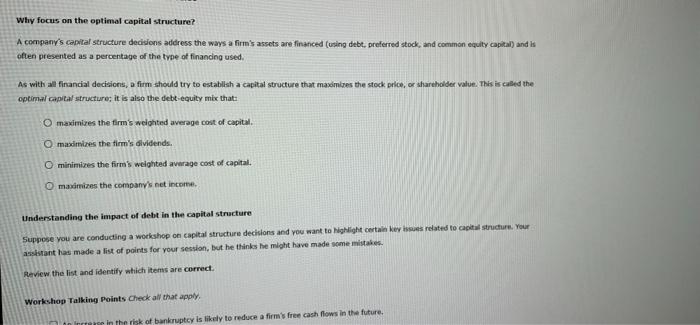

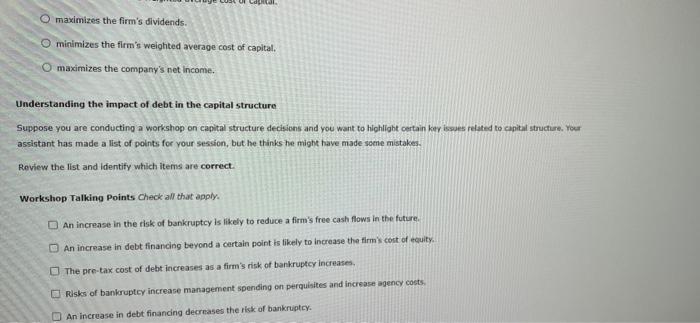

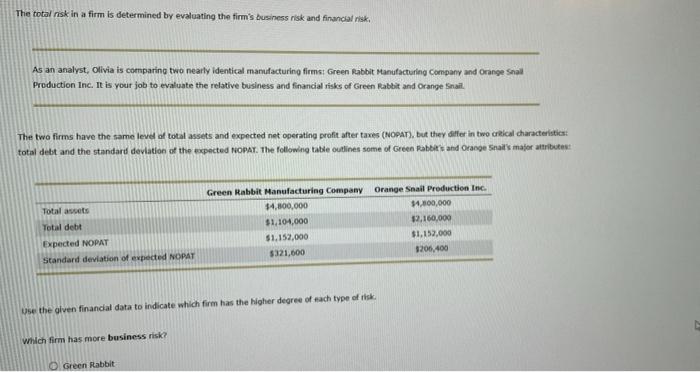

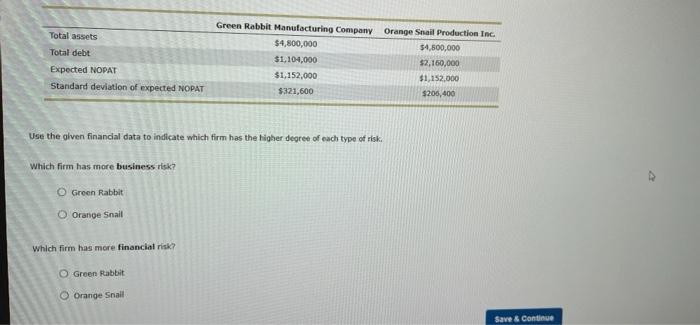

Why focus on the optimal capital structure? A company's capital structure decisions address the ways a firm's assets are financed (uning debt, preferred stock, and common equity capital) and often presented as a percentage of the type of financing used. As with all financial decisions, a firm should try to establish a capital structure that maximizes the stock price, or shareholder value. This is called the optimal capital structure it is also the debt equity mic that: maximizes the tim's weighted average cost of capital O maximizes the firm's dividends. O minimizes the firm's weighted average cost of capital mamizes the company's net income Understanding the impact of debt in the capital structure Suppose you are conducting a workshop on capital structure decisions and you want to highlight certain key les related to capital structure. Your assistant has made a list of points for your session, but he thinks he might have made some mistakes. Review the list and identify which items are correct. Workshop Talking Points Check all that apply terse in the risk of bankruptcy is likely to reduce a firm's free cash flows in the future, maximizes the firm's dividends. O minimizes the firm's weighted average cost of capital. maximizes the company's net Income. Understanding the impact of debt in the capital structure Suppose you are conducting a workshop on capital structure decisions and you want to highlight certain key icons related to capital structure. Your assistant has made a list of points for your session, but he thinks he might have made some mistakes. Review the list and Identify which items are correct Workshop Talking Points Check all that apply. An increase in the risk of bankruptcy is likely to reduce a firm's free cash flows in the future. An increase in debt financing beyond a certain point is likely to increase the firm's cost of equity. The pre-tax cost of debt increases as a firm's risk of bankruptcy increases Risks of bankruptcy increase management spending on perquisites and increase agency costs An increase in debt financing decreases the risk of bankruptcy. The total risk in a firm is determined by evaluating the firm's business risk and financial risk. As an analyst, Olivia is comparing two nearly identical manufacturing firms: Green Rabbit Manufacturing Company and Orange Snail Production Inc. It is your job to evaluate the relative business and financial risks of Green Rabbit and Orange Snail The two firms have the same level of total assets and expected net operating profit after taxes (NOPAT), but they differ in two critical characteristics total debt and the standard deviation of the expected NOPAT. The following table outlines some of Green Rabbits and Orange Snail's major attributest Total assets Total debt Green Rabbit Manufacturing Company Orange Snail Production Inc. $4,000,000 $4,000,000 $1,104,000 12,160,000 $1.152.000 $1,152.000 5321,600 3206,400 Expected NOPAT Standard deviation of expected NOPAT Use the given financial data to indicate which firm has the higher degree of each type of risk which firm has more business risk? O Green Rabbit Total assets Total debt Expected NOPAT Standard deviation of expected NOPAT Green Rabbit Manufacturing Company $4,800,000 $1,104,000 $1,152,000 $321,600 Orange Snail Production Inc. $4,500,000 $2,160,000 $1,152.000 $206,400 Use the given financial data to indicate which firm has the higher degree of each type of risk. Which firm has more business risk? O Green Rabbit Orange Snail which firm has more financial risk O Green Rabbit Orange Snail Save & Continue