Question

Why are indices important to fund managers and how would they affect their investment decisions? What is an index reconstitution? Why does this happen? How

Why are indices important to fund managers and how would they affect their investment decisions?

What is an index reconstitution? Why does this happen? How would it affect a fund manager?

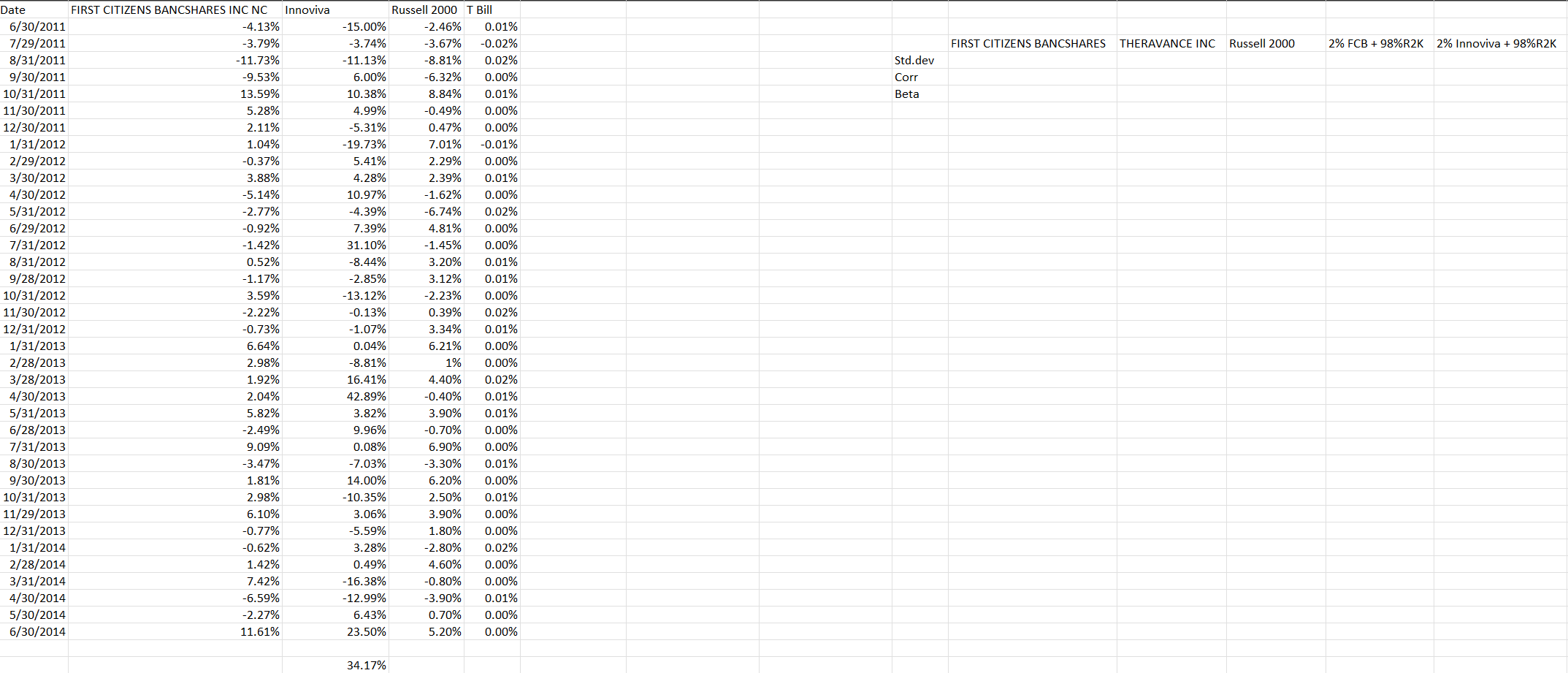

Calculate the Standard Deviation of Innoviva, FCB and the Russell 2000.

If a fund manager were to add a 2% position in either Innoviva or FCB, how would that affect the standard deviation of the portfolio? Assume the other 98% of the managers portfolio can be approximated by the Russell 2000 and calculate the Russell 2000, with the manager adding Innoviva. Repeat this again for adding FCB.

Run a CAPM and 3 Factor model for each of these stocks. Use the Russell 2000 as the market return. According to the market beta, which of these firms is riskier.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started