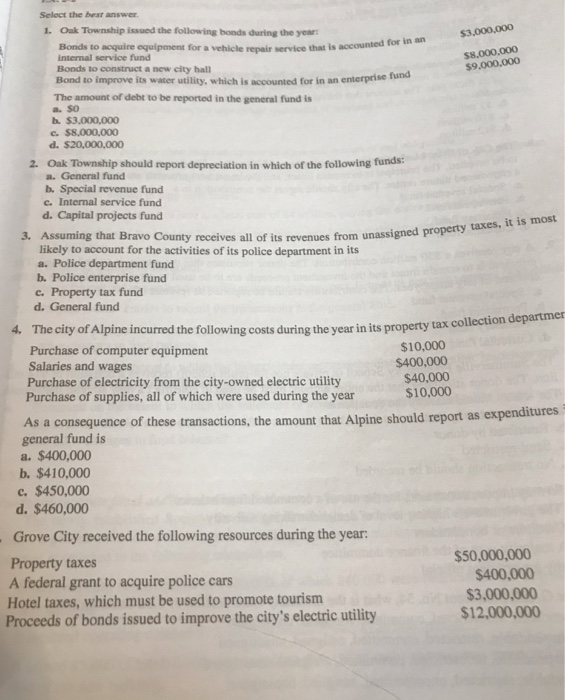

why are the answer 1.a 2. c 4. d 5. c 6. a 7. a 9. a 10. c. please explain in detail.

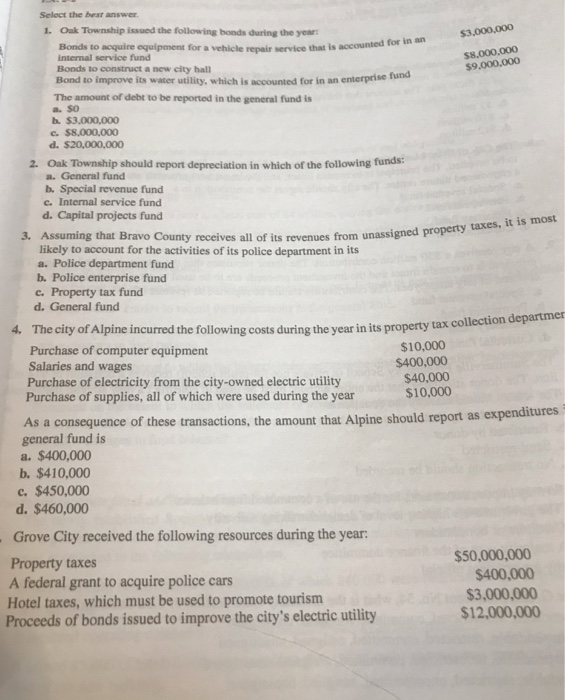

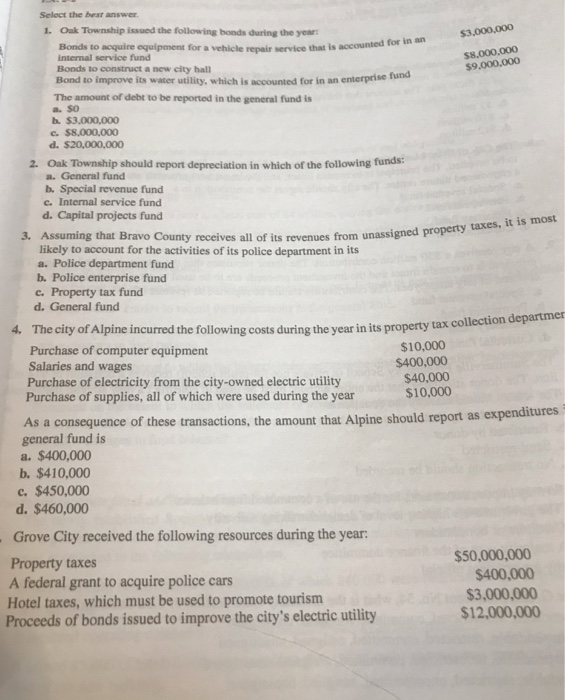

Select the best answer L Oak Township issued the following bonds during the year: $3,000,000 Bonds to acquire equipment for a vehicle repair internal service fund Bonds to construct a new city hall Bond to improve its water utility, which is accounted for in an enterprise The amount of debt to be reported in the general fund is service that is accounted for in an $9,000,000 fund a. so d. $20,000,000 2. Oak Township should report depreciation in which of the following funds: a. General fund b. Special revenue fund c. Internal service fund d. Capital projects fund 3. Assuming that Bravo County receives all of its likely to account for the activities of its police department in its a. Police department fund b. Police enterprise fund c. Property tax fund d. General fund revenues from unassigned property taxes, it is most 4. The city of Alpine incurred the following costs during the year in its property tax co collection departmer Purchase of computer equipment $10,000 $400,000 $40,000 $10,000 Salaries and wages Purchase of electricity from the city-owned electric utility Purchase of supplies, all of which were used during the year As a consequence of these transactions, the amount that Alpine general fund is a. $400,000 b. $410,000 c. $450,000 d. $460,000 should report as expenditures Grove City received the following resources during the year: Property taxes A federal grant to acquire police cars Hotel taxes, which must be used to promote tourism Proceeds of bonds issued to improve the city's electric utility $50,000,000 $400,000 $3,000,000 $12,000,000 in its special revenue funds is The amount tha the city $400,000 A oty inues 520 millioe of general obligation bonds to improve its streets and roads pan d 100,000 for its first payment of interest. The amount of liability that then of principal and $3,400.000 d. $15.400000 e. $65,400,000 with the bovenants, it commined SI million to help ensure that it is able to meet its n fland is report in its debt service .80 $18.9 miliion 7. During the year, Brian County collacts $12 million of property taxes on behalf of Urton Towne remit the balance shortly after d. $20 miliion he end this amount, it remits $10 milion to the township, expecting to so hacal year The amount thar the county should report as its year end net position is h. $2 miltion d. $12 milion &. The City of tobe tnvested. The principal is to remain intact, and the investment proceeds are to be used to suppon a city-owned nature center. The city should report the contribution in a a. Special revenue fund Round Lake receives a contribution of $20 million. The donor stipulates that the monevib b. Permanent fund &Fiduciary fund d. Custodial fund ves a S30 million contribution. The donor stipulates that the money is to be invested. The and the investment proceeds are to be used to provide scholarships for the principal is to remain intact children of city employees. The contribution should be reported as revenue of a a. Special revenue fund b. Permanent fund .Fiduciary fund d. Custodial fund 10. The Summerville Preparatory School (a private not-for-profit school) receives a donation of $14 mil- lion. The donor stipulates that the entire amount must be used to construct a new athletic field house The school should classify the donation as a. Not restricted by donor b. Restricted by donor c. Semi-restricted d. No transaction should be recorded I1. Who may impose constraints for the use of a committed fund balance? a. The government's highest level of decision-making authority b. Creditors or bondholders .A majority vote of the finance committee d. Any govermment official 12. Under GASB Statement No. 54, what is the hierarchy classification of fund balances? a. Spendable, unrestricted. committed, assigned, unassigned b. Nonspendable, restricted, committed, assigned, unassigned c. Nonspendable, unrestricted, committed, assigned, unassigned d. Spendable, restricted, uncommitted, assigned, unassigned