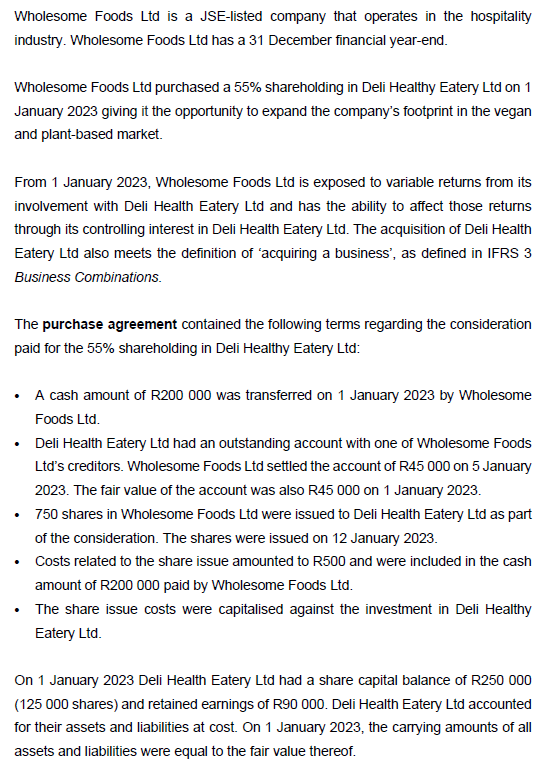

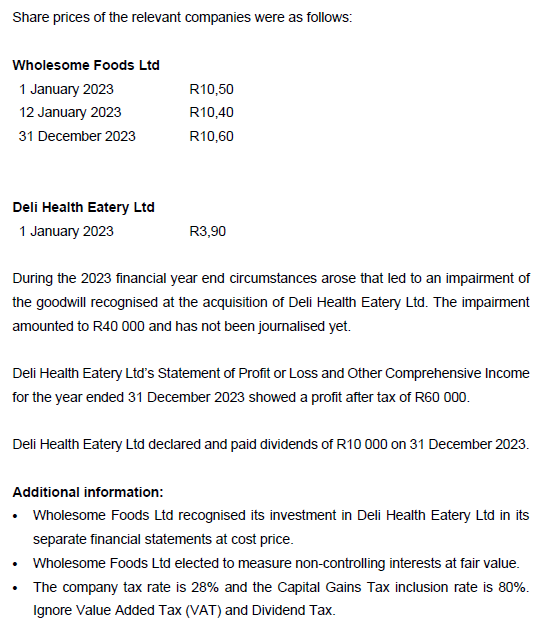

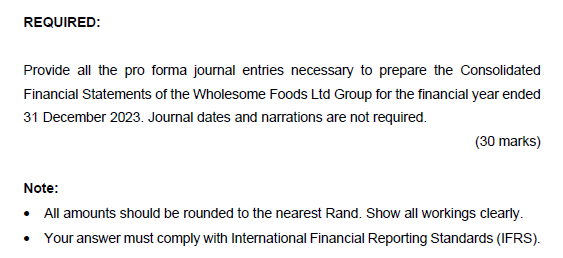

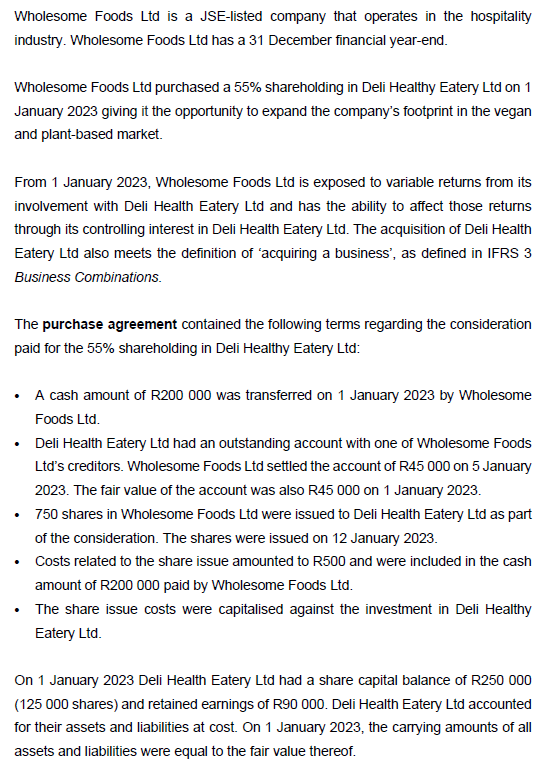

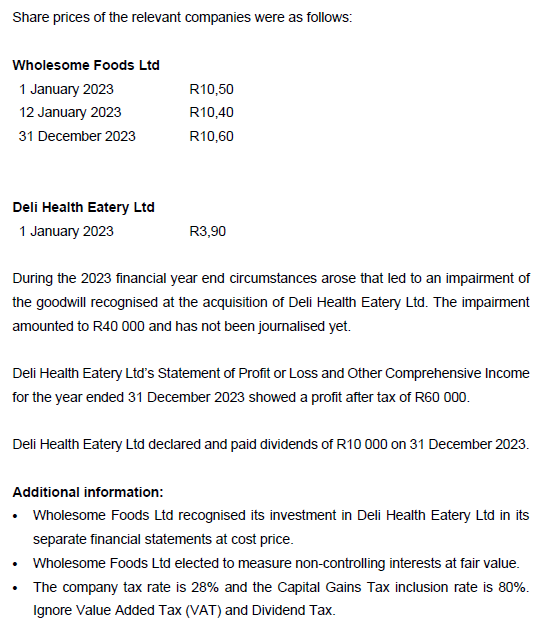

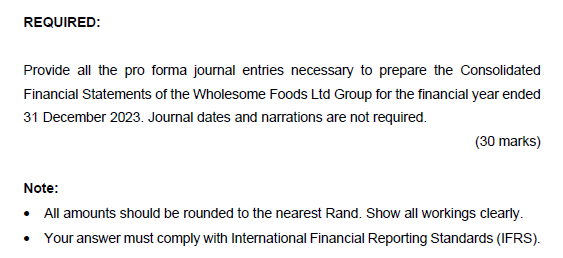

Wholesome Foods Ltd is a JSE-listed company that operates in the hospitality industry. Wholesome Foods Ltd has a 31 December financial year-end. Wholesome Foods Ltd purchased a 55% shareholding in Deli Healthy Eatery Ltd on 1 January 2023 giving it the opportunity to expand the company's footprint in the vegan and plant-based market. From 1 January 2023, Wholesome Foods Ltd is exposed to variable returns from its involvement with Deli Health Eatery Ltd and has the ability to affect those returns through its controlling interest in Deli Health Eatery Ltd. The acquisition of Deli Health Eatery Ltd also meets the definition of 'acquiring a business', as defined in IFRS 3 Business Combinations. The purchase agreement contained the following terms regarding the consideration paid for the 55% shareholding in Deli Healthy Eatery Ltd: - A cash amount of R200 000 was transferred on 1 January 2023 by Wholesome Foods Ltd. - Deli Health Eatery Ltd had an outstanding account with one of Wholesome Foods Ltd's creditors. Wholesome Foods Ltd settled the account of R45 000 on 5 January 2023. The fair value of the account was also R45 000 on 1 January 2023. - 750 shares in Wholesome Foods Ltd were issued to Deli Health Eatery Ltd as part of the consideration. The shares were issued on 12 January 2023. - Costs related to the share issue amounted to R500 and were included in the cash amount of R200 000 paid by