Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Why choices are all in negative? We are supposed to look at the right side of the normal distribution; because the risk is increasing in

Why choices are all in negative? We are supposed to look at the right side of the normal distribution; because the risk is increasing in the interest rate not decreasing.

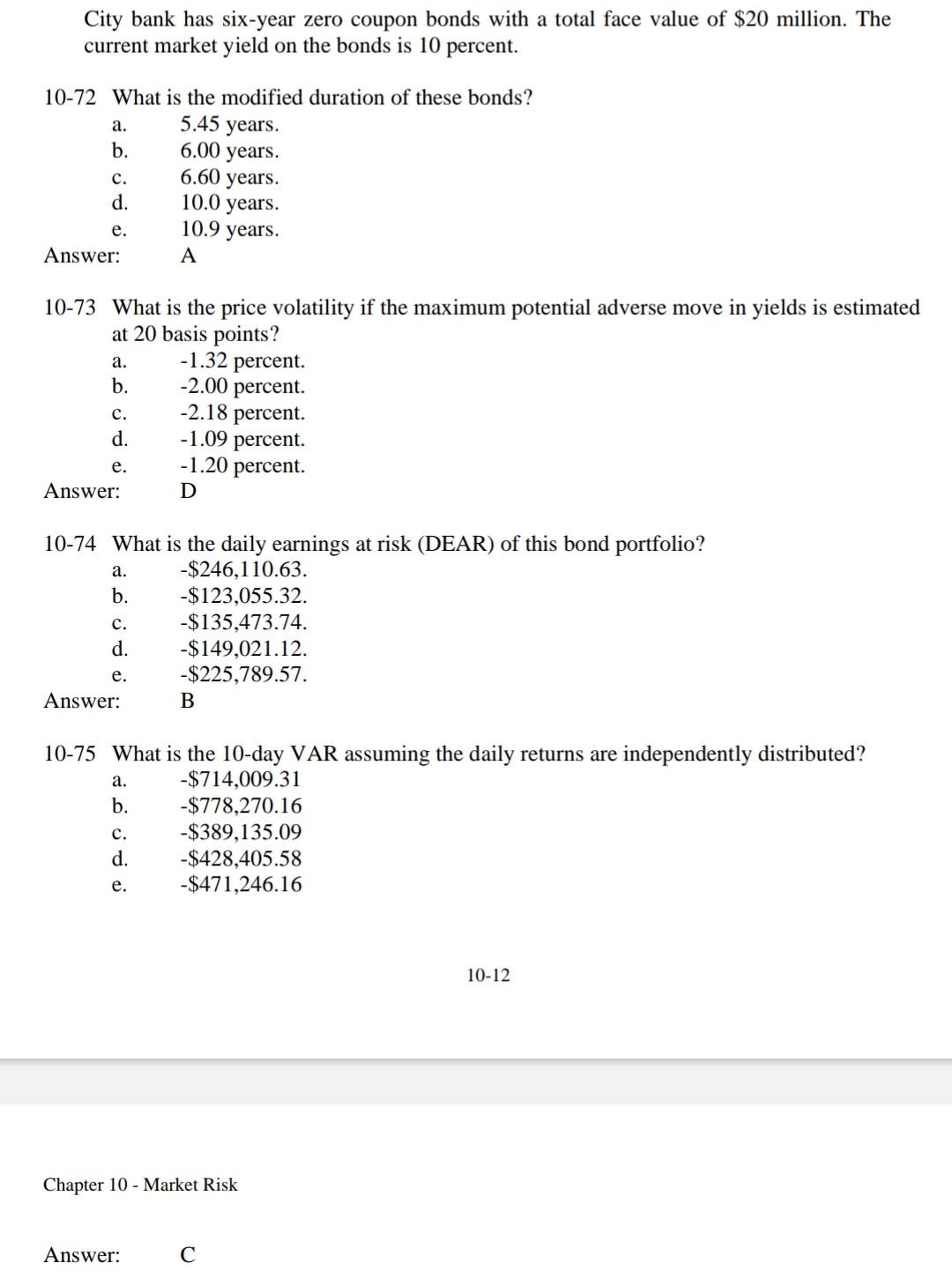

City bank has six-year zero coupon bonds with a total face value of $20 million. The current market yield on the bonds is 10 percent. e. 10-72 What is the modified duration of these bonds? a. 5.45 years. b. 6.00 years. c. 6.60 years. d. 10.0 years. 10.9 years. Answer: A 10-73 What is the price volatility if the maximum potential adverse move in yields is estimated at 20 basis points? a. -1.32 percent. b. -2.00 percent. c. -2.18 percent. d. -1.09 percent. -1.20 percent. Answer: D e. a. 10-74 What is the daily earnings at risk (DEAR) of this bond portfolio? -$246,110.63. b. -$123,055.32. c. -$135,473.74. d. -$149,021.12. -$225,789.57. Answer: B e. 10-75 What is the 10-day VAR assuming the daily returns are independently distributed? a. -$714,009.31 b. -$778,270.16 c. -$389,135.09 d. -$428,405.58 e. -$471,246.16 10-12 Chapter 10 - Market Risk Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started