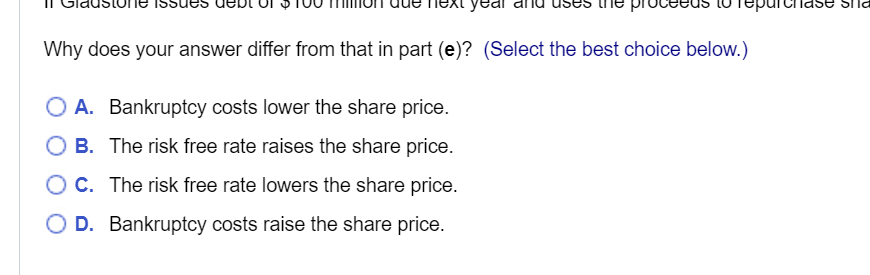

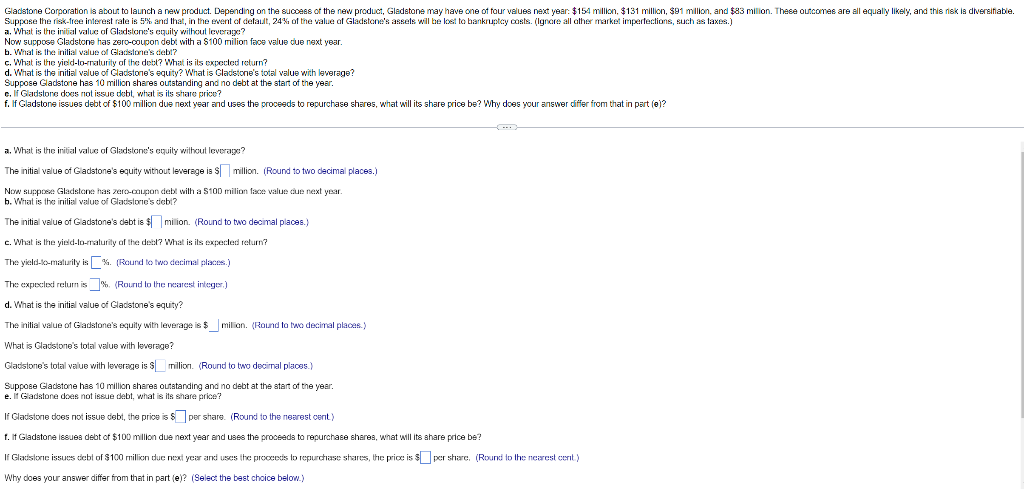

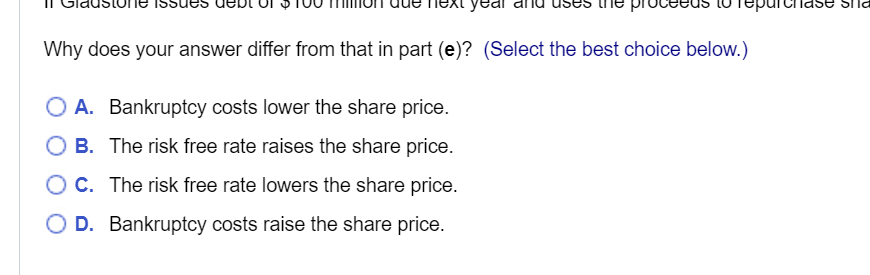

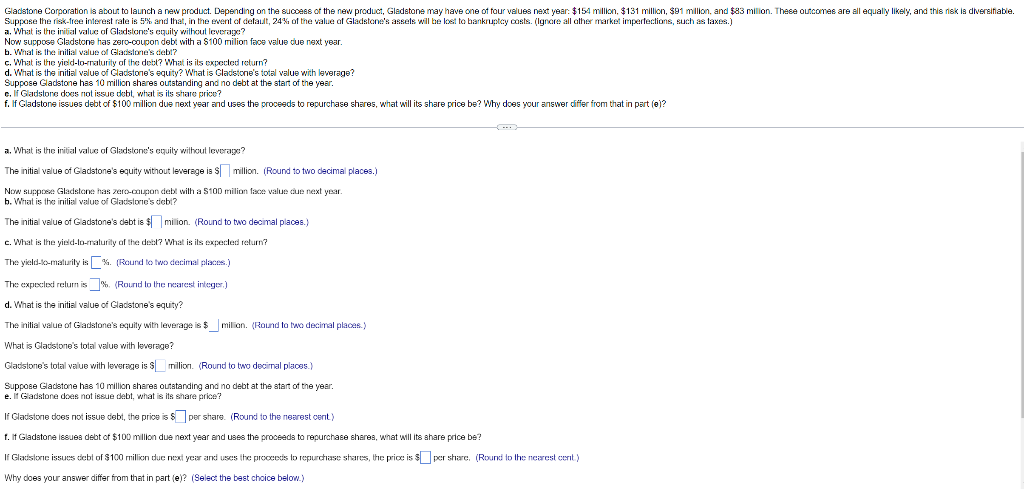

Why does your answer differ from that in part (e)? (Select the best choice below.) A. Bankruptcy costs lower the share price. B. The risk free rate raises the share price. C. The risk free rate lowers the share price. D. Bankruptcy costs raise the share price. a. What is the initial value of Glidstone's equily withoul leverage? Now suppose Gladstone has zero-coupon debt with a 5100 milion faco value due next year. b. Whit is the inilia value of Gliatsino's debt? c. What is the yied-to-maturity of the debt? What is its expected return? d. Winat is the initial value of Gladstone's equity? What is Gladstone's total value with laverage? Suppose Glackstone has 10 million shares outstanding and no debt at the start of the year. e. If Gadstore does not issue debt, what is ils share prike? f. If Gladstone issues debt of $100 million due next year and uses the proceeds to repurchase shares, what will its share price be? Why does your answer differ from that in part (e)? a. What is the iritial value of Glidstone's epuity without leverage? The initial value of Gladstone's equity without leverege is : million. (Round to two dacimal places.) Now suppoes Gladstone has zero-cuupon debt wilh ia Stod milion licce value cue next year. b. What is the irilial velue of Glatislone's debi? The initial value of Gladstone's dabt is: mition. (Round to two decimal places.) c. What is the yied-lo-rralurily of the deab? What is its expected return? The yield-ko-malurily is . (Round to two decimal pliaces.) The expected relum is io. (Rourd to the notarest integes, ) d. What is the initial value of Gladstone's equity? The initial value of Giadstone's equity with leverage is: milion. (Round to two decimal places.) What is Cladsione's total value with lowerage? Gladstone's total value with leverage is \& milion. (Round to two decimal placse.) Suppose Glackstone has 10 million sharea outatanding and no debt at