Answered step by step

Verified Expert Solution

Question

1 Approved Answer

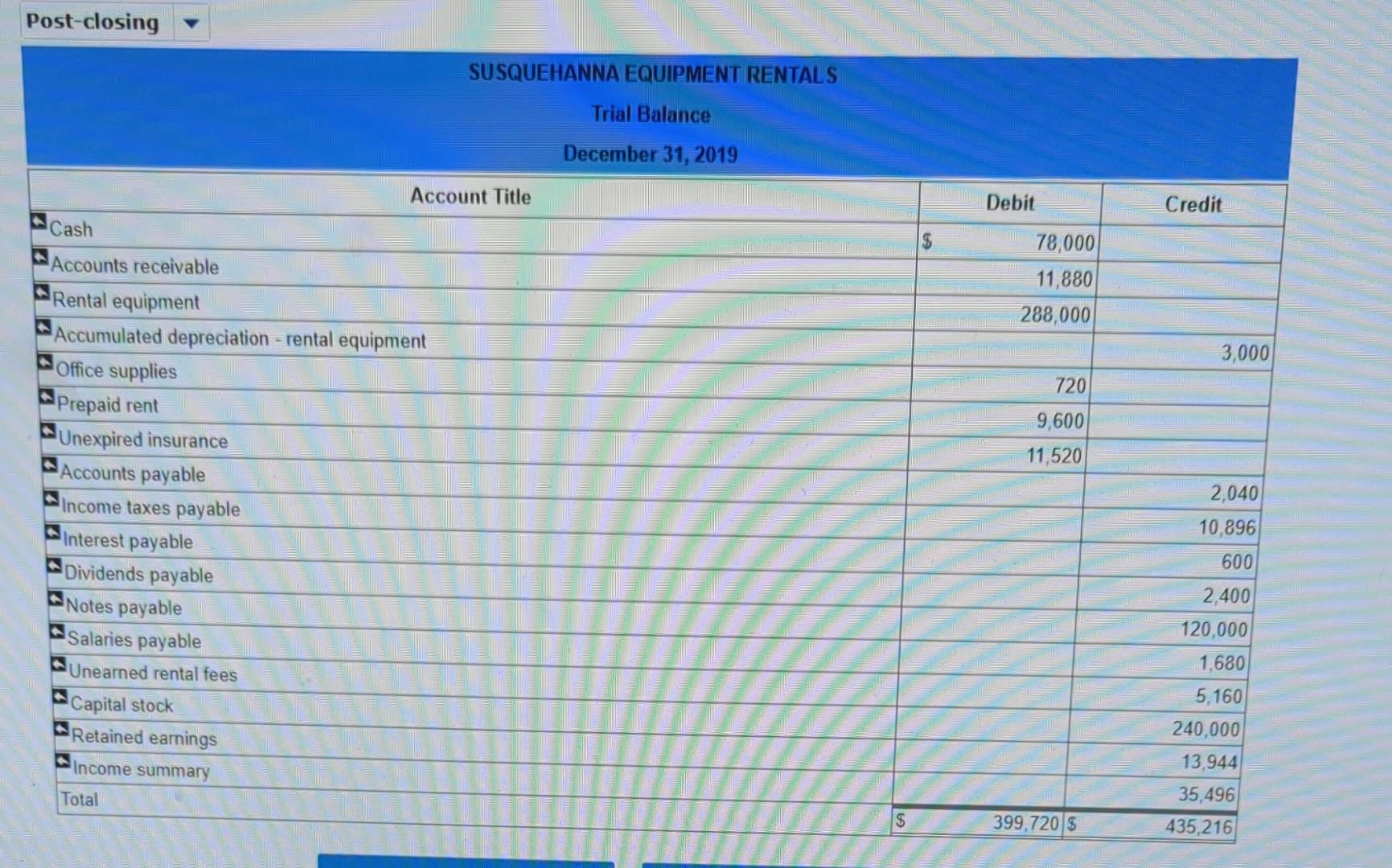

why are the post closing amounts different? what is missing Post-closing SUSQUEHANNA EQUIPMENT RENTALS Trial Balance December 31, 2019 Account Title Debit Credit 1$ 78,000

