Answered step by step

Verified Expert Solution

Question

1 Approved Answer

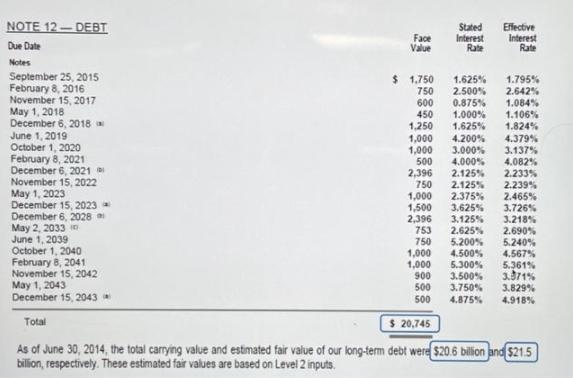

Why does the $20.6 billion carrying value' differ from the $20.745 billion face value? NOTE 12- DEBT Face Value Stated Interest Rate Effective Interest Rate

Why does the $20.6 billion "carrying value' differ from the $20.745 billion "face value"?

NOTE 12- DEBT Face Value Stated Interest Rate Effective Interest Rate Due Date Notes September 25, 2015 February 8, 2016 November 15, 2017 May 1, 2018 December 6, 2018 June 1, 2019 October 1, 2020 February 8, 2021 December 6, 2021 November 15, 2022 May 1, 2023 December 15, 2023 December 6, 2028 May 2, 2033 in June 1, 2039 October 1, 2040 February 8, 2041 November 15, 2042 May 1, 2043 December 15, 2043 $ 1,750 750 600 450 1,250 1.795% 2.642% 1.084% 1.106% 1.824% 4.379% 3.137% 4.082% 2.233% 2.239% 2.465% 3.726% 3.218% 2.690% 5.240% 4.567% 5.361% 3.371% 1.625% 2.500% 0.875% 1.000% 1.625% 1,000 1,000 500 2,396 750 1,000 1,500 2,396 753 750 1,000 1,000 900 500 500 4.200% 3.000% 4.000% 2.125% 2.125% 2.375% 3.625% 3.125% 2.625% 5.200% 4.500% 5.300% 3.500% 3.750% 3.829% 4.918% 4.875% Total $ 20,745 As of June 30, 2014, the total carrying value and estimated fair value of our long-term debt were $20.6 bilion and $21.5 billion, respectively. These estimated fair values are based on Level 2 inputs.

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The carrying value of 206 billion differs from the face value of 2745 billion because ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started