Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Why are capital budgeting decisions important for a business firm? Discuss their concept and significance. List the types of information generally required for evaluating

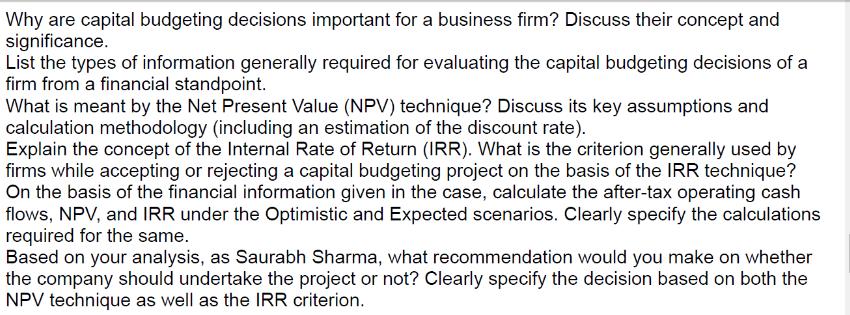

Why are capital budgeting decisions important for a business firm? Discuss their concept and significance. List the types of information generally required for evaluating the capital budgeting decisions of a firm from a financial standpoint. What is meant by the Net Present Value (NPV) technique? Discuss its key assumptions and calculation methodology (including an estimation of the discount rate). Explain the concept of the Internal Rate of Return (IRR). What is the criterion generally used by firms while accepting or rejecting a capital budgeting project on the basis of the IRR technique? On the basis of the financial information given in the case, calculate the after-tax operating cash flows, NPV, and IRR under the Optimistic and Expected scenarios. Clearly specify the calculations required for the same. Based on your analysis, as Saurabh Sharma, what recommendation would you make on whether the company should undertake the project or not? Clearly specify the decision based on both the NPV technique as well as the IRR criterion.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Capital budgeting decisions are crucial for a business as they involve allocating resources to longterm investments that will impact the firms future profitability and growth These decisions determine ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started