Why don't we include changes in NWC during the project's life in Incremental FCFs?

Hello guys, so I got this screenshot here showing a problem on which the NWC from year 2 through 4 wasn't subtracted from the incremental FCFs.

Why do we assume that only investments in NWC at the beginning of the project affect our FCFs (obviously...) but not during the project's life? The assumption that we invest in NWC at the beginning of the project and that we don't need to add more to NWC during the project's life seems very unreasonable to me.

The question assumed that those 1,125 will be the same and/or enough for year 2,3, and 4? I don't get it.

Thank you!

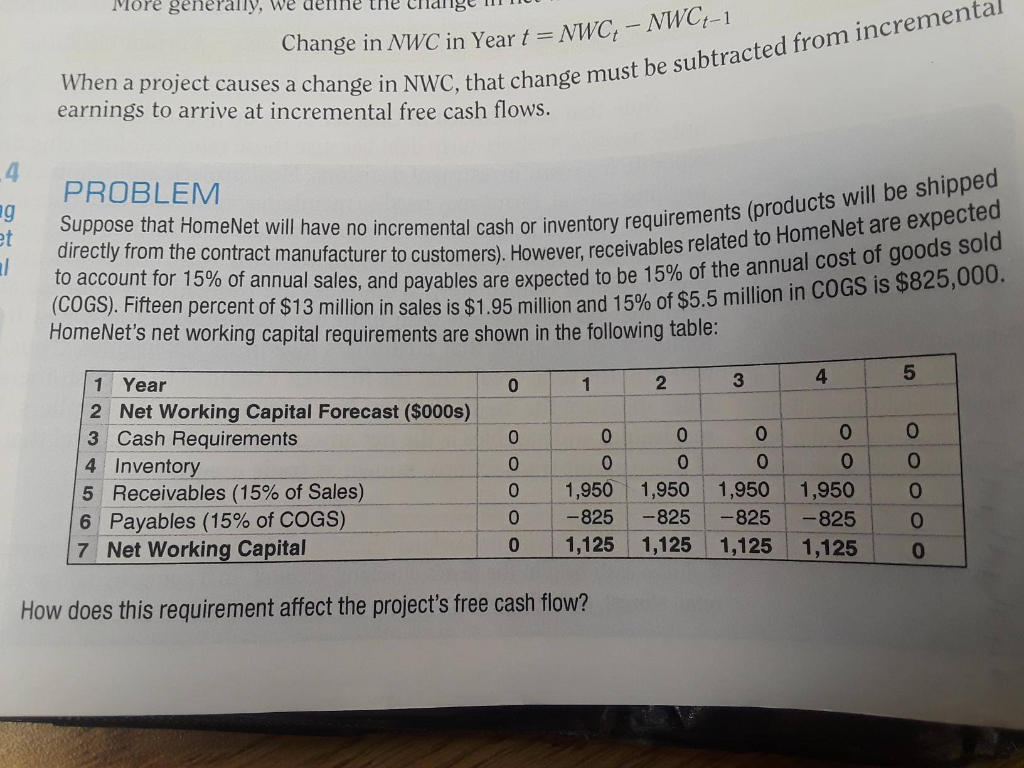

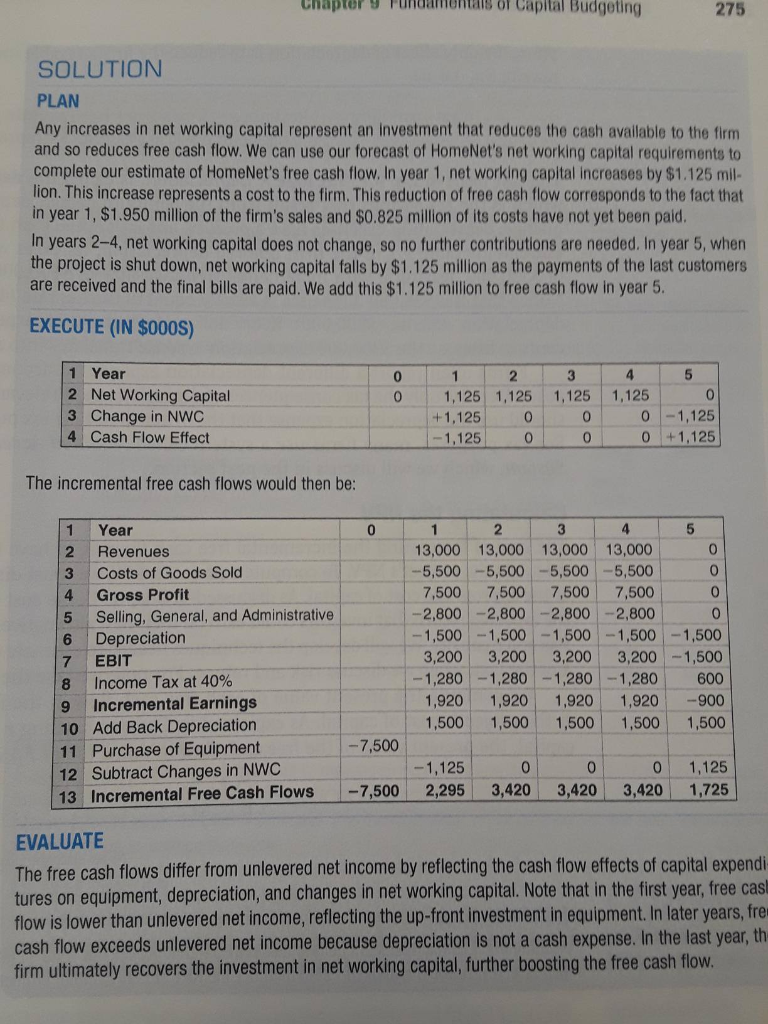

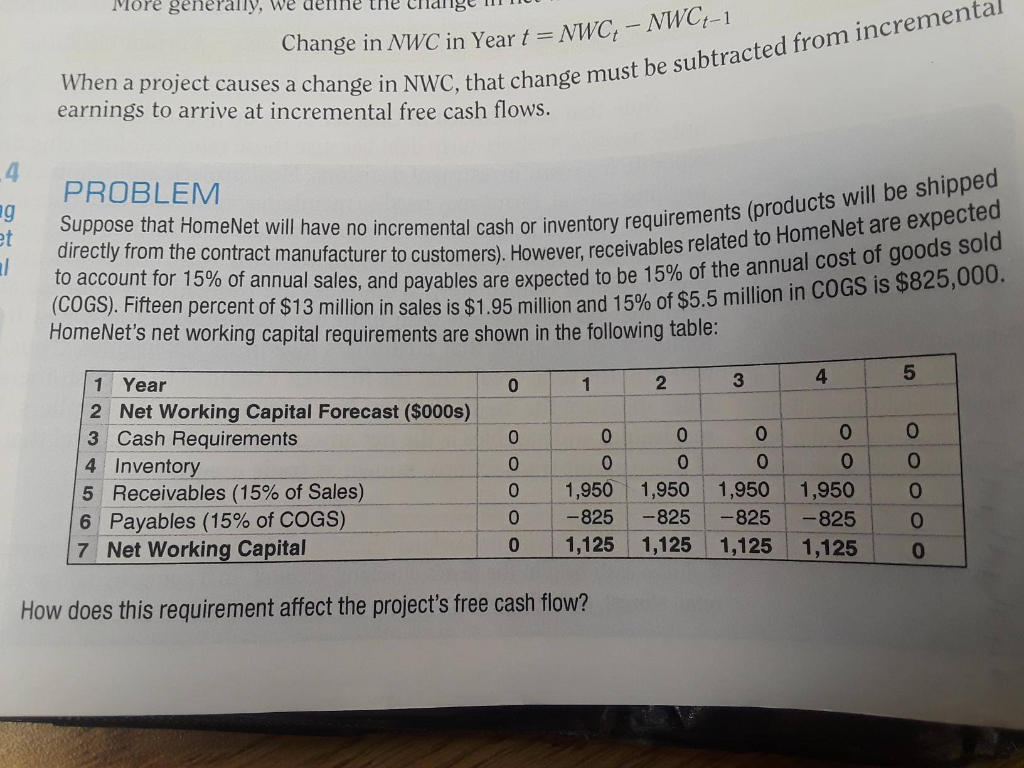

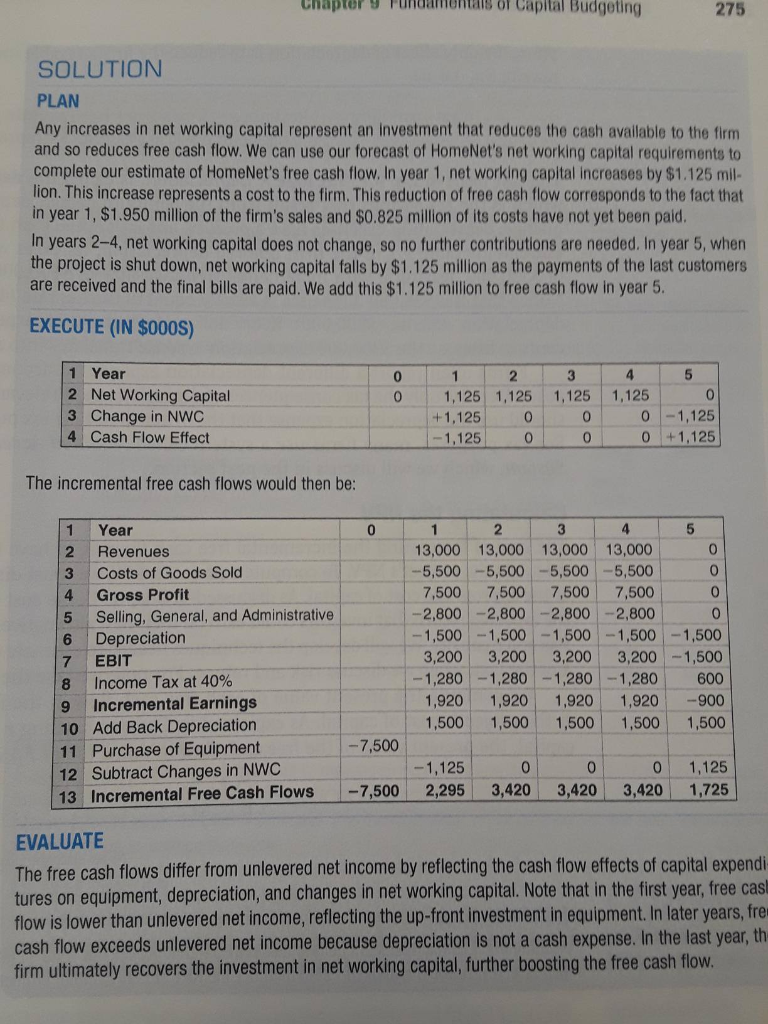

More generally, we were le cudlige han Change in NWC in Year t = NWC7 - NWCt-1 When a project causes a change in NWC, that change mu earnings to arrive at incremental free cash flows. nge must be subtracted from incrementai PROBLEM Suppose that HomeNet will have no incremental cash or inventory requ directly from the contract manufacturer to customers). However, receivable to account for 15% of annual sales, and payables are expected to be 10 (COGS). Fifteen percent of $13 million in sales is $1.95 million and 15% of $5.5 mm HomeNet's net working capital requirements are