Answered step by step

Verified Expert Solution

Question

1 Approved Answer

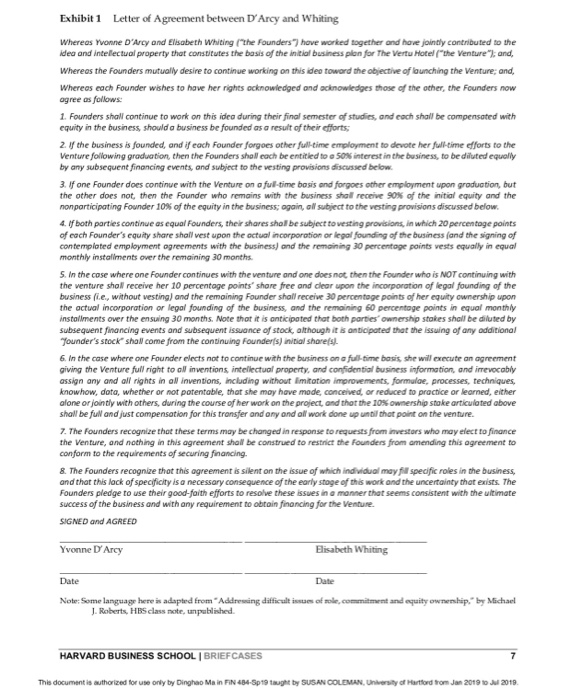

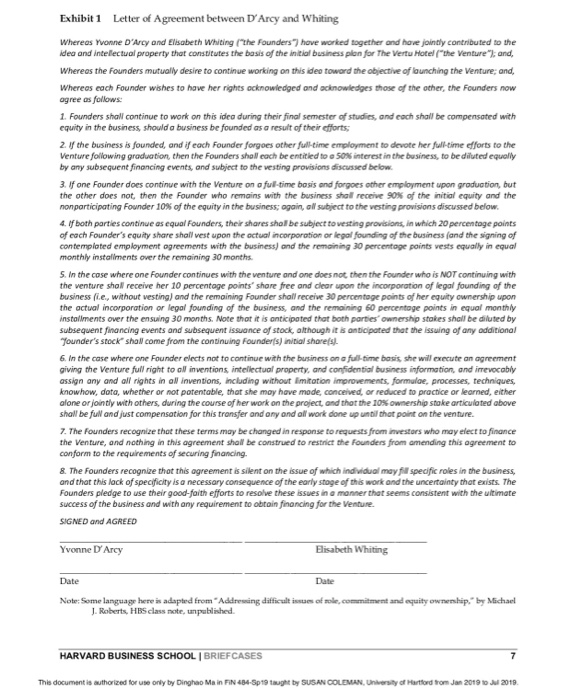

Why did the 2 entrepreneurs do a letter of agreement? Was this a good idea? Why or why not? Exhibit 1 Letter of Agreement between

Why did the 2 entrepreneurs do a letter of agreement? Was this a good idea? Why or why not?