why are the post closing amounts different? what is missing

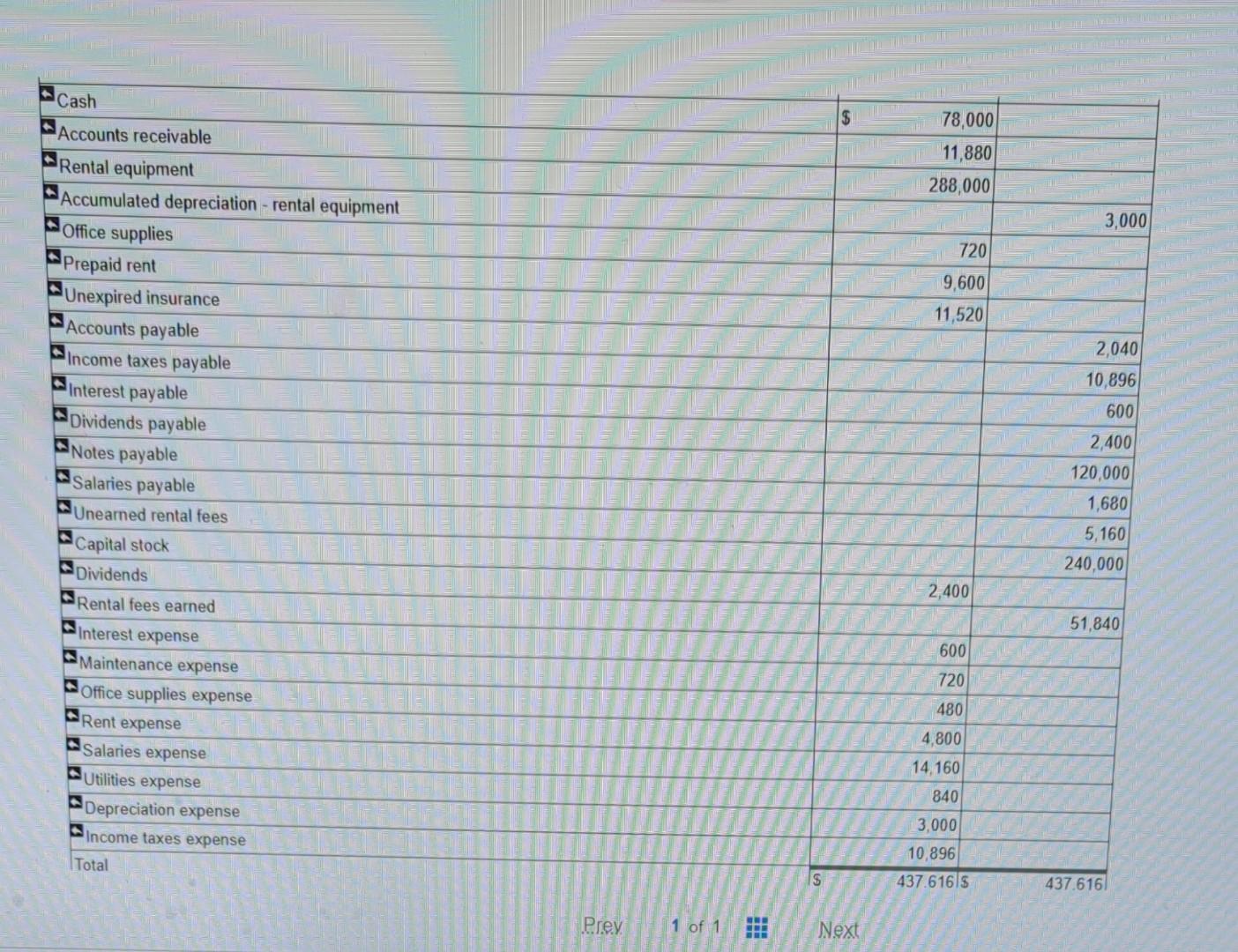

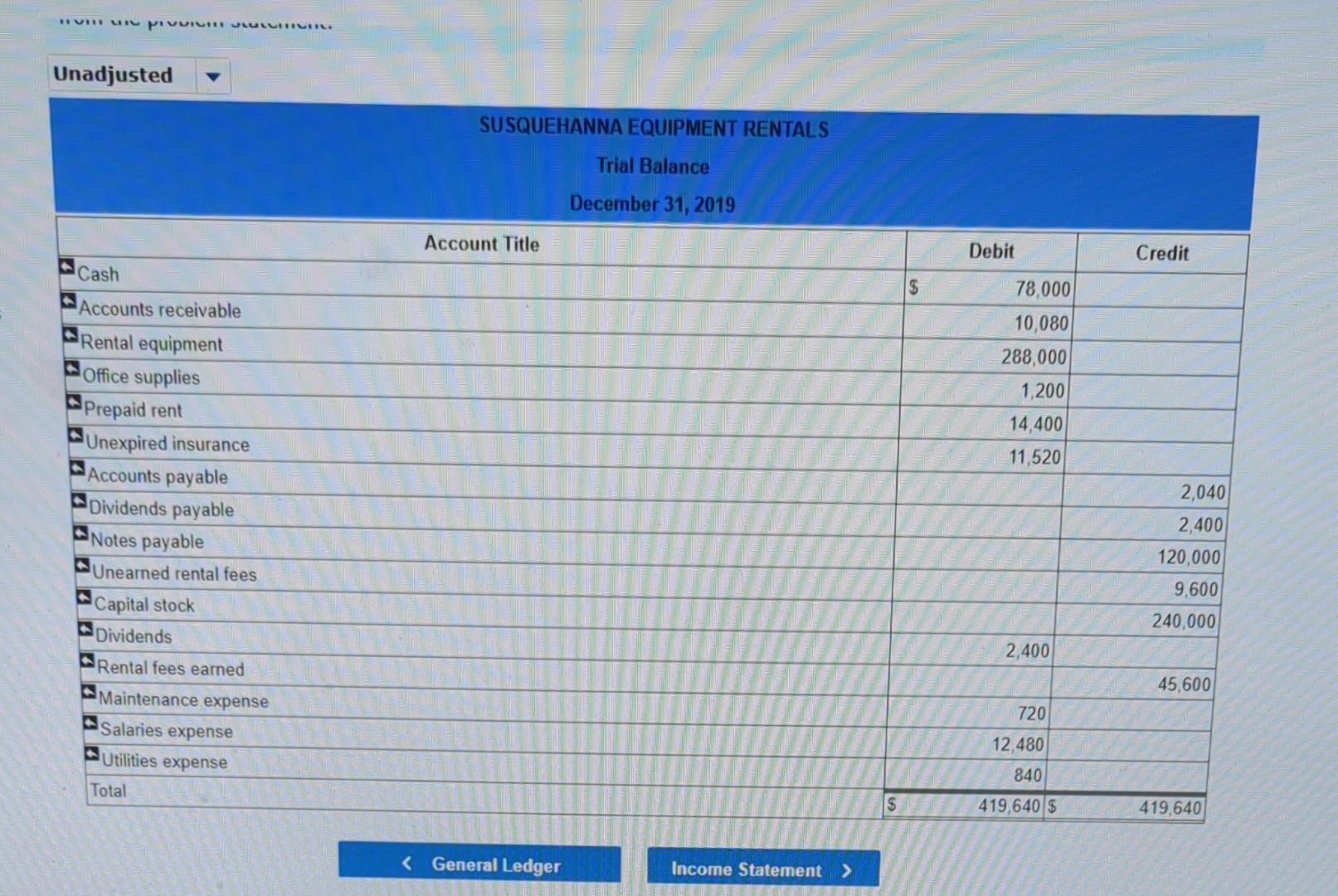

Post-closing SUSQUEHANNA EQUIPMENT RENTALS Trial Balance December 31, 2019 Account Title Debit Credit 1$ 78,000 11,880 288,000 3,000 720 9,600 11,520 Cash Accounts receivable Rental equipment Accumulated depreciation - rental equipment Office supplies Prepaid rent Unexpired insurance Accounts payable Income taxes payable Interest payable Dividends payable Notes payable Salaries payable Uneamed rental fees Capital stock Retained earnings Income summary Total 2,040 10,896 600 2,400 120,000 1,680 5,160 240,000 13,944 35,496 435,216 S 399,720 $ 1 78,000 11,880 288,000 3,000 720 19,600 11,520 Cash Accounts receivable Rental equipment Accumulated depreciation - rental equipment Office supplies Prepaid rent Unexpired insurance Accounts payable Income taxes payable Interest payable Dividends payable Notes payable Salaries payable Unearned rental fees Capital stock Dividends Rental fees earned 2,040 10,896 600 2,400 120,000 1,680 5,160 240,000 2,400 51,840 600 720 480 Interest expense Maintenance expense Office supplies expense Rent expense Salaries expense Utilities expense Depreciation expense Income taxes expense 4,800 14,160 840 3,000 10,896 437.61615 Total S 437.616 Prey 1 of 1 CHE Next "V pivic JULICIIL. Unadjusted SUSQUEHANNA EQUIPMENT RENTALS Trial Balance December 31, 2019 Account Title Debit Credit Cash $ Accounts receivable 78,000 10,080 288,000 1,200 14,400 11,520 Rental equipment Office supplies Prepaid rent Unexpired insurance Accounts payable Dividends payable Notes payable Unearned rental fees Capital stock Dividends Rental fees earned Maintenance expense Salaries expense Utilities expense Total 2,040 2,400 120,000 9,600 240,000 2,400 45,600 720 12,480 840 $ 419,640 $ 419,640Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started