shown in the following table. ntory requirements (products will be shipped ever, receivables related to HomeNet are expected pected to be 15% of the annual cost of goods sold n and 15% of $5.5 million in COGS is $825,000. 1 2 3 4 0 1 Year 10 2 Net Working Capital Forecast ($000s) 3 Cash Requirements 4 Inventory O 5 Receivables (15% of Sales) O 6 Payables (15% of COGS) O 7 Net Working Capital 0 0 1,950 -825 1,125 0 0 1,950 -825 1,125 0 0 1,950 -825 1,125 0 0 0 0 0 1,950 10 -825 1,125 How does this requirement affect the project's free cash flow? Chapter y Fundamentals of Capital Budgeting 275 SOLUTION PLAN Any increases in net working capital represent an investment that reduces the cash available to the firm and so reduces free cash flow. We can use our forecast of HomeNet's not working capital requirements to complete our estimate of HomeNet's free cash flow. In year 1, net working capital increases by $1.125 mil- lion. This increase represents a cost to the firm. This reduction of free cash flow corresponds to the fact that in year 1, $1.950 million of the firm's sales and $0.825 million of its costs have not yet been paid. In years 2-4, net working capital does not change, so no further contributions are needed. In year 5, when the project is shut down, net working capital falls by $1.125 million as the payments of the last customers are received and the final bills are paid. We add