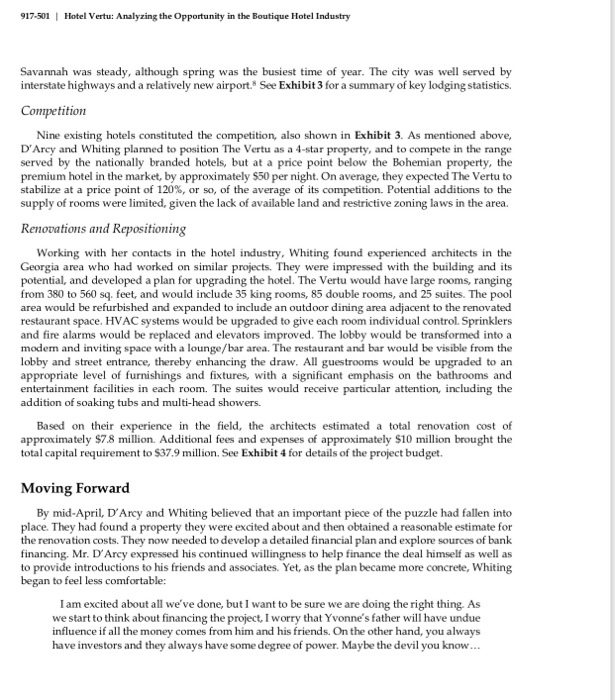

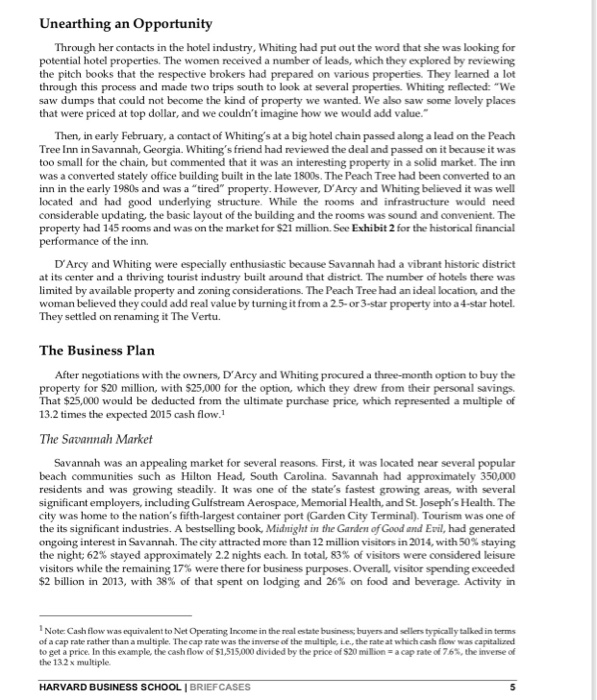

Exhibit 1 Letter of Agreement between D'Arcy and Whiting Whereas Yvonne D'Arcy and Elisabeth Whiting the Founders 7 have worked together and have jointly contributed to the idea and intelectual property that constitutes the basis of the initial business plon for The Vertu Hotel fthe Venture"l; and Whereas the Founders mutually desire to continue working on this ideo toward the objective of launching the Venture; and Whereas each Founder wishes to have her rights acknowiedged and acknowledges those of the other, the Founders now agree as follows 1. Founders shall continue to work on this idea during their final semester of studies, and each shall be compensated with equity in the business should a business be founded as a result of their dfforts 2.f the business is founded, and if each Founder forgoes other fulltime employment to devote her full-time efforts to the Venture following graduation, then the Founders shall each be entitled to c 50% interest in the business, to be diluted equally by any subsequent financing events, and subject to the vesting provisions discussed below 3. If one Founder does continue with the Venture on o full-time bosis and forgoes other employment upon graduation, but the other does not, then the Founder who remains with the business shof receive 90% of the initio, equity and the nonparticipating founder 10% of the equity in the business; ogan, ol sub ect to the vesting provisions discussed below. 4 If both parties continue as equal Founders, their shares shol be subject to vesting provisions, in which 20 percentoge points of each Founder's equity share shall vest upon the actual incorporation or legal founding of the business (and the signing of contemploted employment ogreements with the business) and the remaining 30 percentage points vests equaly in equal monthly instaliments over the remaining 30 months S. In the case where one Founder continues with the venture and one does not then the Founder who is NOT continuing with the venture shall receive her 10 percentage points shore free and clear upon the incorporation of legal founding of the business fie, without vesting) and the remaining Founder shall receive 30 percentoge points of her equity ownership upon the actual incorporation or legal founding of the business, and the remaining 60 percentoge points in equal monthly instaliments over the ensuing 30 months. Note thot it is onticipoted that both parties ownership stakes sholl be diluted by subsequent financing events and subsequent issuance of stock, although it is anticipated that the issuing of any odditional Tounder's stock shall come from the continuing Founderfs) initial shorefs. 6. In the case where one Founder elects not to continue with the business on a full-time basis she will execute an agreement giving the Venture full right to oll inventions intellectual property, and confidential business information, and irrevocably assign any and all rights in al inventions, including without imitation improvements, formulae, processes, techniques, knowhow, dota, whether or not potentable, that she moy have mode, conceived, or reduced to practice or learned, either alone or jontly with others, during the course of her work on the project, and that the 10% ownership stake articulated above shall be fulW and just compensation for this transfer and any and all work done up unbil that point on the venture. 7. The founders recognize thot these terms may be changed in response to requests from investors who may elect to finance the venture, ond nothing in this agreement shall be construed to restrict the founders from amending this greement to conform to the requirements of securing financing. & The Founders recognize thot this agreement is silent on the issue of which individual may fill specific roles in the business, and that this lack of specificity is a necessary consequence of the early stoge of this work and the uncertainty thet exists. The Founders pledge to use their good-faith efforts to resolve these issues in a manner that seems consistent with the ultimate success of the business and with any requirement to obtain financing for the Venture. SIGNED and AGREED Yvonne D' Arcy Elisabeth Whiting Date Date Note: Some language here is adapted from "Addresing difficult issues of rolle, commitment and equity ownenship. by Michael J. Roberts, HBS class mote, unpablished HARVARD BUSINESS SCHOOL I BRIEFCASES This document is authorized for use only by Dinghao Ma in FIN 484-Sp19 taught by SUSAN COLEMAN, University of Hartord trom Jan 2019 1o Jul 2019 917-501 Hotel Vertu: Analyzing the Opportunity in the Boutique Hotel Industry Savannah was steady, although spring was the busiest time of year. The city was well served by interstate highways and a relatively new airport. See Exhibit3 for a summary of key lodging statistics Competition Nine existing hotels constituted the competition, also shown in Exhibit 3. As mentioned above, D'Arcy and Whiting planned to position The Vertu as a 4-star property, and to compete in the range served by the nationally branded hotels, but at a price point below the Bohemian property, the premium hotel in the market, by approximately $50 per night. On average, they expected The Vertu to stabilize at a price point of 120%, or so, of the average of its competition. Potential additions to the supply of rooms were limited, given the lack of available land and restrictive zoning laws in the area. Renovations and Repositioning Working with her contacts in the hotel industry, Whiting found experienced architects in the Georgia area who had worked on similar projects. They were impressed with the building and its potential, and developed a plan for upgrading the