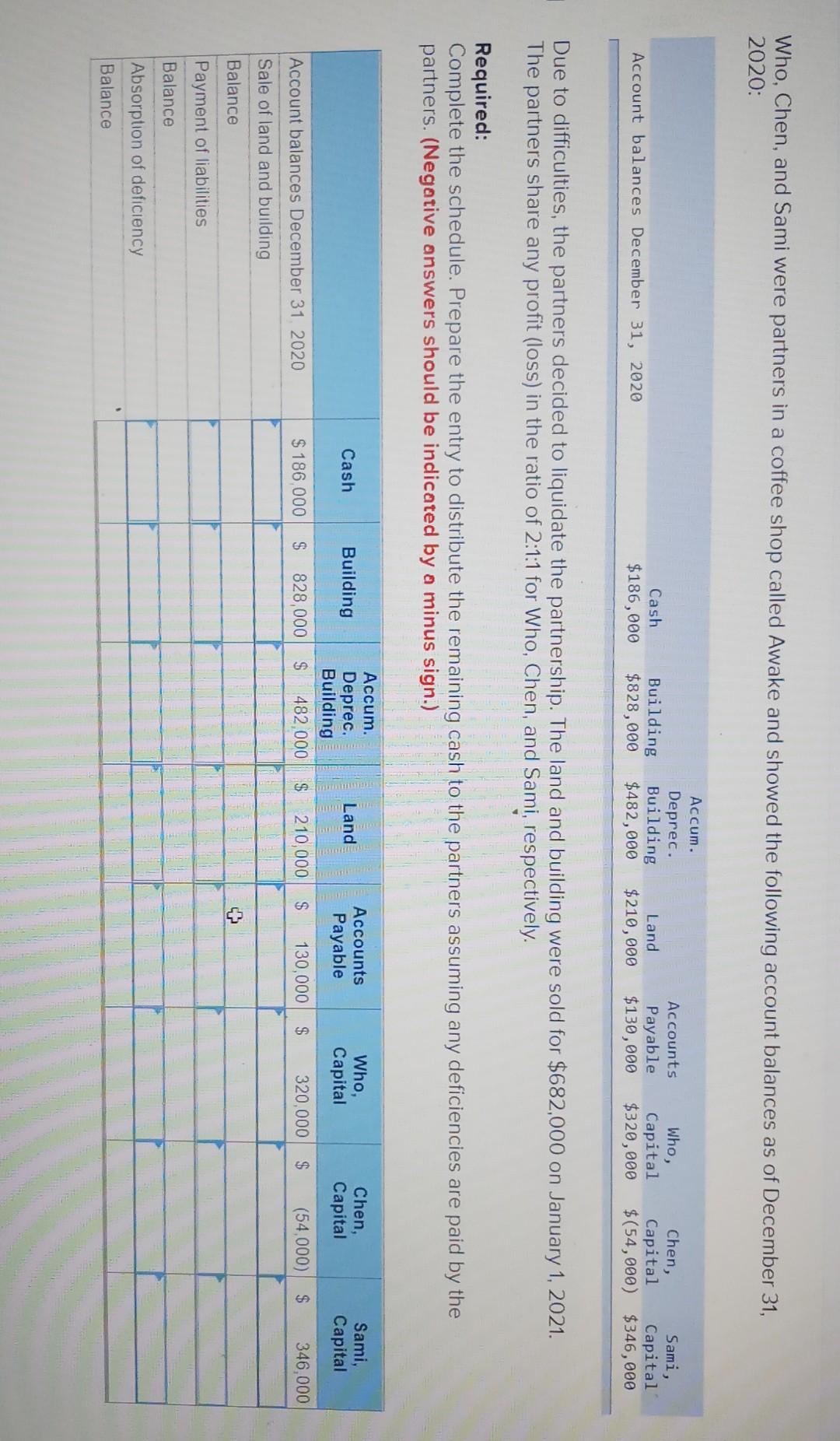

Who, Chen, and Sami were partners in a coffee shop called Awake and showed the following account balances as of December 31, 2020: Cash $186,000

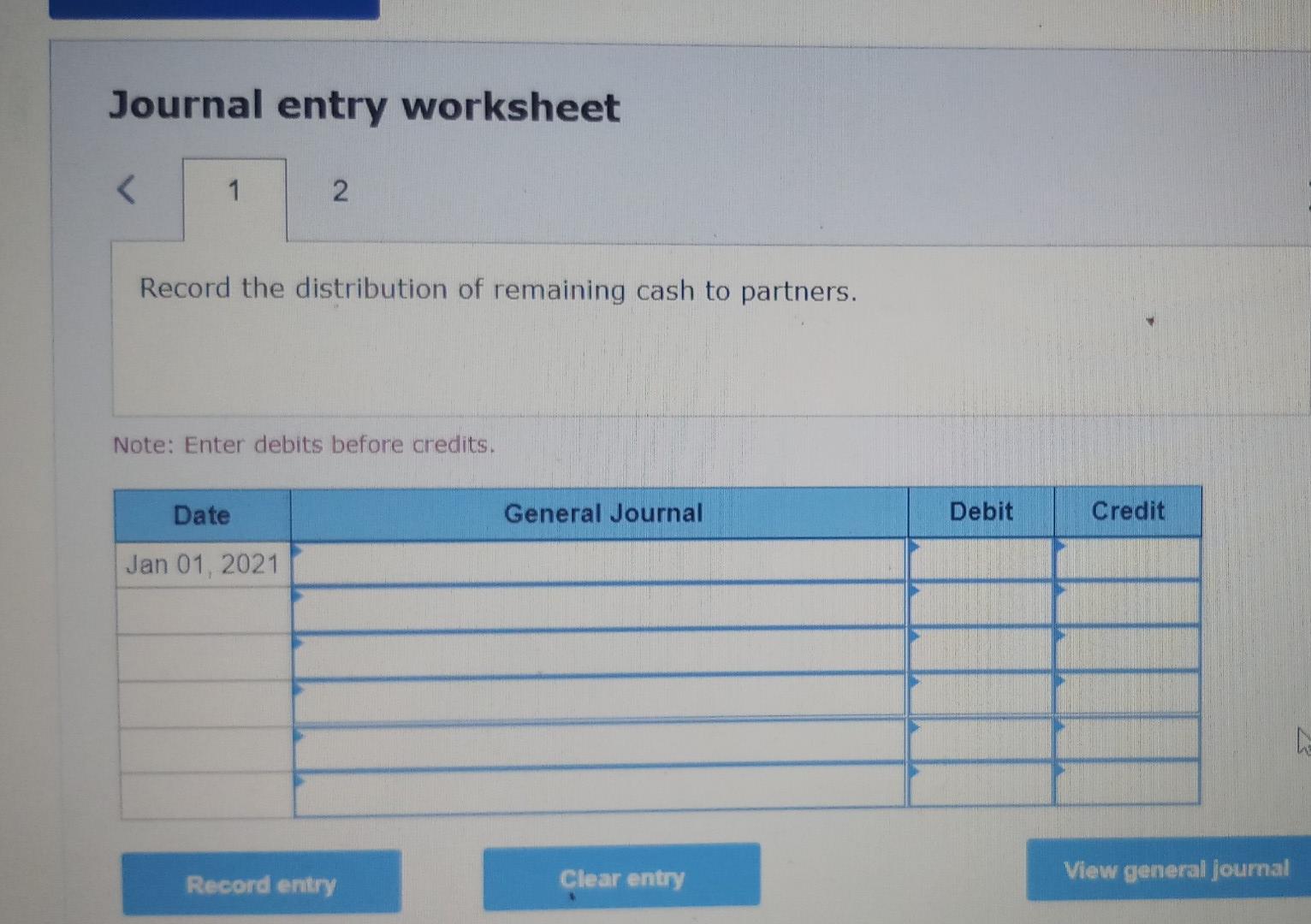

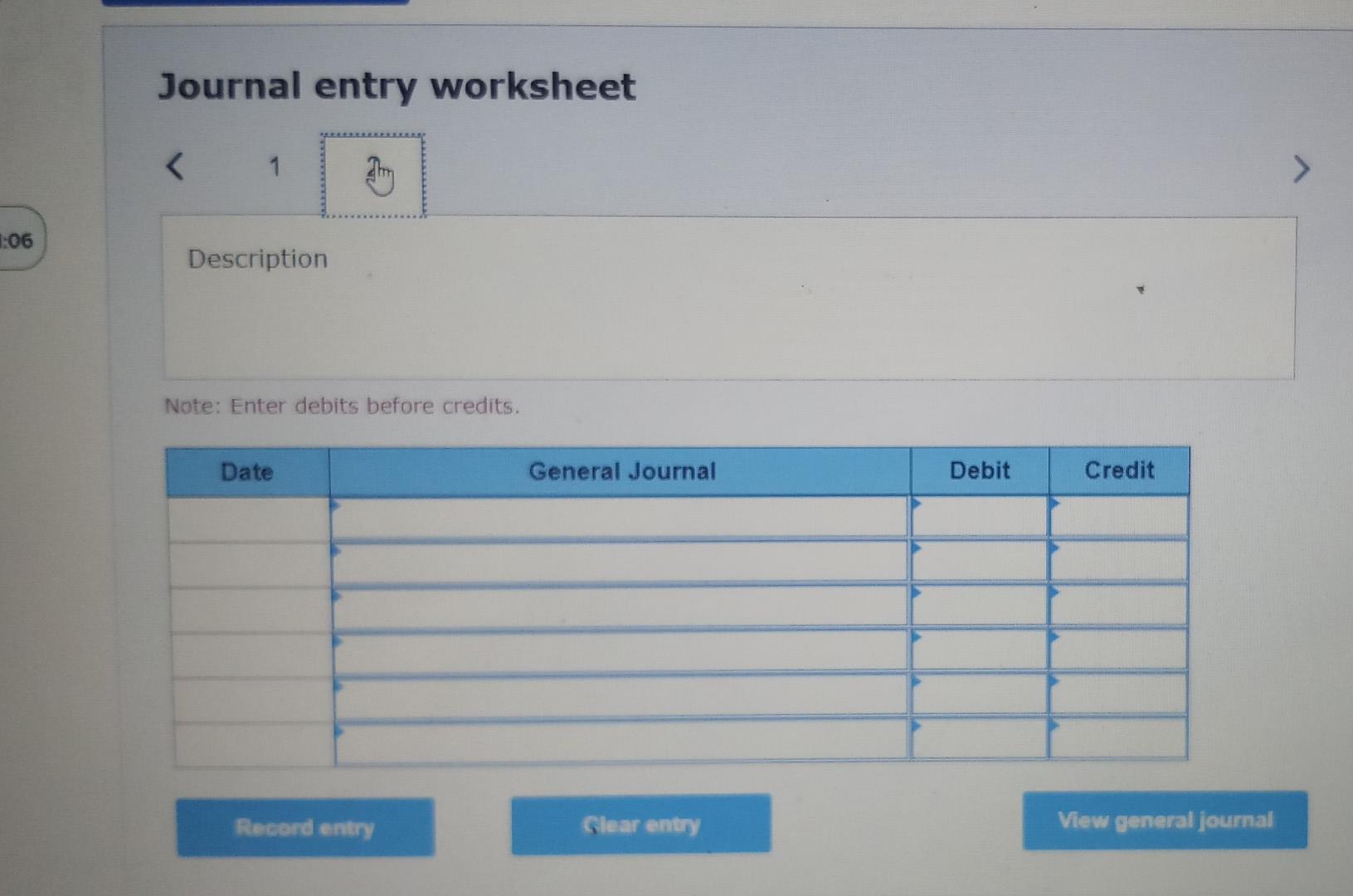

Who, Chen, and Sami were partners in a coffee shop called Awake and showed the following account balances as of December 31, 2020: Cash $186,000 Accum. Deprec. Building $482,000 Building $828,000 Accounts Payable $130,000 Land $210,000 Account balances December 31, 2020 Who, Capital $320,000 Chen, Sami, Capital Capital $(54,000) $346,000 Due to difficulties, the partners decided to liquidate the partnership. The land and building were sold for $682,000 on January 1, 2021. The partners share any profit (loss) in the ratio of 2:1:1 for Who, Chen, and Sami, respectively. Required: Complete the schedule. Prepare the entry to distribute the remaining cash to the partners assuming any deficiencies are paid by the partners. (Negative answers should be indicated by a minus sign.) Cash Building Land Accum. Deprec. Building $ 482.000 Accounts Payable Who Capital Chen, Capital Sami, Capital Account balances December 31, 2020 $ 186 000 $ 828,000 $ $ 210,000 $ 130,000 $ 320,000 $ (54,000) $ 346,000 Sale of land and building Balance Payment of liabilities Balance Absorption of deficiency Balance Journal entry worksheet 1:06 Description Note: Enter debits before credits. Date General Journal Debit Credit Record entry Glear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started