Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Why is Cost of goods sold used instead of inventory in the suggested solution of the problem? Can someone explain the journal entries in the

Why is Cost of goods sold used instead of inventory in the suggested solution of the problem? Can someone explain the journal entries in the suggested solution.

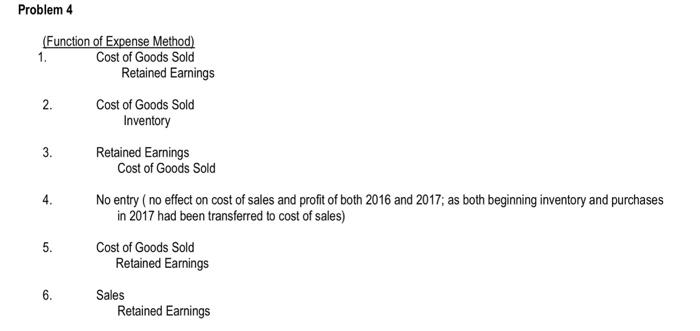

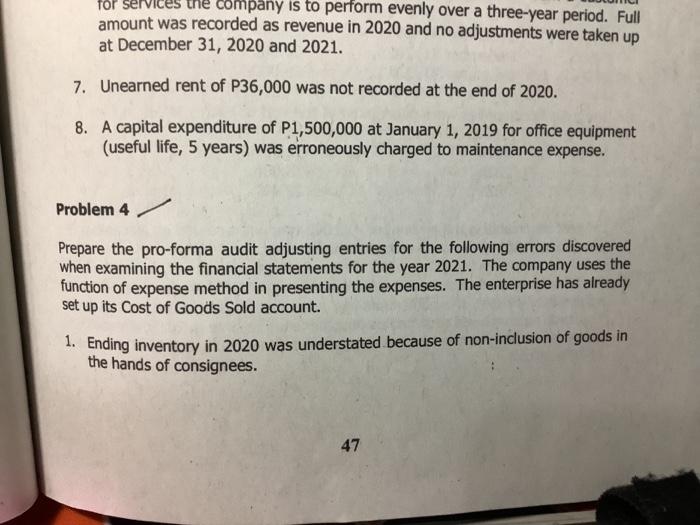

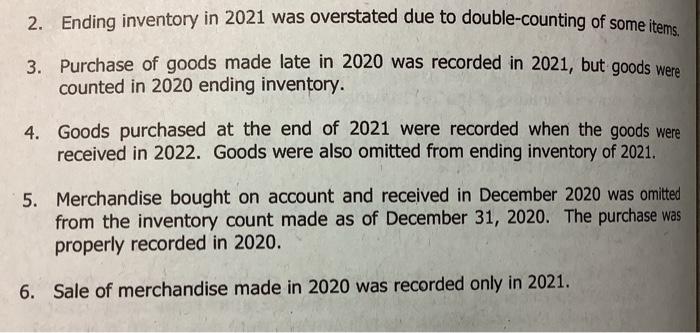

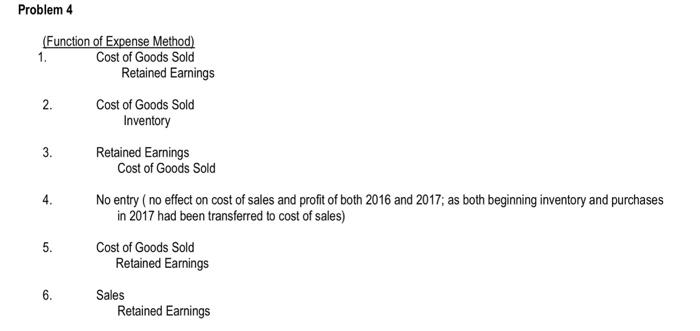

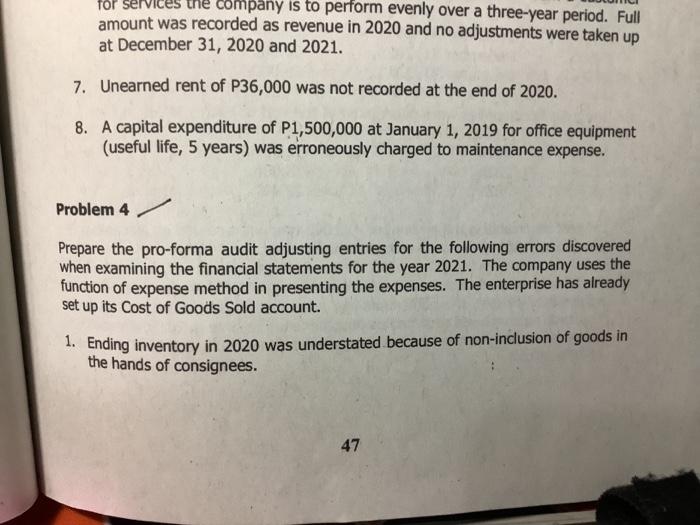

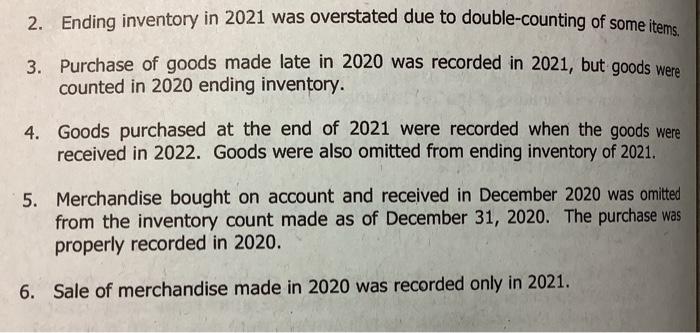

(Function of Expense Method) 1. Cost of Goods Sold Retained Earnings 2. Cost of Goods Sold Inventory 3. Retained Earnings Cost of Goods Sold 4. No entry ( no effect on cost of sales and profit of both 2016 and 2017; as both beginning inventory and purchases in 2017 had been transferred to cost of sales) 5. Cost of Goods Sold Retained Earnings 6. Sales Retained Earnings for services the company is to perform evenly over a three-year period. Full amount was recorded as revenue in 2020 and no adjustments were taken up at December 31, 2020 and 2021. 7. Unearned rent of P36,000 was not recorded at the end of 2020. 8. A capital expenditure of P1,500,000 at January 1,2019 for office equipment (useful life, 5 years) was erroneously charged to maintenance expense. Problem 4 Prepare the pro-forma audit adjusting entries for the following errors discovered when examining the financial statements for the year 2021. The company uses the function of expense method in presenting the expenses. The enterprise has already set up its Cost of Goods Sold account. 1. Ending inventory in 2020 was understated because of non-inclusion of goods in the hands of consignees. 2. Ending inventory in 2021 was overstated due to double-counting of some items. 3. Purchase of goods made late in 2020 was recorded in 2021 , but goods were counted in 2020 ending inventory. 4. Goods purchased at the end of 2021 were recorded when the goods were received in 2022 . Goods were also omitted from ending inventory of 2021. 5. Merchandise bought on account and received in December 2020 was omitted from the inventory count made as of December 31,2020 . The purchase was properly recorded in 2020 . 6. Sale of merchandise made in 2020 was recorded only in 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started