hotel. The Vertu would have large rooms, ranging from 380 to 560 sq. feet, and would include 35 king rooms, 85 double rooms, and 25 suites. The pool area would be refurbished and expanded to include an outdoor dining area adjacent to the renovated restaurant space. HVAC systems would be upgraded to give each room individual control. Sprinklers and fire alarms would be replaced and elevators improved. The lobby would be transformed into a modem and inviting space with a lounge/bar area. The restaurant and bar would be visible from the lobby and street entrance, thereby enhancing the draw. All guestrooms would be upgraded to an appropriate level of furnishings and fixtures, with a significant emphasis on the bathrooms and entertainment facilities in each room. The suites would receive particular attention, including the addition of soaking tubs and multi-head showers. Based on their experience in the field, the architects estimated a total renovation cost of approximately $7.8 million. Additional fees and expenses of approximately $10 million brought the total capital requirement to $37.9 . See Exhibit 4 for details of the project budget Moving Forward By mid-April, D'Arcy and Whiting believed that an important piece of the puzzle had fallen into place. They had found a property they were excited about and then obtained a reasonable estimate for the renovation costs. They now needed to develop a detailed financial plan and explore sources of bank financing. Mr. D'Arcy expressed his continued willingness to help finance the deal himself as well as to provide introductions to his friends and associates. Yet, as the plan became more concrete, Whiting began to feel less comfortable: I am excited about all we've done, but I want to be sure we are doing the right thing. As we start to think about financing the project, I worry that Yvonne's father will have undue influence if all the money comes from him and his friends. On the other hand, you always have investors and they always have some degree of power. Maybe the devil you know.. Unearthing an Opportunity Through her contacts in the hotel industry, Whiting had put out the word that she was looking for potential hotel properties. The women received a number of leads, which they explored by reviewing the pitch books that the respective brokers had prepared on various properties. They learned a lot through this process and made two trips south to look at several properties. Whiting reflected: "We saw dumps that could not become the kind of property we wanted. We also saw some lovely places that were priced at top dollar, and we couldn't imagine how we would add value. Then, in early February, a contact of Whiting's at a big hotel chain passed along a lead on the Peach Tree Inn in Savannah, Georgia. Whiting's friend had reviewed the deal and passed on it because it was too small for the chain, but commented that it was an interesting property in a solid market. The inn was a converted stately office building built in the late 1800s. The Peach Tree had been converted to an inn in the early 1980s and was a tired" property. However, D'Arcy and Whiting believed it was well located and had good underlying structure. While the rooms and infrastructure would need considerable updating, the basic layout of the building and the rooms was sound and convenient. The property had 145 rooms and was on the market for $21 million. See Exhibit 2 for the historical financial performance of the inn. D'Arcy and Whiting were especially enthusiastic because Savannah had a vibrant historic district at its center and a thriving tourist industry built around that district. The number of hotels there was limited by available property and zoning considerations. The Peach Tree had an ideal location, and the woman believed they could add real value by turning it from a 2.5-or 3-star property into a 4-star hotel. They settled on renaming it The Vertu. Business Plan After negotiations with the owners, D'Arcy and Whiting procured a three-month option to buy the property for $20 million, with $25,000 for the option, which they drew from their personal savings That $25,000 would be deducted from the ultimate purchase price, which represented a multiple of 13.2 times the expected 2015 cash flow.1 The Savannah Market Savannah was an appealing market for several reasons. First, it was located near several popular beach communities such as Hilton Head, South Carolina. Savannah had approximately 350,000 residents and was growing steadily. It was one of the state's fastest growing areas, with several significant employers, including Gulfstream Aerospace, Memorial Health, and St. Joseph's Health. The city was home to the nation's fifth-largest container port (Garden City Terminal). Tourism was one of the its significant industries. A bestselling book, Midnight in the Garden of Good and Evil, had generated ongoing interest in Savannah. The city attracted more than 12 million visitors in 2014, with 50% staying the night, 62% stayed approximately 2.2 nights each. In total, 83% of visitors were considered leisure visitors while the remaining 17% were there for business purposes. Overall, visitor spending exceeded $2 billion in 2013, with 38% of that spent on lodging and 26% on food and beverage. Activity in Note Cash flow was equivalent to Net Operating Income in the real estate business buyers and sellers typically talked in terms of a cap rate rather than a multiple. The cap rate was the inverse of the multiple, Le, the rate at which cash flow was capitalized to get a price. In this example, the cash flor of $1,515,000 divided by the price of S20 million a cap rate of 7.6%, the m esef the 132 x multiple HARVARD BUSINESS SCHOOL I BRIEFCASES

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started