Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Why is GM worried about the ARS exposure? What operational decisions could it have made or now make to manage this exposure? (Check exhibit 12

-

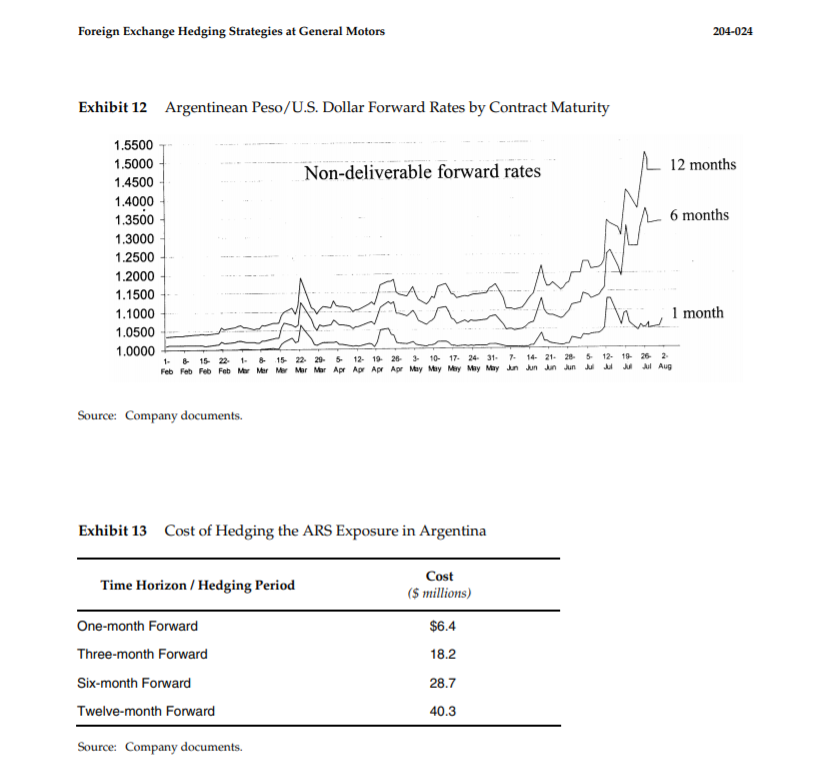

Why is GM worried about the ARS exposure? What operational decisions could it have made or now make to manage this exposure? (Check exhibit 12 and 13what are the forward rates telling you? Recall that we learned that forward rates capture market expectations of future exchange rate movements? What does this mean for how expensive hedging is by this time? Indeed, this is why anticipatory risk management is so criticalwhen hedging a risk is the most desirable, the cost of that hedge rises substantially too. Good news is that there are some non-financial alternatives to hedging this exposure)

Why is GM worried about the ARS exposure? What operational decisions could it have made or now make to manage this exposure? (Check exhibit 12 and 13what are the forward rates telling you? Recall that we learned that forward rates capture market expectations of future exchange rate movements? What does this mean for how expensive hedging is by this time? Indeed, this is why anticipatory risk management is so criticalwhen hedging a risk is the most desirable, the cost of that hedge rises substantially too. Good news is that there are some non-financial alternatives to hedging this exposure)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started