Wholesome Foods Ltd. - The share issue costs were capitalised against the investment in Deli Healthy Eatery Ltd. On 1 January 2023 Deli Health Eatery Ltd had a share capital balance of R250 000 (125 000 shares) and retained earnings of R90 000. Deli Health Eatery Ltd accounted for their assets and liabilities at cost. On 1 January 2023, the carrying amounts of all assets and liabilities were equal to the fair value thereof. Share prices of the relevant companies were as follows: During the 2023 financial year end circumstances arose that led to an impairment of the goodwill recognised at the acquisition of Deli Health Eatery Ltd. The impairment amounted to R40 000 and has not been journalised yet. Deli Health Eatery Ltd's Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2023 showed a profit after tax of R60 000. Deli Health Eatery Ltd declared and paid dividends of R10 000 on 31 December 2023. Additional information: - Wholesome Foods Ltd recognised its investment in Deli Health Eatery Ltd in its separate financial statements at cost price. - Wholesome Foods Ltd elected to measure non-controlling interests at fair value. - The company tax rate is 28% and the Capital Gains Tax inclusion rate is 80%. Ignore Value Added Tax (VAT) and Dividend Tax. Provide all the pro forma journal entries necessary to prepare the Consolidated Financial Statements of the Wholesome Foods Ltd Group for the financial year ended 31 December 2023. Journal dates and narrations are not required. (30 marks) Note: - All amounts should be rounded to the nearest Rand. Show all workings clearly. - Your answer must comply with International Financial Reporting Standards (IFRS)