the start of the year. e. It Glacstone does not issue debt, what is its share price? Why does your answer differ from that in part (e)? (Select the best choice below.) A. Bankruptcy costs lower the share price. B. The risk free rate raises the share price. C. The risk free rate lowers the share price. D. Bankruptcy costs raise the share price. a. What is the initial value of Glidstone's equily withoul leverage? Now suppose Gladstone has zero-coupon debt with a 5100 milion faco value due next year. b. Whit is the inilia value of Gliatsino's debt? c. What is the yied-to-maturity of the debt? What is its expected return? d. Winat is the initial value of Gladstone's equity? What is Gladstone's total value with laverage? Suppose Glackstone has 10 million shares outstanding and no debt at the start of the year. e. If Gadstore does not issue debt, what is ils share prike? f. If Gladstone issues debt of $100 million due next year and uses the proceeds to repurchase shares, what will its share price be? Why does your answer differ from that in part (e)? a. What is the iritial value of Glidstone's epuity without leverage? The initial value of Gladstone's equity without leverege is : million. (Round to two dacimal places.) Now suppoes Gladstone has zero-cuupon debt wilh ia Stod milion licce value cue next year. b. What is the irilial velue of Glatislone's debi? The initial value of Gladstone's dabt is: mition. (Round to two decimal places.) c. What is the yied-lo-rralurily of the deab? What is its expected return? The yield-ko-malurily is . (Round to two decimal pliaces.) The expected relum is io. (Rourd to the notarest integes, ) d. What is the initial value of Gladstone's equity? The initial value of Giadstone's equity with leverage is: milion. (Round to two decimal places.) What is Cladsione's total value with lowerage? Gladstone's total value with leverage is \& milion. (Round to two decimal placse.) Suppose Glackstone has 10 million sharea outatanding and no debt at the start of the year. e. It Glacstone does not issue debt, what is its share price