this $1.125 million to free cash flow in year 5. EXECUTE (IN $000S) 0 1 Year 2 Net Working Capital 3 Change in NWC 4 Cash Flow Effect 1 1,125 +1,125 -1,125 2 1.125 0 0 3 1.125 0 0 4 5 1 1,125 0 -1,125 0 +1,125 The incremental free cash flows would then be: 1 Year 2 Revenues 3 Costs of Goods Sold 4 Gross Profit 5 Selling, General, and Administrative 6 Depreciation EBIT 8 Income Tax at 40% 9 Incremental Earnings 10 Add Back Depreciation 11 Purchase of Equipment 12 Subtract Changes in NWC | 13 Incremental Free Cash Flows 1 2 13,000 13,000 -5,500 -5,500 7,500 7,500 -2,800 -2,800 -1,500 -1,500 3,200 3,200 -1,280 -1,280 1,920 1,920 1,500 1,500 3 13,000 -5,500 7,500 -2,800 -1,500 3,200 -1,280 1,920 1,500 4 5 13,000 0 -5,500 0 7,500 -2,800 -1,500 -1,500 3,200 -1,500 -1,280 600 1,920 -900 1,500 1,500 - 7,500 -1,125 2,295 0 3,420 0 3,420 0 3,420 1,125 1,725 -7,500 EVALUATE The free cash flows differ from unlevered net income by reflecting the cash flow effects of capital expendi tures on equipment, depreciation, and changes in net working capital. Note that in the first year, free cast flow is lower than unlevered net income, reflecting the up-front investment in equipment. In later years, frer cash flow exceeds unlevered net income because depreciation is not a cash expense. In the last year, th, firm ultimately recovers the investment in net working capital, further boosting the free cash flow